A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

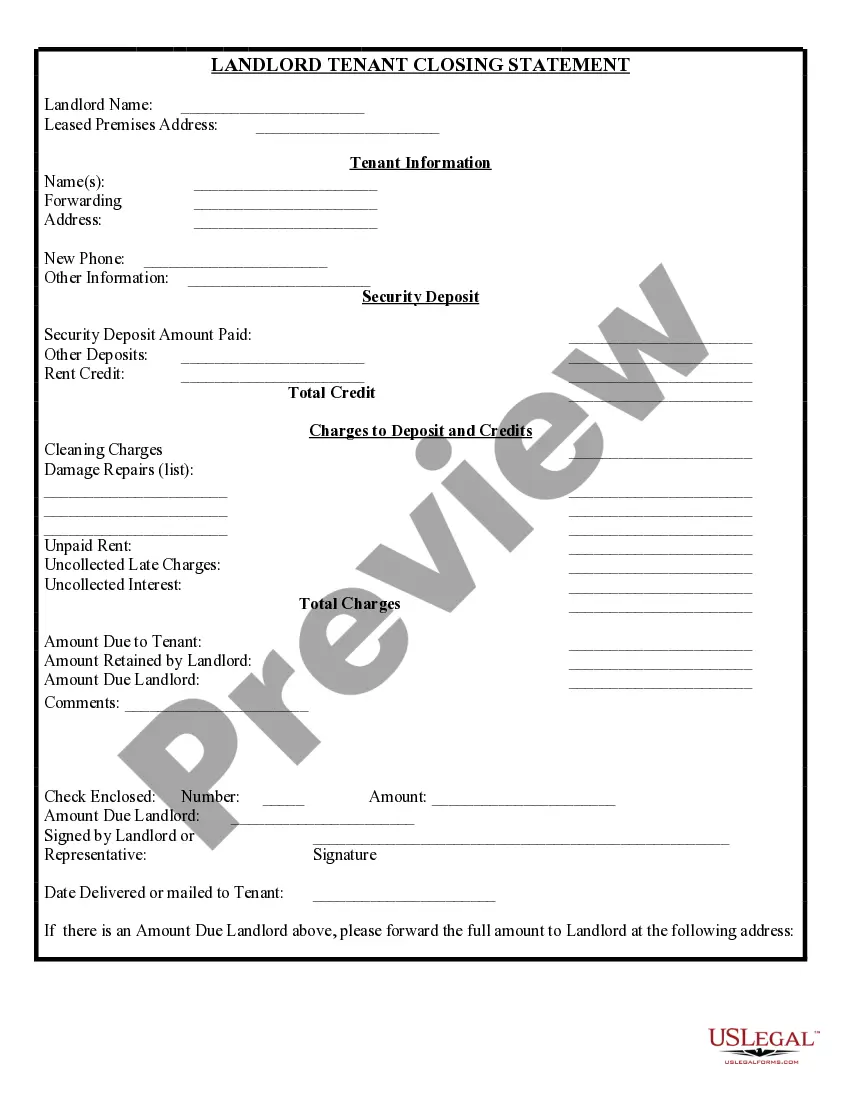

Miami-Dade Florida Landlord Tenant Closing Statement to Reconcile Security Deposit is a crucial document that outlines the financial transactions between the landlord and tenant upon the termination of a lease agreement. This statement ensures transparency in assessing the return or deduction of the security deposit. Keywords: Miami-Dade County, Florida, landlord, tenant, closing statement, reconcile, security deposit, lease agreement, financial transactions, return, deduction. Types of Miami-Dade Florida Landlord Tenant Closing Statement to Reconcile Security Deposit: 1. Standard Miami-Dade Florida Landlord Tenant Closing Statement: This is a generic statement used in most lease termination cases in Miami-Dade County. It includes details regarding the security deposit amount, any deductions made, outstanding rent or fees, and the final amount refunded to the tenant. 2. Itemized Miami-Dade Florida Landlord Tenant Closing Statement: This type of closing statement provides a detailed breakdown of deductions made from the security deposit. It lists the specific charges incurred by the tenant, such as unpaid rent, property damages, cleaning fees, or any outstanding utilities. 3. Disputed Miami-Dade Florida Landlord Tenant Closing Statement: In cases where the landlord and tenant disagree on the deductions made from the security deposit, a disputed closing statement may be necessary. It includes an explanation of the dispute, supporting evidence, and any proposed solutions for resolution. 4. Furnished Rental Miami-Dade Florida Landlord Tenant Closing Statement: If the rental property was furnished, this specific type of closing statement accounts for any damages or missing items from the furnished unit, along with associated costs for repair or replacement. 5. Commercial Property Miami-Dade Florida Landlord Tenant Closing Statement: For lease agreements involving commercial properties, this closing statement is tailored to account for unique factors such as alterations, improvements, or modifications made by the tenant, and any related costs deducted from the security deposit. 6. Multiple Tenants Miami-Dade Florida Landlord Tenant Closing Statement: In cases where multiple individuals shared a lease agreement, this type of closing statement provides a breakdown of the security deposit refunds or deductions for each tenant, ensuring clarity and fairness in dividing the funds. It is important for both landlords and tenants in Miami-Dade County, Florida, to carefully review the Landlord Tenant Closing Statement to Reconcile Security Deposit, ensuring accuracy, fairness, and compliance with local laws and regulations.