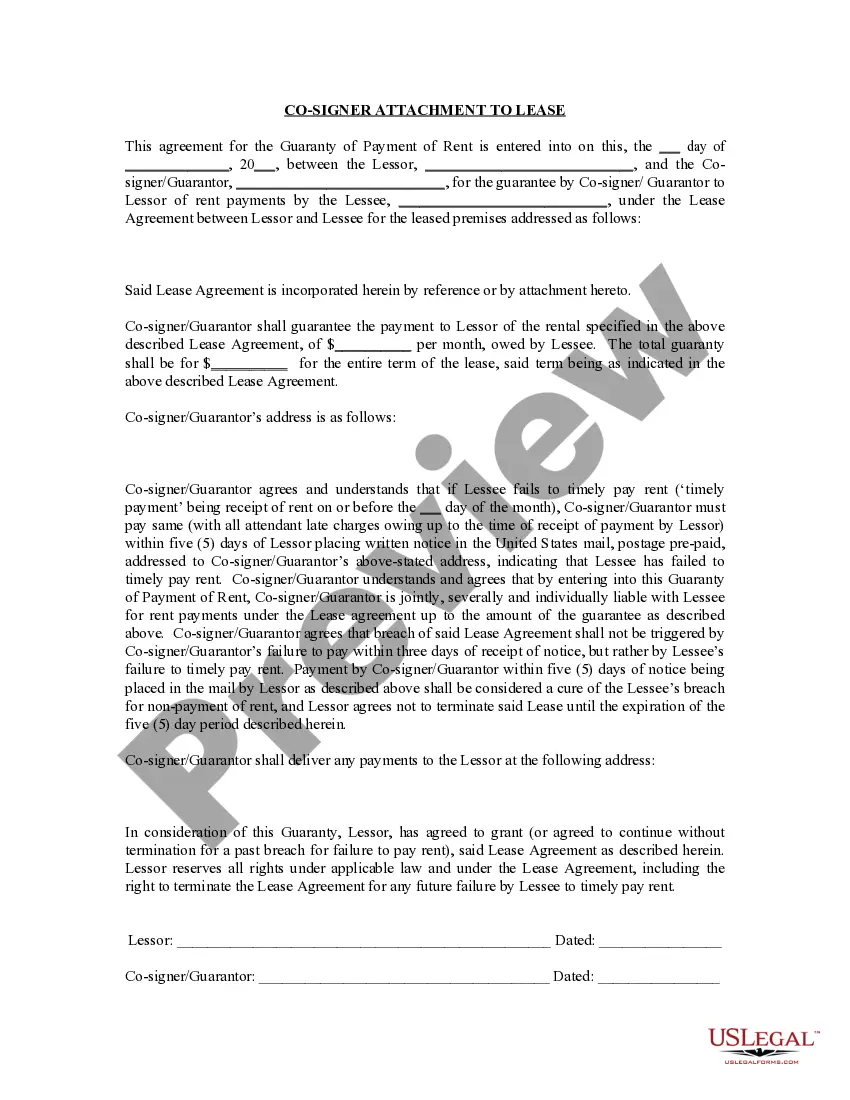

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). Miramar Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a legally binding document that outlines the responsibilities and obligations of a guarantor or cosigner in a lease agreement. In situations where the primary tenant does not meet the financial requirements set by the landlord, a guarantor or cosigner steps in to provide added assurance and guarantee for the lease. The purpose of the Miramar Florida Guaranty Attachment to Lease is to protect the landlord's interests in case the tenant fails to meet their rental obligations. The attachment serves as an additional security measure, ensuring that the guarantor or cosigner will be legally obligated to fulfill the tenant's financial responsibilities if they default on the lease agreement. This attachment form typically includes crucial information such as the names and contact details of the guarantor or cosigner, the tenant, and the landlord. It also outlines the specific lease terms and conditions and clearly highlights the guarantor's obligations, including rent payments, damages, repairs, and any other financial liabilities. Moreover, the Miramar Florida Guaranty Attachment to Lease for Guarantor or Cosigner can specify any limitations or exclusions regarding the guarantor's liabilities. For example, it may state that the guarantor's responsibility is limited to a specific timeframe or that their obligations will cease upon the tenant's fulfilling certain conditions, such as consistently making rent payments for a predetermined period. It is important to note that there may be different types of Miramar Florida Guaranty Attachments to Lease for Guarantor or Cosigner. These variations could arise due to landlords' preferences, property-specific conditions, or the specific requirements of the guarantor or cosigner. Some possible variations can include: 1. Limited Guaranty Attachment: This type of attachment sets specific limitations on the guarantor's responsibilities and obligations. It may define a maximum liability amount or limit the duration of the guarantor's obligations. 2. Continuing Guaranty Attachment: A continuing guaranty attachment specifies that the guarantor's obligations extend beyond the initial lease term, encompassing subsequent lease renewals or extensions. 3. Commercial Lease Guaranty Attachment: This variant pertains to commercial property leases in Miramar, Florida. It outlines the specific terms and conditions relevant to commercial leasing, such as business-related liabilities and financial obligations. In conclusion, the Miramar Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a crucial document that solidifies the responsibilities and obligations of a guarantor or cosigner in a lease agreement. This legally binding attachment provides added security to the landlord, ensuring that an alternate party is held accountable in case the tenant defaults on their rental obligations.

Miramar Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a legally binding document that outlines the responsibilities and obligations of a guarantor or cosigner in a lease agreement. In situations where the primary tenant does not meet the financial requirements set by the landlord, a guarantor or cosigner steps in to provide added assurance and guarantee for the lease. The purpose of the Miramar Florida Guaranty Attachment to Lease is to protect the landlord's interests in case the tenant fails to meet their rental obligations. The attachment serves as an additional security measure, ensuring that the guarantor or cosigner will be legally obligated to fulfill the tenant's financial responsibilities if they default on the lease agreement. This attachment form typically includes crucial information such as the names and contact details of the guarantor or cosigner, the tenant, and the landlord. It also outlines the specific lease terms and conditions and clearly highlights the guarantor's obligations, including rent payments, damages, repairs, and any other financial liabilities. Moreover, the Miramar Florida Guaranty Attachment to Lease for Guarantor or Cosigner can specify any limitations or exclusions regarding the guarantor's liabilities. For example, it may state that the guarantor's responsibility is limited to a specific timeframe or that their obligations will cease upon the tenant's fulfilling certain conditions, such as consistently making rent payments for a predetermined period. It is important to note that there may be different types of Miramar Florida Guaranty Attachments to Lease for Guarantor or Cosigner. These variations could arise due to landlords' preferences, property-specific conditions, or the specific requirements of the guarantor or cosigner. Some possible variations can include: 1. Limited Guaranty Attachment: This type of attachment sets specific limitations on the guarantor's responsibilities and obligations. It may define a maximum liability amount or limit the duration of the guarantor's obligations. 2. Continuing Guaranty Attachment: A continuing guaranty attachment specifies that the guarantor's obligations extend beyond the initial lease term, encompassing subsequent lease renewals or extensions. 3. Commercial Lease Guaranty Attachment: This variant pertains to commercial property leases in Miramar, Florida. It outlines the specific terms and conditions relevant to commercial leasing, such as business-related liabilities and financial obligations. In conclusion, the Miramar Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a crucial document that solidifies the responsibilities and obligations of a guarantor or cosigner in a lease agreement. This legally binding attachment provides added security to the landlord, ensuring that an alternate party is held accountable in case the tenant defaults on their rental obligations.