The cosigner is also sometimes be called a guarantor. A guaranty is a contract under which one person (guarantor) agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

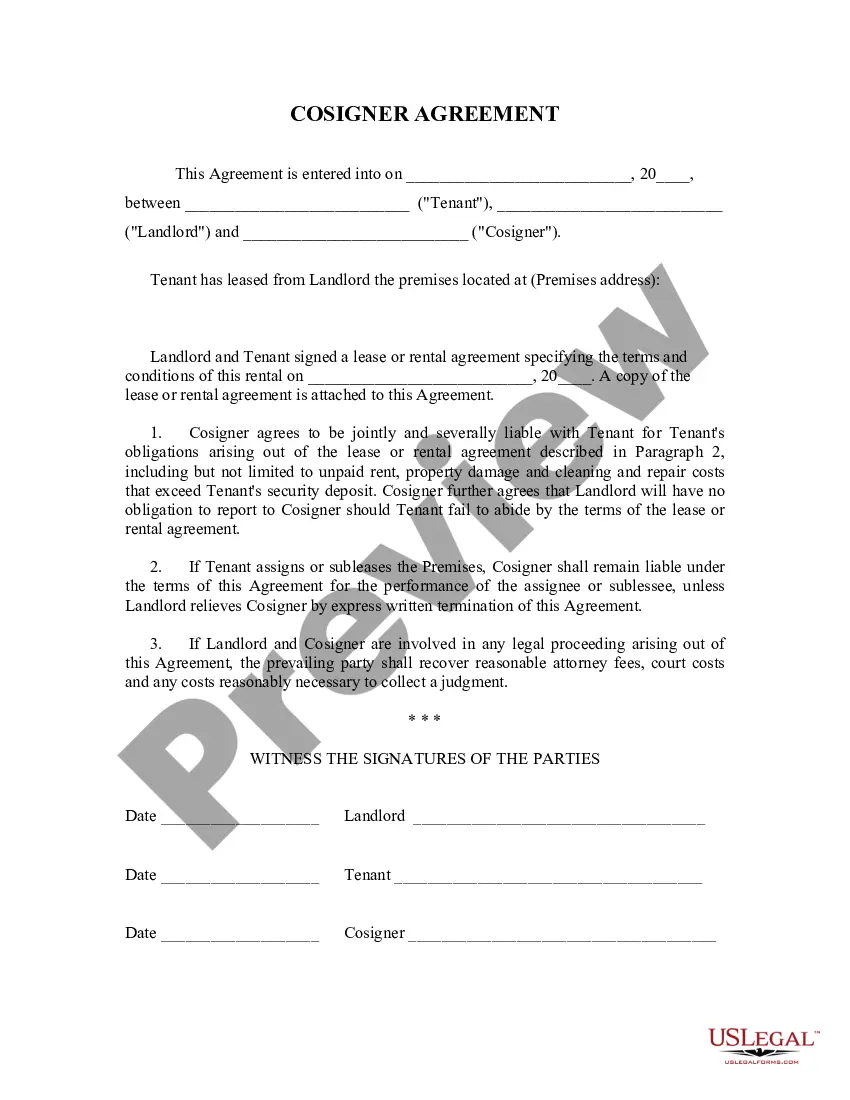

A Miramar Florida Landlord Tenant Lease Co-Signer Agreement is a legal document that outlines the terms and conditions between a landlord, tenant, and a co-signer in the city of Miramar, Florida. This agreement is commonly used when a tenant does not meet the financial criteria set by the landlord and requires a co-signer to secure the lease. In a Miramar Florida Landlord Tenant Lease Co-Signer Agreement, the co-signer agrees to take on financial responsibility for the lease if the tenant fails to fulfill their obligations. This includes paying rent, utilities, and any damages caused by the tenant during the lease term. It is essential for both the landlord and co-signer to thoroughly understand their roles and obligations before signing the agreement. The main purpose of a co-signer agreement is to provide the landlord with an additional layer of financial security, minimizing the risk of non-payment or other breaches of the lease. This agreement allows landlords to consider tenants who may not have a strong credit history or sufficient income to meet the rental criteria on their own. There are different types of Miramar Florida Landlord Tenant Lease Co-Signer agreements, depending on the specific needs and circumstances of the parties involved. Some examples include: 1. Full co-signer agreement: In this type of agreement, the co-signer assumes complete responsibility for the lease along with the tenant. This means that if the tenant fails to meet their obligations, the co-signer is fully liable for any unpaid rent or damages. 2. Partial co-signer agreement: In a partial co-signer agreement, the co-signer is responsible for a specific portion of the lease obligations, such as a percentage of the rent or a specific time frame. This type of agreement may be suitable when the tenant has part-time or fluctuating income. 3. Limited co-signer agreement: A limited co-signer agreement places certain restrictions or conditions on the co-signer's liability. For example, the co-signer may only be responsible for a certain amount of rent or damages up to a specified limit. 4. Conditional co-signer agreement: This type of agreement includes specific conditions that must be met by either the tenant or co-signer for the co-signer's obligations to become effective. This could include the tenant making a certain number of on-time rental payments or providing proof of employment. It is important for all parties involved to carefully review and understand the terms and conditions of the Miramar Florida Landlord Tenant Lease Co-Signer Agreement before signing. It is recommended to seek legal advice to ensure that the agreement accurately reflects the intentions and protects the interests of each party involved.