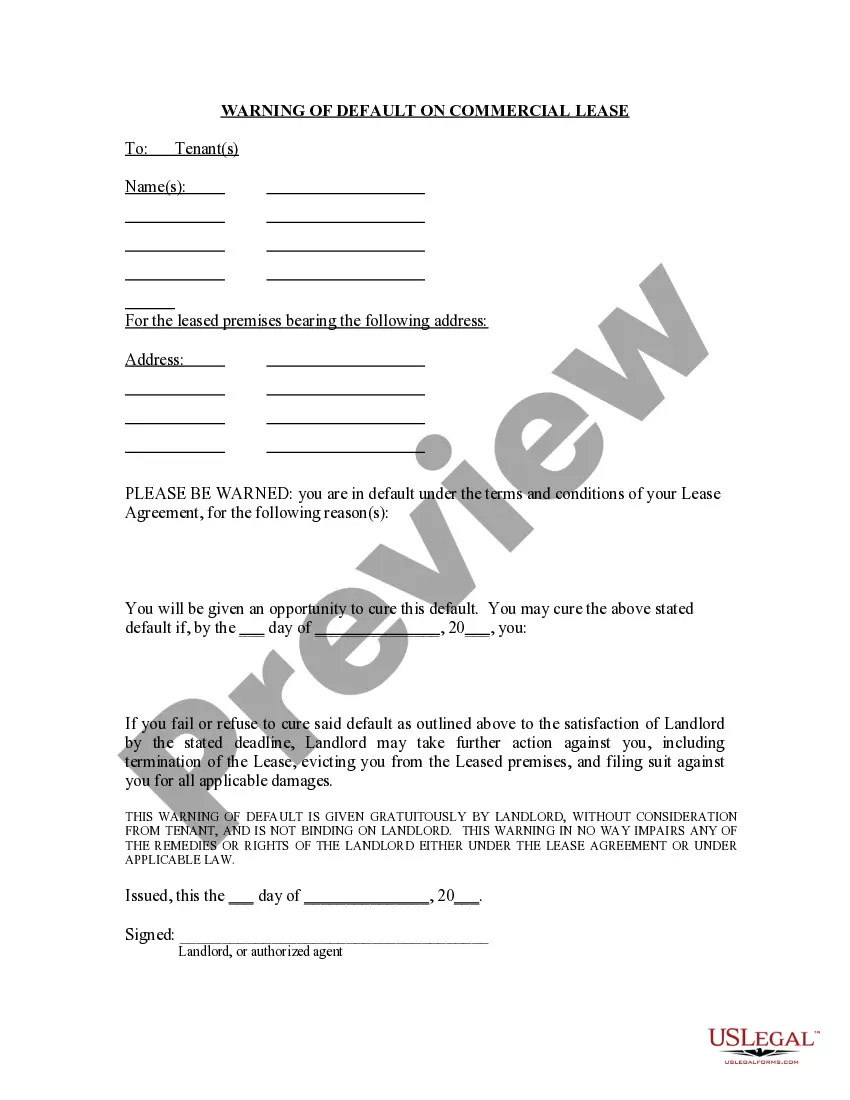

In landlord-tenant law, default usually refers to the failure of a tenant to timely pay rent due. In anticipation of such an occurence, landlords commonly require a new tenant to pay a security deposit, which may be used to remedy defaults in payment of rent and other monetary obligations under the rental agreement. In general, the landlord is required to give the tenant notice of the default before bringing eviction proceedings or applying security deposit proceeds to the payment in default. The fixing of a definite default date for payment of rent can be critical if it becomes necessary to evict a tenant for a default in the payment of rent. Landlords often require a background and/or reference check on prospective tenants in an attempt to minimize defaults in rent payments. Title: Understanding the Tallahassee Florida Warning of Default on Commercial Lease: A Comprehensive Overview Keywords: Tallahassee Florida, commercial lease, warning of default, consequences, remedies, types Introduction: Navigating a Commercial Lease in Tallahassee, Florida can be a complex process for both tenants and landlords. However, it is crucial for all parties involved to be knowledgeable about the potential risks associated with defaulting on a commercial lease. In this article, we will delve into the intricacies of a Tallahassee Florida Warning of Default on Commercial Lease, exploring various types and shedding light on their consequences and remedies. Types of Tallahassee Florida Warning of Default on Commercial Lease: 1. Non-payment of Rent: One of the most common types of default occurs when a tenant fails to fulfill their financial obligation by not paying rent in accordance with the lease terms. Landlords may issue a warning of default if this occurs. 2. Late Payments: In some cases, tenants may consistently pay rent beyond the agreed-upon due date, violating the lease terms. This could lead to the issuance of a warning of default if the issue persists. 3. Breach of Lease Clauses: Lease agreements typically include specific clauses that tenants must adhere to. Instances such as unauthorized subletting, property damage, or failure to maintain or insure the premises as required may prompt a warning of default. 4. Unauthorized Alterations: If a tenant makes alterations to the commercial space without obtaining prior consent from the landlord, this can be considered a breach of lease terms and may result in a warning of default. Consequences of Default on a Commercial Lease: 1. Termination of Lease: The landlord may choose to terminate the lease agreement, potentially leading to eviction and legal proceedings against the defaulting tenant. 2. Financial Liabilities: Defaulting on a commercial lease may expose the tenant to financial penalties, such as having to reimburse the landlord for costs associated with finding a new tenant or covering delinquent rent payments. 3. Damage to Credit History: Failure to rectify the default situation can negatively impact the defaulting tenant's credit history, making it difficult to secure future leases or loans. Remedies for Default on Commercial Lease: 1. Cure Period: In some cases, tenants may be granted a limited timeframe, known as a "cure period," to rectify the default and bring their lease obligations up to date. 2. Negotiating with the Landlord: It may be possible for tenants to negotiate with the landlord, proposing alternative solutions to rectify the default situation, such as catching up on missed payments over time. 3. Legal Representation: Seeking legal advice from an experienced attorney who specializes in commercial lease disputes can help tenants understand their rights and explore potential legal remedies. Conclusion: Understanding the Tallahassee Florida Warning of Default on Commercial Lease is essential for all parties involved in commercial lease agreements. By being aware of the various types of defaults, their consequences, and potential remedies, both tenants and landlords can help mitigate potential risks and maintain a harmonious landlord-tenant relationship.

Title: Understanding the Tallahassee Florida Warning of Default on Commercial Lease: A Comprehensive Overview Keywords: Tallahassee Florida, commercial lease, warning of default, consequences, remedies, types Introduction: Navigating a Commercial Lease in Tallahassee, Florida can be a complex process for both tenants and landlords. However, it is crucial for all parties involved to be knowledgeable about the potential risks associated with defaulting on a commercial lease. In this article, we will delve into the intricacies of a Tallahassee Florida Warning of Default on Commercial Lease, exploring various types and shedding light on their consequences and remedies. Types of Tallahassee Florida Warning of Default on Commercial Lease: 1. Non-payment of Rent: One of the most common types of default occurs when a tenant fails to fulfill their financial obligation by not paying rent in accordance with the lease terms. Landlords may issue a warning of default if this occurs. 2. Late Payments: In some cases, tenants may consistently pay rent beyond the agreed-upon due date, violating the lease terms. This could lead to the issuance of a warning of default if the issue persists. 3. Breach of Lease Clauses: Lease agreements typically include specific clauses that tenants must adhere to. Instances such as unauthorized subletting, property damage, or failure to maintain or insure the premises as required may prompt a warning of default. 4. Unauthorized Alterations: If a tenant makes alterations to the commercial space without obtaining prior consent from the landlord, this can be considered a breach of lease terms and may result in a warning of default. Consequences of Default on a Commercial Lease: 1. Termination of Lease: The landlord may choose to terminate the lease agreement, potentially leading to eviction and legal proceedings against the defaulting tenant. 2. Financial Liabilities: Defaulting on a commercial lease may expose the tenant to financial penalties, such as having to reimburse the landlord for costs associated with finding a new tenant or covering delinquent rent payments. 3. Damage to Credit History: Failure to rectify the default situation can negatively impact the defaulting tenant's credit history, making it difficult to secure future leases or loans. Remedies for Default on Commercial Lease: 1. Cure Period: In some cases, tenants may be granted a limited timeframe, known as a "cure period," to rectify the default and bring their lease obligations up to date. 2. Negotiating with the Landlord: It may be possible for tenants to negotiate with the landlord, proposing alternative solutions to rectify the default situation, such as catching up on missed payments over time. 3. Legal Representation: Seeking legal advice from an experienced attorney who specializes in commercial lease disputes can help tenants understand their rights and explore potential legal remedies. Conclusion: Understanding the Tallahassee Florida Warning of Default on Commercial Lease is essential for all parties involved in commercial lease agreements. By being aware of the various types of defaults, their consequences, and potential remedies, both tenants and landlords can help mitigate potential risks and maintain a harmonious landlord-tenant relationship.