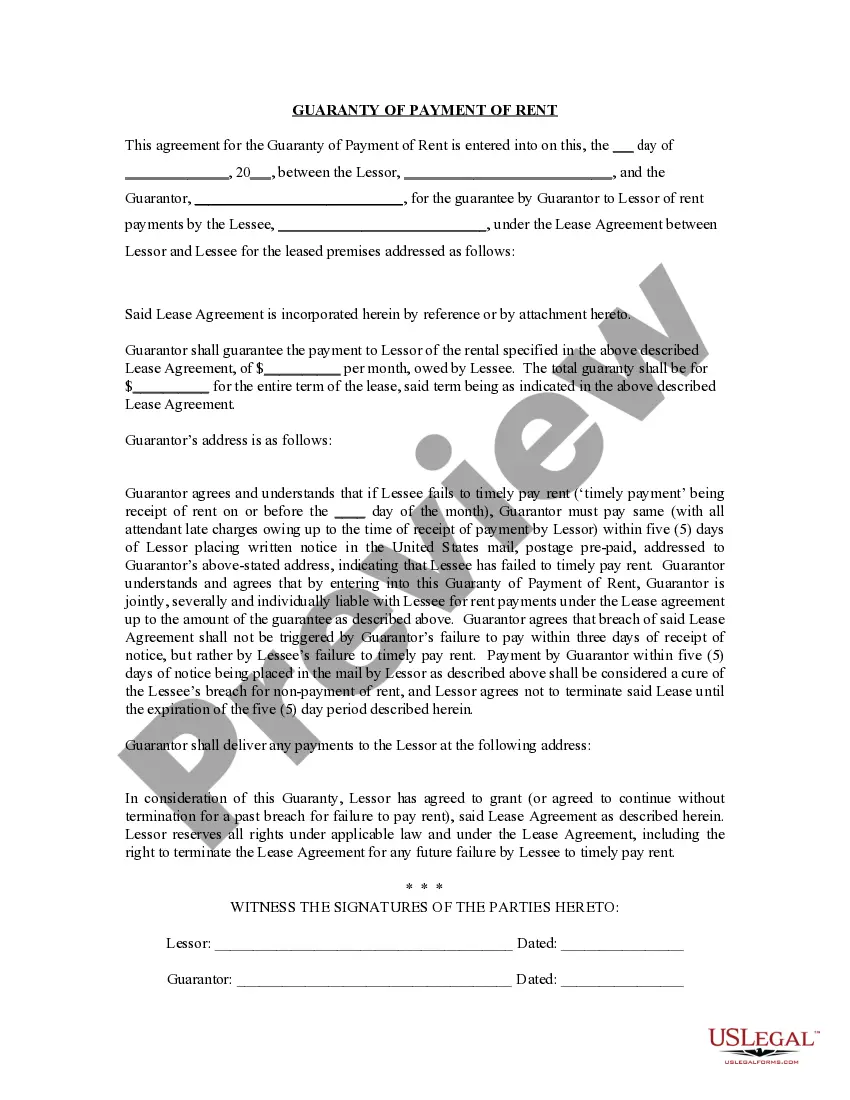

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). In West Palm Beach, Florida, the Guaranty or Guarantee of Payment of Rent is a legal agreement between a landlord and a tenant in which a third party, known as the guarantor, assumes the responsibility of ensuring the payment of rent in case the tenant defaults. One type of Guaranty or Guarantee of Payment of Rent in West Palm Beach is the Personal Guaranty. This type of guaranty involves an individual, often the tenant's parent or guardian, taking responsibility for the rent payment if the tenant is unable to fulfill their obligations. The guarantor's income, creditworthiness, and assets may be taken into consideration during the evaluation process. Another type of Guaranty or Guarantee of Payment of Rent in West Palm Beach is the Corporate Guaranty. This type of guaranty involves a corporation or business entity assuming the responsibility of rent payment on behalf of the tenant. Typically, the corporation provides financial statements, credit reports, and other relevant documentation to demonstrate their ability to cover the rent in case of default. Landlords in West Palm Beach may require a Guaranty or Guarantee of Payment of Rent to mitigate the risks associated with renting out their properties. It provides them with an additional layer of financial security, ensuring that rent payments will be made even if the tenant encounters financial hardships. When drafting a West Palm Beach Florida Guaranty or Guarantee of Payment of Rent, important elements to consider include the identification of the tenant, the guarantor, and the rental property. In addition, the agreement should clearly state the guarantor's obligations, the duration of the guaranty, and any limitations or conditions that may apply. Landlords may also request supporting documents such as income statements, credit reports, bank statements, and personal guarantees to assess the guarantor's financial stability. This helps ensure that the guaranty is a reliable protection mechanism and strengthens the landlord's confidence in the tenant's ability to meet their rent obligations. In conclusion, the West Palm Beach Florida Guaranty or Guarantee of Payment of Rent serves as a safeguard for landlords in cases where tenants might default on their rent payments. Personal Guaranties and Corporate Guaranties are the most common types, each involving different parties assuming responsibility for the rent payment. These agreements are designed to protect the interests of both landlords and tenants, providing financial security and stability in the rental market.

In West Palm Beach, Florida, the Guaranty or Guarantee of Payment of Rent is a legal agreement between a landlord and a tenant in which a third party, known as the guarantor, assumes the responsibility of ensuring the payment of rent in case the tenant defaults. One type of Guaranty or Guarantee of Payment of Rent in West Palm Beach is the Personal Guaranty. This type of guaranty involves an individual, often the tenant's parent or guardian, taking responsibility for the rent payment if the tenant is unable to fulfill their obligations. The guarantor's income, creditworthiness, and assets may be taken into consideration during the evaluation process. Another type of Guaranty or Guarantee of Payment of Rent in West Palm Beach is the Corporate Guaranty. This type of guaranty involves a corporation or business entity assuming the responsibility of rent payment on behalf of the tenant. Typically, the corporation provides financial statements, credit reports, and other relevant documentation to demonstrate their ability to cover the rent in case of default. Landlords in West Palm Beach may require a Guaranty or Guarantee of Payment of Rent to mitigate the risks associated with renting out their properties. It provides them with an additional layer of financial security, ensuring that rent payments will be made even if the tenant encounters financial hardships. When drafting a West Palm Beach Florida Guaranty or Guarantee of Payment of Rent, important elements to consider include the identification of the tenant, the guarantor, and the rental property. In addition, the agreement should clearly state the guarantor's obligations, the duration of the guaranty, and any limitations or conditions that may apply. Landlords may also request supporting documents such as income statements, credit reports, bank statements, and personal guarantees to assess the guarantor's financial stability. This helps ensure that the guaranty is a reliable protection mechanism and strengthens the landlord's confidence in the tenant's ability to meet their rent obligations. In conclusion, the West Palm Beach Florida Guaranty or Guarantee of Payment of Rent serves as a safeguard for landlords in cases where tenants might default on their rent payments. Personal Guaranties and Corporate Guaranties are the most common types, each involving different parties assuming responsibility for the rent payment. These agreements are designed to protect the interests of both landlords and tenants, providing financial security and stability in the rental market.