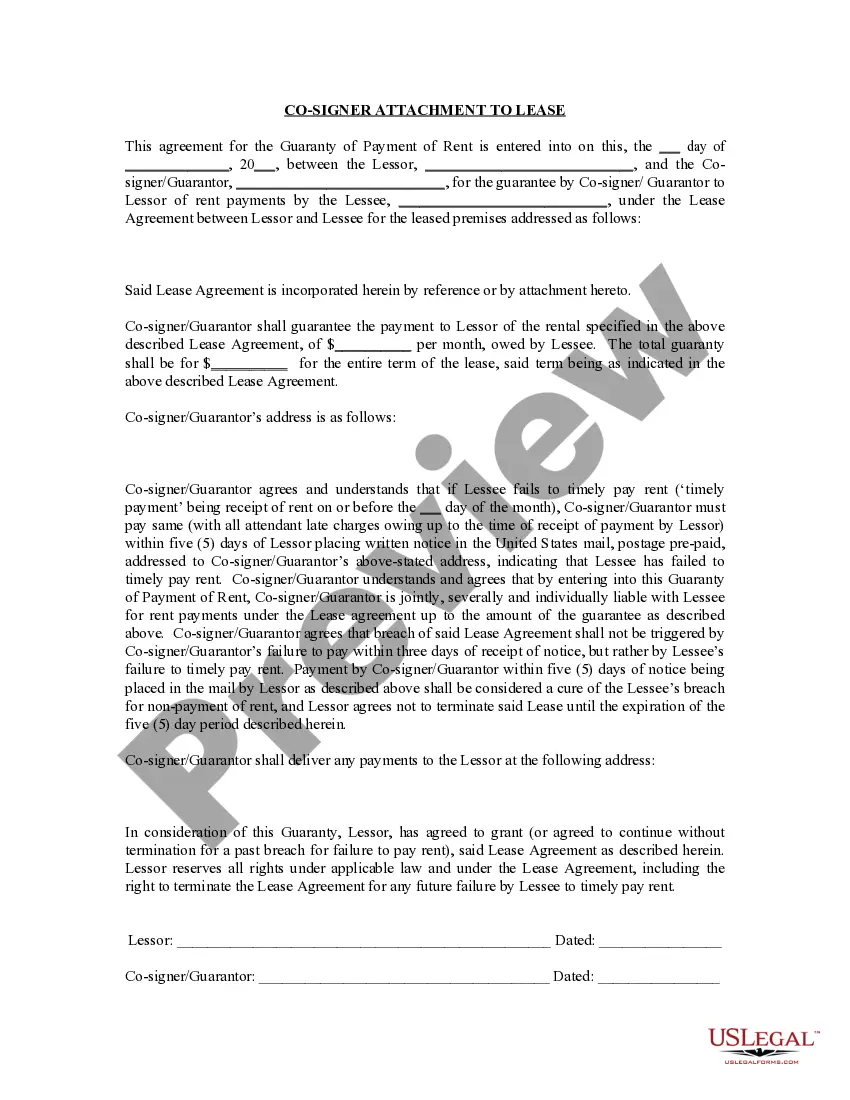

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). Orlando, Florida Guaranty Attachment to Lease for Guarantor or Cosigner provides a detailed description of the terms and conditions associated with the guarantor or cosigner's obligations related to a lease agreement in the city of Orlando, Florida. This document is essential for protecting the interests of both the landlord and the guarantor or cosigner, ensuring that all parties involved are aware of their rights and responsibilities. The Orlando, Florida Guaranty Attachment to Lease for Guarantor or Cosigner is typically utilized when a tenant requires a guarantor or cosigner to guarantee the lease agreement. This is common in situations where the primary tenant has insufficient credit history or income to qualify for the lease independently. The guarantor or cosigner effectively acts as a financial backer, providing an additional layer of security for the landlord, should the primary tenant default on the lease obligations. This form outlines the terms and conditions that the guarantor or cosigner agrees to, including: 1. Guarantee of Lease Obligations: The guarantor or cosigner undertakes the responsibility to guarantee the lease obligations, including rent payments, property damages, and any other charges or penalties outlined in the lease agreement. 2. Financial Capacity Verification: The guarantor or cosigner must provide appropriate documentation proving their financial capacity to fulfill the lease obligations. This may include bank statements, tax returns, or proof of income. 3. Liability and Indemnification: The guarantor or cosigner agrees to indemnify and hold the landlord harmless from any incurred losses, damages, or expenses resulting from the tenant's default on the lease. 4. Co-Debtorship and Joint Liability: In some cases, the guarantor or cosigner may assume co-debtorship with the tenant, making them jointly and severally liable for all lease obligations. 5. Duration and Termination: The Guaranty Attachment specifies the duration of the guarantor or cosigner's obligations, which may align with the duration of the lease or extend beyond it. It also outlines the circumstances under which the guarantor or cosigner can request termination of the guaranty. Different types of Orlando, Florida Guaranty Attachment to Lease for Guarantor or Cosigner may include variations based on the lease term, the specific obligations being guaranteed, or the inclusion of additional provisions to suit the respective requirements of the landlord and parties involved. In summary, the Orlando, Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a comprehensive legal document designed to protect the interests of landlords and guarantors or cosigners. It defines the responsibilities, liabilities, and obligations of the guarantor or cosigner, ensuring the smooth execution of lease agreements in the vibrant city of Orlando, Florida.

Orlando, Florida Guaranty Attachment to Lease for Guarantor or Cosigner provides a detailed description of the terms and conditions associated with the guarantor or cosigner's obligations related to a lease agreement in the city of Orlando, Florida. This document is essential for protecting the interests of both the landlord and the guarantor or cosigner, ensuring that all parties involved are aware of their rights and responsibilities. The Orlando, Florida Guaranty Attachment to Lease for Guarantor or Cosigner is typically utilized when a tenant requires a guarantor or cosigner to guarantee the lease agreement. This is common in situations where the primary tenant has insufficient credit history or income to qualify for the lease independently. The guarantor or cosigner effectively acts as a financial backer, providing an additional layer of security for the landlord, should the primary tenant default on the lease obligations. This form outlines the terms and conditions that the guarantor or cosigner agrees to, including: 1. Guarantee of Lease Obligations: The guarantor or cosigner undertakes the responsibility to guarantee the lease obligations, including rent payments, property damages, and any other charges or penalties outlined in the lease agreement. 2. Financial Capacity Verification: The guarantor or cosigner must provide appropriate documentation proving their financial capacity to fulfill the lease obligations. This may include bank statements, tax returns, or proof of income. 3. Liability and Indemnification: The guarantor or cosigner agrees to indemnify and hold the landlord harmless from any incurred losses, damages, or expenses resulting from the tenant's default on the lease. 4. Co-Debtorship and Joint Liability: In some cases, the guarantor or cosigner may assume co-debtorship with the tenant, making them jointly and severally liable for all lease obligations. 5. Duration and Termination: The Guaranty Attachment specifies the duration of the guarantor or cosigner's obligations, which may align with the duration of the lease or extend beyond it. It also outlines the circumstances under which the guarantor or cosigner can request termination of the guaranty. Different types of Orlando, Florida Guaranty Attachment to Lease for Guarantor or Cosigner may include variations based on the lease term, the specific obligations being guaranteed, or the inclusion of additional provisions to suit the respective requirements of the landlord and parties involved. In summary, the Orlando, Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a comprehensive legal document designed to protect the interests of landlords and guarantors or cosigners. It defines the responsibilities, liabilities, and obligations of the guarantor or cosigner, ensuring the smooth execution of lease agreements in the vibrant city of Orlando, Florida.