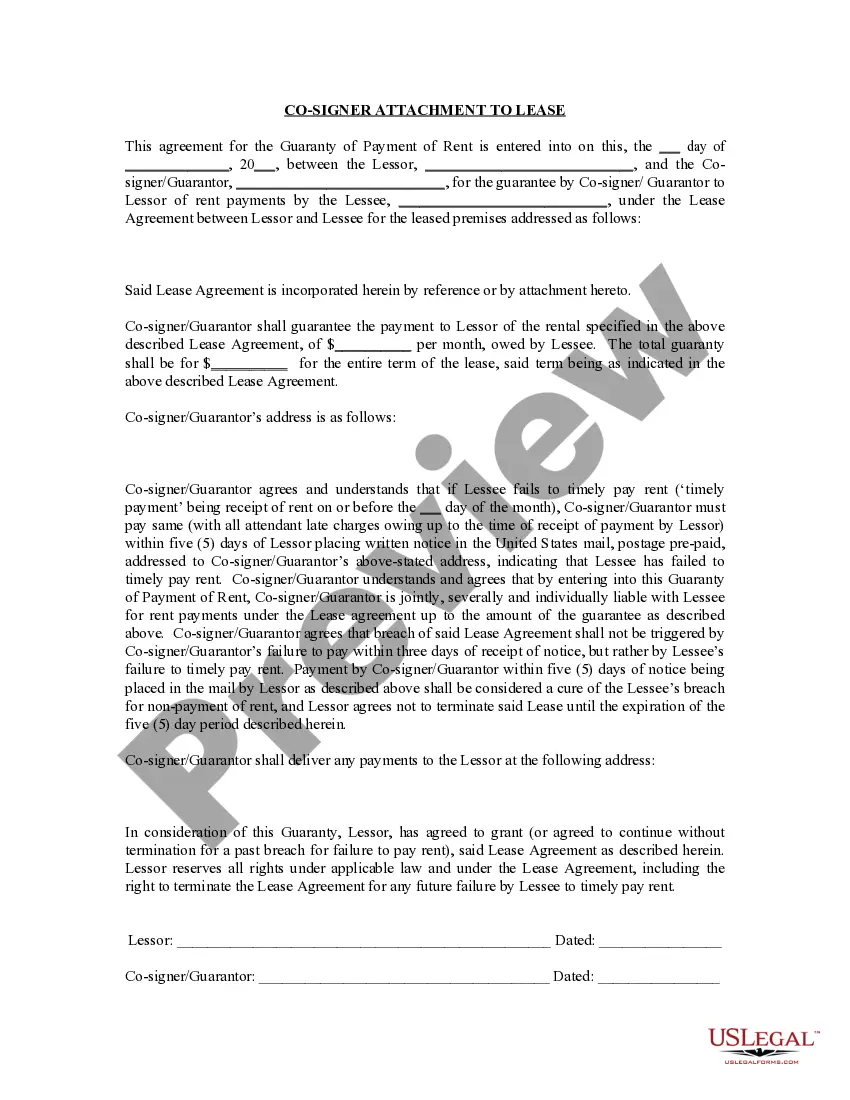

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). A Tampa Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a legal document that provides additional security to a landlord when renting a property. This agreement is typically used when the primary tenant does not meet the landlord's requirements or lacks a sufficient credit score, income, or rental history. The purpose of a Guaranty Attachment to Lease is to protect the landlord's financial interests by having a guarantor or cosigner on the lease agreement. The guarantor or cosigner is an individual who agrees to be legally responsible for fulfilling the obligations of the lease if the primary tenant fails to do so. Here are two different types of Tampa Florida Guaranty Attachment to Lease for Guarantor or Cosigner: 1. Individual Guarantor: This type of attachment includes a specific individual who agrees to act as the guarantor for the lease. Usually, the individual guarantor must pass certain credit checks and meet income requirements to qualify. The individual guarantor takes on the responsibility of paying rent, fees, damages, and any other financial obligations in case the primary tenant defaults. 2. Corporate Guarantor: In some cases, especially for commercial leases, a corporation or business entity might act as the guarantor or cosigner. This type of attachment involves a corporate entity providing financial and legal assurance to the landlord. The agreement typically includes the terms and conditions related to the corporate guarantor, such as financial statements, collateral, and personal guarantees provided by company owners or directors. A Tampa Florida Guaranty Attachment to Lease for Guarantor or Cosigner should include essential details such as the names of the parties involved (landlord, tenant, guarantor/cosigner), the address of the property being leased, lease term and duration, and the specific financial obligations the guarantor or cosigner is undertaking. It is essential for all parties involved to carefully review and understand the terms specified in the attachment before signing, as it legally binds the guarantor or cosigner to the lease agreement. Consulting a qualified attorney is highly recommended ensuring that all legal requirements are met and to protect the interests of all parties involved.

A Tampa Florida Guaranty Attachment to Lease for Guarantor or Cosigner is a legal document that provides additional security to a landlord when renting a property. This agreement is typically used when the primary tenant does not meet the landlord's requirements or lacks a sufficient credit score, income, or rental history. The purpose of a Guaranty Attachment to Lease is to protect the landlord's financial interests by having a guarantor or cosigner on the lease agreement. The guarantor or cosigner is an individual who agrees to be legally responsible for fulfilling the obligations of the lease if the primary tenant fails to do so. Here are two different types of Tampa Florida Guaranty Attachment to Lease for Guarantor or Cosigner: 1. Individual Guarantor: This type of attachment includes a specific individual who agrees to act as the guarantor for the lease. Usually, the individual guarantor must pass certain credit checks and meet income requirements to qualify. The individual guarantor takes on the responsibility of paying rent, fees, damages, and any other financial obligations in case the primary tenant defaults. 2. Corporate Guarantor: In some cases, especially for commercial leases, a corporation or business entity might act as the guarantor or cosigner. This type of attachment involves a corporate entity providing financial and legal assurance to the landlord. The agreement typically includes the terms and conditions related to the corporate guarantor, such as financial statements, collateral, and personal guarantees provided by company owners or directors. A Tampa Florida Guaranty Attachment to Lease for Guarantor or Cosigner should include essential details such as the names of the parties involved (landlord, tenant, guarantor/cosigner), the address of the property being leased, lease term and duration, and the specific financial obligations the guarantor or cosigner is undertaking. It is essential for all parties involved to carefully review and understand the terms specified in the attachment before signing, as it legally binds the guarantor or cosigner to the lease agreement. Consulting a qualified attorney is highly recommended ensuring that all legal requirements are met and to protect the interests of all parties involved.