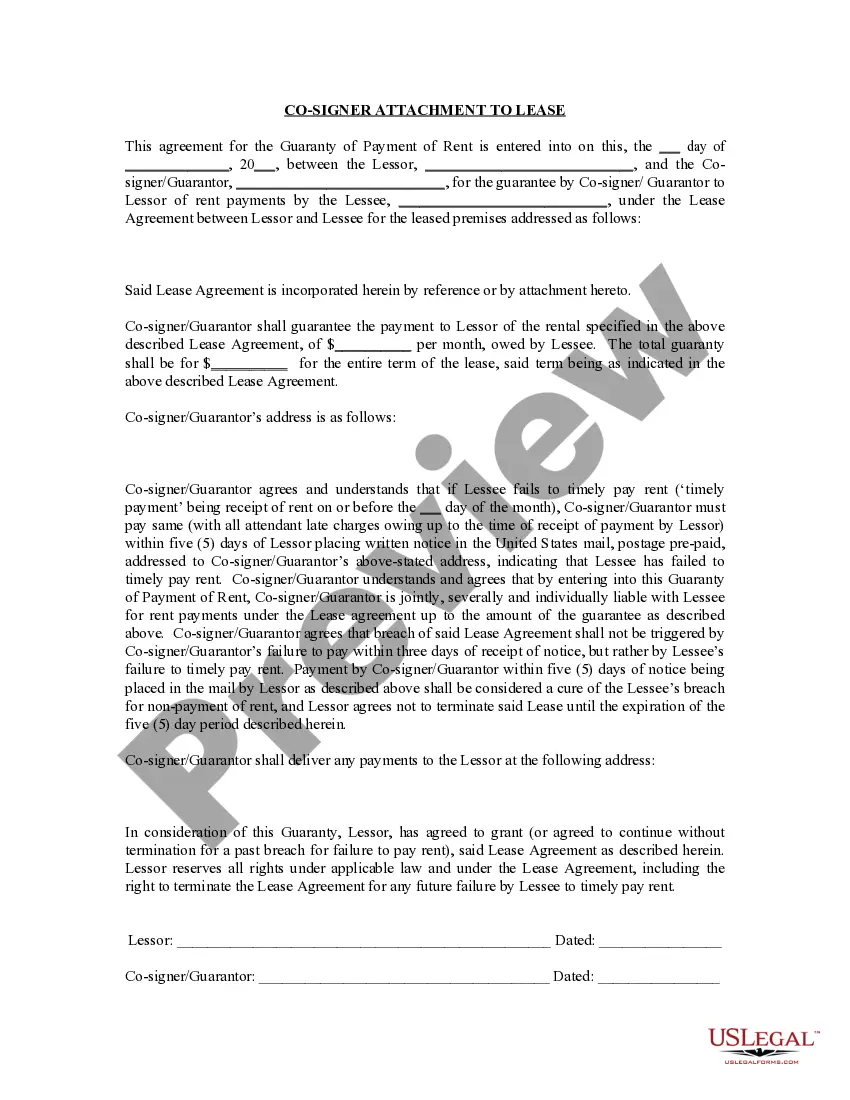

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). The Port St. Lucie Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a legally binding document that serves as an additional layer of security for landlords when entering into a lease agreement. This attachment provides protection and assurance to the landlord in case the tenant fails to fulfill their obligations under the lease agreement. Port St. Lucie, located on Florida's east coast, is a vibrant city known for its beautiful beaches, lush golf courses, and a variety of recreational activities. There are several types of Port St. Lucie Florida Guaranty Attachment to Lease for Guarantor or Cosigner. Some of them include: 1. Financial Guaranty Attachment: The financial guaranty attachment is commonly used when tenants have uncertain or insufficient financial standing. This attachment ensures that the guarantor or cosigner agrees to assume full responsibility for the payment of rent, damages, and any other financial obligations outlined in the lease agreement, in the event the tenant fails to do so. 2. Performance Guaranty Attachment: The performance guaranty attachment is utilized when a tenant poses a higher risk due to unpredictable behavior or unreliable rental history. This attachment ensures that the guarantor or cosigner guarantees the tenant's compliance with all lease terms and conditions, including maintenance responsibilities and adherence to the rules outlined in the lease agreement. 3. Default Guaranty Attachment: The default guaranty attachment is most commonly used when the tenant has a history of defaulting on lease agreements in the past. This attachment states that the guarantor or cosigner will assume the tenant's obligations in the case of default, including rental payments, damages, and any legal fees incurred due to the tenant's breach of the lease agreement. 4. Indemnity Guaranty Attachment: The indemnity guaranty attachment offers protection to the landlord against any loss, damage, or expense suffered due to the tenant's actions. The guarantor or cosigner undertakes to indemnify the landlord for any costs incurred as a result of the tenant's breach or negligence, thereby safeguarding the landlord from potential financial losses. In conclusion, the Port St. Lucie Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a crucial document used to protect landlords from potential financial loss or breach of lease by tenants. Landlords in Port St. Lucie can choose from various types of guaranty attachments to ensure adequate protection and security when entering into lease agreements.

The Port St. Lucie Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a legally binding document that serves as an additional layer of security for landlords when entering into a lease agreement. This attachment provides protection and assurance to the landlord in case the tenant fails to fulfill their obligations under the lease agreement. Port St. Lucie, located on Florida's east coast, is a vibrant city known for its beautiful beaches, lush golf courses, and a variety of recreational activities. There are several types of Port St. Lucie Florida Guaranty Attachment to Lease for Guarantor or Cosigner. Some of them include: 1. Financial Guaranty Attachment: The financial guaranty attachment is commonly used when tenants have uncertain or insufficient financial standing. This attachment ensures that the guarantor or cosigner agrees to assume full responsibility for the payment of rent, damages, and any other financial obligations outlined in the lease agreement, in the event the tenant fails to do so. 2. Performance Guaranty Attachment: The performance guaranty attachment is utilized when a tenant poses a higher risk due to unpredictable behavior or unreliable rental history. This attachment ensures that the guarantor or cosigner guarantees the tenant's compliance with all lease terms and conditions, including maintenance responsibilities and adherence to the rules outlined in the lease agreement. 3. Default Guaranty Attachment: The default guaranty attachment is most commonly used when the tenant has a history of defaulting on lease agreements in the past. This attachment states that the guarantor or cosigner will assume the tenant's obligations in the case of default, including rental payments, damages, and any legal fees incurred due to the tenant's breach of the lease agreement. 4. Indemnity Guaranty Attachment: The indemnity guaranty attachment offers protection to the landlord against any loss, damage, or expense suffered due to the tenant's actions. The guarantor or cosigner undertakes to indemnify the landlord for any costs incurred as a result of the tenant's breach or negligence, thereby safeguarding the landlord from potential financial losses. In conclusion, the Port St. Lucie Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a crucial document used to protect landlords from potential financial loss or breach of lease by tenants. Landlords in Port St. Lucie can choose from various types of guaranty attachments to ensure adequate protection and security when entering into lease agreements.