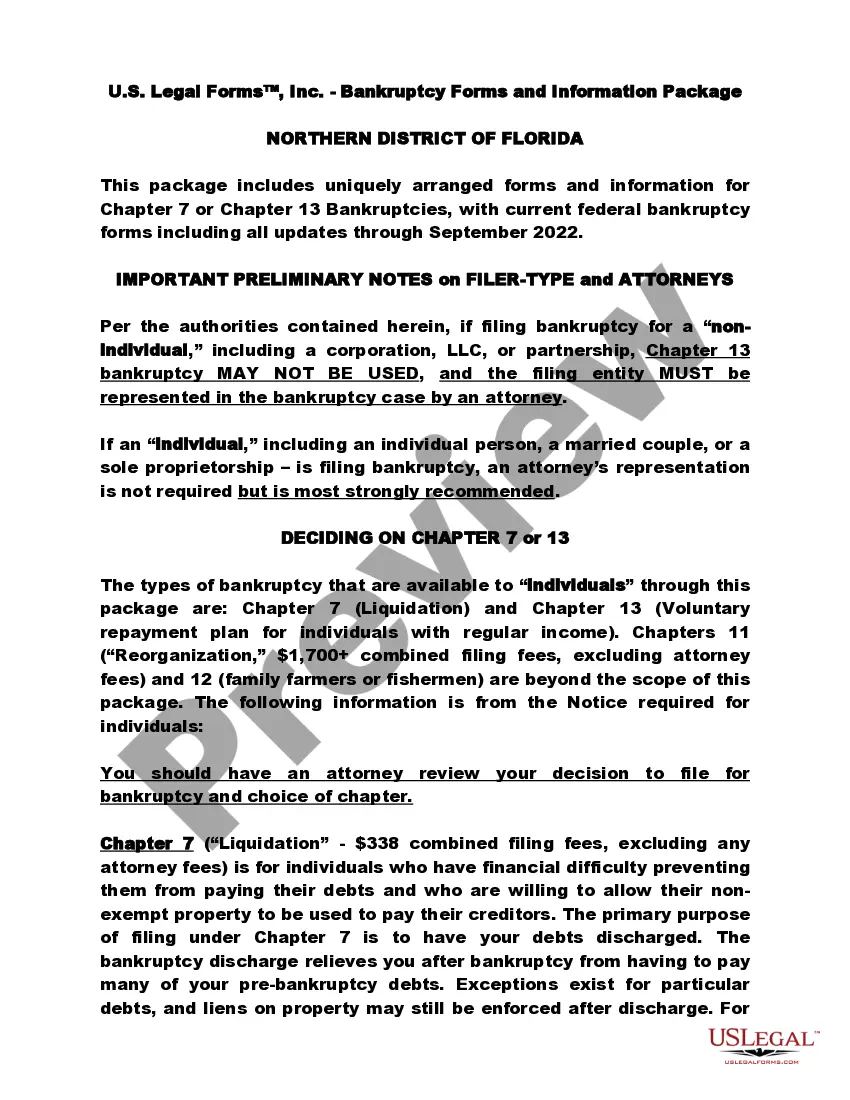

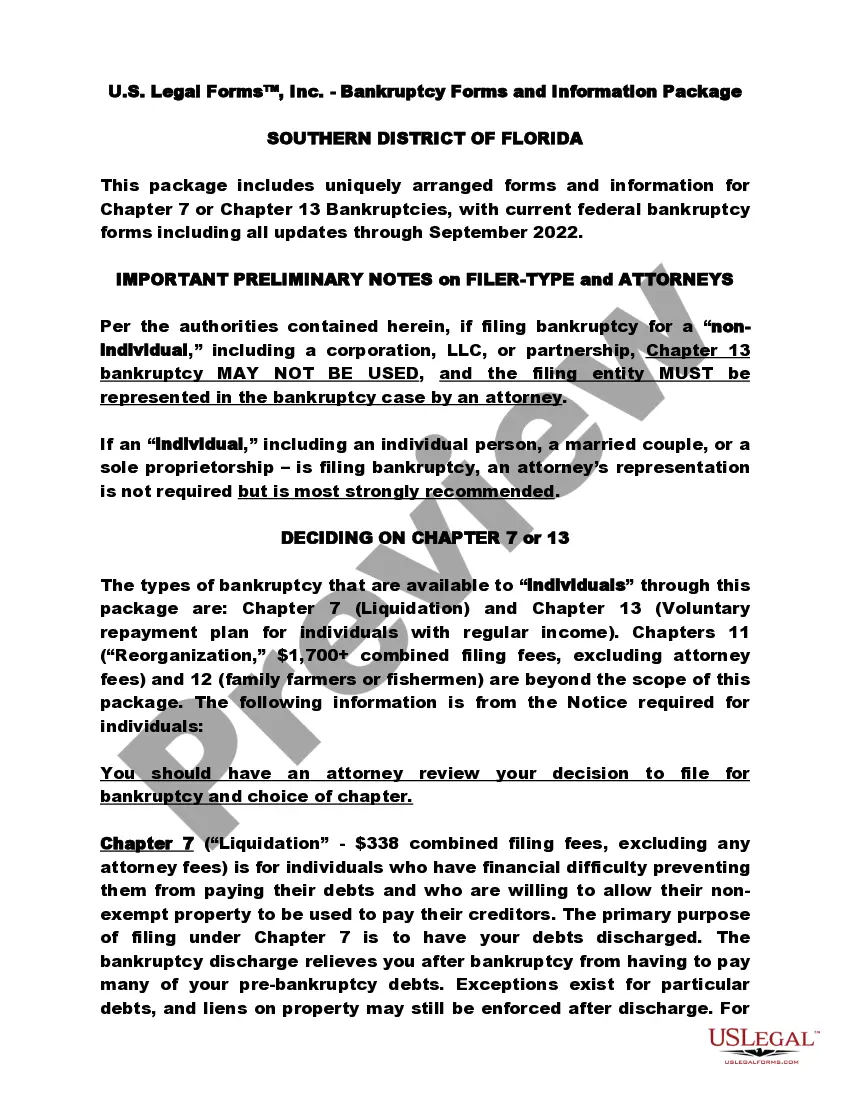

Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

The Tampa Florida Middle District Bankruptcy Guide and Forms Package for Chapters 7 or 13 is a comprehensive resource designed to assist individuals or businesses considering bankruptcy in the Middle District of Florida, specifically in the Tampa area. This guide provides detailed information and all the necessary forms for filing bankruptcy under either Chapter 7 or Chapter 13 of the United States Bankruptcy Code. For individuals who are unable to pay off their debts and wish to seek a fresh start, Chapter 7 bankruptcy may be the suitable option. This package includes a step-by-step guide that walks users through the entire Chapter 7 bankruptcy process, including eligibility requirements, how to prepare and file the necessary forms, and what to expect before, during, and after the bankruptcy case. On the other hand, Chapter 13 bankruptcy is an alternative for individuals who have a regular source of income and want to reorganize their debts into a more manageable repayment plan. This package also offers a comprehensive guide for Chapter 13 bankruptcy, explaining the eligibility criteria, how to develop a repayment plan, and the procedures involved in filing and completing a Chapter 13 case. The Tampa Florida Middle District Bankruptcy Guide and Forms Package for Chapters 7 or 13 may include additional variations based on specific circumstances, such as: 1. Personal Bankruptcy Package: This package caters to individuals who are seeking bankruptcy relief for their personal debts, including credit card bills, medical expenses, personal loans, etc. 2. Business Bankruptcy Package: Designed for business owners or self-employed individuals facing overwhelming debts and seeking a resolution for their business-related financial crisis. This package specifically focuses on the unique considerations that may arise during a business bankruptcy, such as liquidation of assets, employee-related issues, and business closure procedures. 3. Bankruptcy Exemptions Package: This supplementary package provides detailed information on the various bankruptcy exemptions available in the Middle District of Florida. Exemptions allow individuals to protect certain assets from being seized or sold during the bankruptcy process, including homes, vehicles, retirement accounts, and personal belongings. This package assists users in understanding their rights and limitations when it comes to exempting property during bankruptcy. Regardless of the specific package chosen, the Tampa Florida Middle District Bankruptcy Guide and Forms Package for Chapters 7 or 13 offers a comprehensive and easy-to-understand resource for anyone considering bankruptcy in the Tampa area. With step-by-step guidance and all the required forms, this package aims to empower individuals or businesses going through financial hardships to navigate the bankruptcy process effectively and efficiently.The Tampa Florida Middle District Bankruptcy Guide and Forms Package for Chapters 7 or 13 is a comprehensive resource designed to assist individuals or businesses considering bankruptcy in the Middle District of Florida, specifically in the Tampa area. This guide provides detailed information and all the necessary forms for filing bankruptcy under either Chapter 7 or Chapter 13 of the United States Bankruptcy Code. For individuals who are unable to pay off their debts and wish to seek a fresh start, Chapter 7 bankruptcy may be the suitable option. This package includes a step-by-step guide that walks users through the entire Chapter 7 bankruptcy process, including eligibility requirements, how to prepare and file the necessary forms, and what to expect before, during, and after the bankruptcy case. On the other hand, Chapter 13 bankruptcy is an alternative for individuals who have a regular source of income and want to reorganize their debts into a more manageable repayment plan. This package also offers a comprehensive guide for Chapter 13 bankruptcy, explaining the eligibility criteria, how to develop a repayment plan, and the procedures involved in filing and completing a Chapter 13 case. The Tampa Florida Middle District Bankruptcy Guide and Forms Package for Chapters 7 or 13 may include additional variations based on specific circumstances, such as: 1. Personal Bankruptcy Package: This package caters to individuals who are seeking bankruptcy relief for their personal debts, including credit card bills, medical expenses, personal loans, etc. 2. Business Bankruptcy Package: Designed for business owners or self-employed individuals facing overwhelming debts and seeking a resolution for their business-related financial crisis. This package specifically focuses on the unique considerations that may arise during a business bankruptcy, such as liquidation of assets, employee-related issues, and business closure procedures. 3. Bankruptcy Exemptions Package: This supplementary package provides detailed information on the various bankruptcy exemptions available in the Middle District of Florida. Exemptions allow individuals to protect certain assets from being seized or sold during the bankruptcy process, including homes, vehicles, retirement accounts, and personal belongings. This package assists users in understanding their rights and limitations when it comes to exempting property during bankruptcy. Regardless of the specific package chosen, the Tampa Florida Middle District Bankruptcy Guide and Forms Package for Chapters 7 or 13 offers a comprehensive and easy-to-understand resource for anyone considering bankruptcy in the Tampa area. With step-by-step guidance and all the required forms, this package aims to empower individuals or businesses going through financial hardships to navigate the bankruptcy process effectively and efficiently.