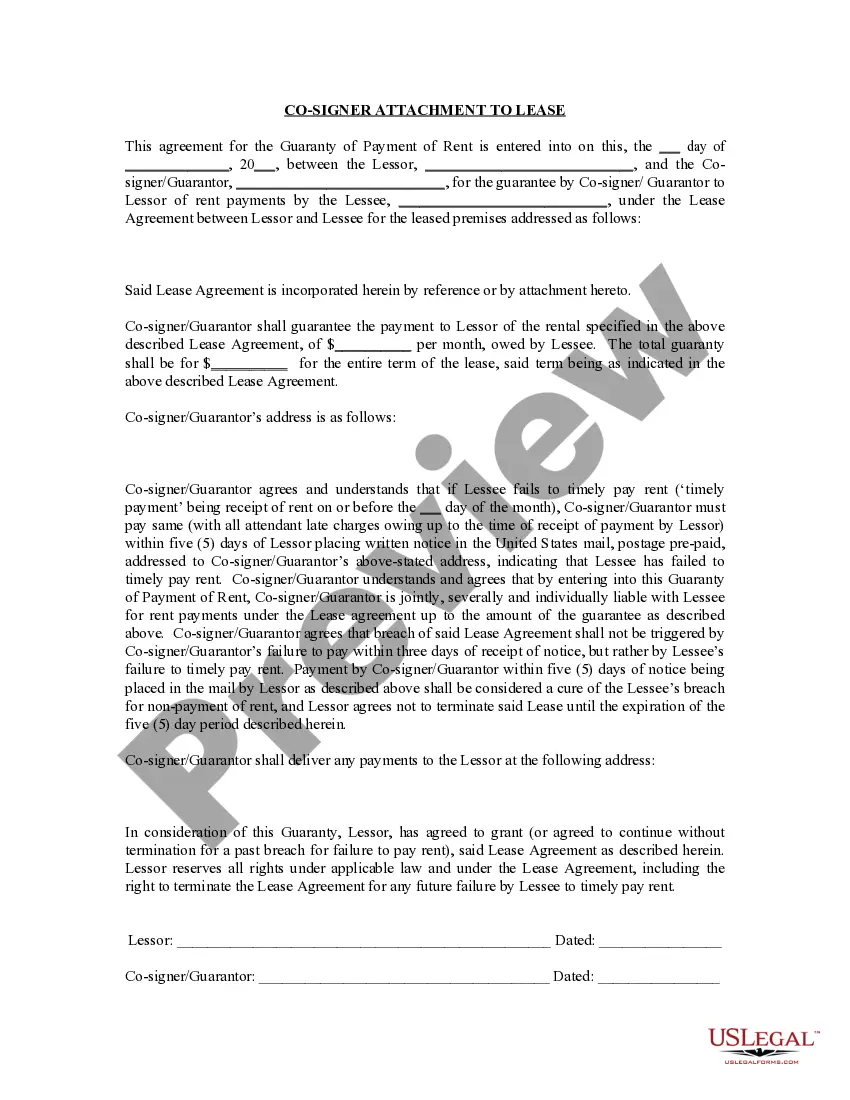

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). The Jacksonville Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a legal document that outlines the terms and conditions of an agreement between a landlord and a guarantor or cosigner. This attachment is an integral part of the lease agreement, providing additional security to the landlord in case the tenant fails to fulfill their financial obligations. The purpose of this agreement is to establish the guarantor's or cosigner's liability for the tenant's rent, damages, and any other costs incurred during the lease term. By signing this attachment, the guarantor or cosigner agrees to take on the responsibility of ensuring that the landlord receives all payments due, in the event that the tenant is unable to make them. The Jacksonville Florida Guaranty Attachment to Lease for Guarantor or Cosigner typically includes the following key details: 1. Parties: The attachment identifies the parties involved in the agreement, namely the landlord, tenant, and guarantor or cosigner. Each party's legal names and contact information are provided. 2. Lease Agreement: The attachment specifies the lease agreement it is attached to, including the dates of the lease term and the address of the property being leased. 3. Guarantor's/Cosigner's Obligations: This section outlines the specific obligations of the guarantor or cosigner. It includes their commitment to pay rent, deposit, utility bills, and any other charges outlined in the lease agreement. The guarantor or cosigner might also agree to cover any damages caused by the tenant, as well as legal fees if any legal actions arise. 4. Duration of Guaranty: The attachment clarifies the duration of the guarantor's or cosigner's obligations. It may state that they are bound until the end of the lease term or even extend their liability until the tenant fulfills all financial obligations. 5. Waivers and Consent: This section outlines any waivers or consents made by the guarantor or cosigner. For instance, they may agree to continue being bound by the lease agreement even if the lease term is extended or modified. 6. Joint and Several liabilities: The attachment may include a provision stating that if there are multiple guarantors or cosigners, they are jointly and severally liable. This means that each guarantor or cosigner is individually responsible for fulfilling the obligations and can be held accountable for the entire amount owed by the tenant. It is important to note that the specific terms and clauses within the Guaranty Attachment to Lease for Guarantor or Cosigner may vary depending on the agreement between the parties involved and the specific requirements of the jurisdiction. While there may not be different types of Jacksonville Florida Guaranty Attachment to Lease for Guarantor or Cosigner, the content and clauses within the attachment can be customized to suit the specific needs and preferences of the landlord and the guarantor or cosigner.

The Jacksonville Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a legal document that outlines the terms and conditions of an agreement between a landlord and a guarantor or cosigner. This attachment is an integral part of the lease agreement, providing additional security to the landlord in case the tenant fails to fulfill their financial obligations. The purpose of this agreement is to establish the guarantor's or cosigner's liability for the tenant's rent, damages, and any other costs incurred during the lease term. By signing this attachment, the guarantor or cosigner agrees to take on the responsibility of ensuring that the landlord receives all payments due, in the event that the tenant is unable to make them. The Jacksonville Florida Guaranty Attachment to Lease for Guarantor or Cosigner typically includes the following key details: 1. Parties: The attachment identifies the parties involved in the agreement, namely the landlord, tenant, and guarantor or cosigner. Each party's legal names and contact information are provided. 2. Lease Agreement: The attachment specifies the lease agreement it is attached to, including the dates of the lease term and the address of the property being leased. 3. Guarantor's/Cosigner's Obligations: This section outlines the specific obligations of the guarantor or cosigner. It includes their commitment to pay rent, deposit, utility bills, and any other charges outlined in the lease agreement. The guarantor or cosigner might also agree to cover any damages caused by the tenant, as well as legal fees if any legal actions arise. 4. Duration of Guaranty: The attachment clarifies the duration of the guarantor's or cosigner's obligations. It may state that they are bound until the end of the lease term or even extend their liability until the tenant fulfills all financial obligations. 5. Waivers and Consent: This section outlines any waivers or consents made by the guarantor or cosigner. For instance, they may agree to continue being bound by the lease agreement even if the lease term is extended or modified. 6. Joint and Several liabilities: The attachment may include a provision stating that if there are multiple guarantors or cosigners, they are jointly and severally liable. This means that each guarantor or cosigner is individually responsible for fulfilling the obligations and can be held accountable for the entire amount owed by the tenant. It is important to note that the specific terms and clauses within the Guaranty Attachment to Lease for Guarantor or Cosigner may vary depending on the agreement between the parties involved and the specific requirements of the jurisdiction. While there may not be different types of Jacksonville Florida Guaranty Attachment to Lease for Guarantor or Cosigner, the content and clauses within the attachment can be customized to suit the specific needs and preferences of the landlord and the guarantor or cosigner.