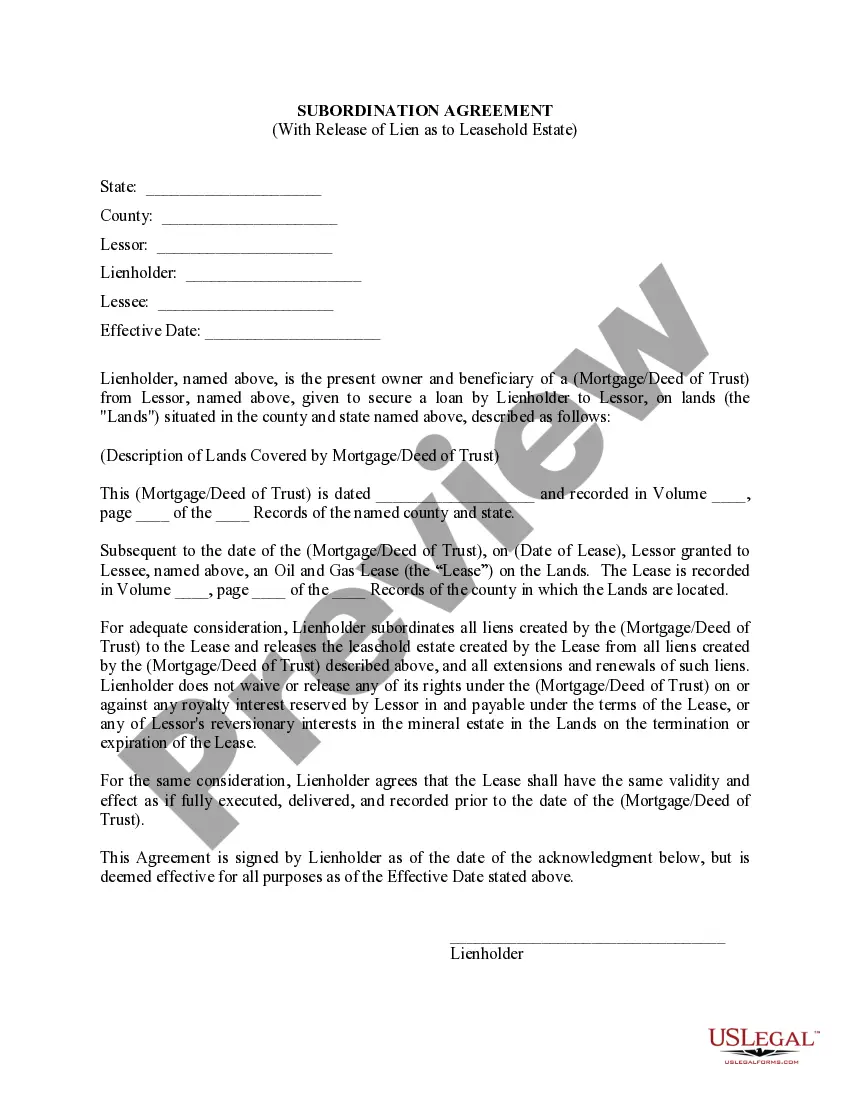

Subordination means an agreement to put a debt or claim which has priority in a lower position behind another debt, particularly a new loan. A property owner with a loan secured by the property who applies for a second mortgage to make additions or repairs usually must get a subordination of the original loan so the new loan has first priority. A declaration of homestead must always be subordinated to a loan. A Hillsborough Florida Lease Subordination Agreement is a legally binding document that outlines the subordination of a lease to a mortgage agreement in the state of Florida. This agreement is typically used when a property owner wants to secure a mortgage on the leased property, but the lease term extends beyond the mortgage term, creating a potential conflict in priority of interests between the landlord and the lender. This agreement allows the mortgage lender to have priority over the lease agreement in case of default or foreclosure. In essence, it relegates the lease agreement to a subordinate position, ensuring that the lender's rights take precedence in the event of non-payment or default by the property owner. There are different types of Hillsborough Florida Lease Subordination Agreements, depending on the specific circumstances and parties involved. Here are a few common types: 1. Commercial Lease Subordination Agreement: This type of agreement is commonly used in commercial real estate transactions where a business tenant wants to enter into a lease while the property owner obtains a mortgage. The tenant agrees to subordinate their lease rights to the lender's interests. 2. Residential Lease Subordination Agreement: Similar to a commercial lease subordination agreement, this type is used when a residential tenant is leasing a property that is subject to a mortgage. The tenant acknowledges that the lender's rights will take precedence over their lease agreement. 3. Partial Subordination Agreement: In some cases, only a portion of the lease agreement may need to be subordinated. This could occur when the landlord wants to refinance the property and needs to secure additional financing while keeping the existing lease intact. A partial subordination agreement allows for the prioritization of the new loan without affecting the entire lease. 4. Estoppel Certificate Subordination Agreement: This type of agreement involves the tenant providing a signed estoppel certificate, which confirms the terms and conditions of their lease. The certificate is then attached as an exhibit to the subordination agreement, adding an extra layer of clarity and documentation. It is important for both parties to carefully review and understand all the terms and conditions outlined in the Hillsborough Florida Lease Subordination Agreement before signing. Seeking legal advice or assistance from a real estate professional is recommended to ensure that the agreement accurately reflects the intentions of all parties involved and complies with Florida laws and regulations.

A Hillsborough Florida Lease Subordination Agreement is a legally binding document that outlines the subordination of a lease to a mortgage agreement in the state of Florida. This agreement is typically used when a property owner wants to secure a mortgage on the leased property, but the lease term extends beyond the mortgage term, creating a potential conflict in priority of interests between the landlord and the lender. This agreement allows the mortgage lender to have priority over the lease agreement in case of default or foreclosure. In essence, it relegates the lease agreement to a subordinate position, ensuring that the lender's rights take precedence in the event of non-payment or default by the property owner. There are different types of Hillsborough Florida Lease Subordination Agreements, depending on the specific circumstances and parties involved. Here are a few common types: 1. Commercial Lease Subordination Agreement: This type of agreement is commonly used in commercial real estate transactions where a business tenant wants to enter into a lease while the property owner obtains a mortgage. The tenant agrees to subordinate their lease rights to the lender's interests. 2. Residential Lease Subordination Agreement: Similar to a commercial lease subordination agreement, this type is used when a residential tenant is leasing a property that is subject to a mortgage. The tenant acknowledges that the lender's rights will take precedence over their lease agreement. 3. Partial Subordination Agreement: In some cases, only a portion of the lease agreement may need to be subordinated. This could occur when the landlord wants to refinance the property and needs to secure additional financing while keeping the existing lease intact. A partial subordination agreement allows for the prioritization of the new loan without affecting the entire lease. 4. Estoppel Certificate Subordination Agreement: This type of agreement involves the tenant providing a signed estoppel certificate, which confirms the terms and conditions of their lease. The certificate is then attached as an exhibit to the subordination agreement, adding an extra layer of clarity and documentation. It is important for both parties to carefully review and understand all the terms and conditions outlined in the Hillsborough Florida Lease Subordination Agreement before signing. Seeking legal advice or assistance from a real estate professional is recommended to ensure that the agreement accurately reflects the intentions of all parties involved and complies with Florida laws and regulations.