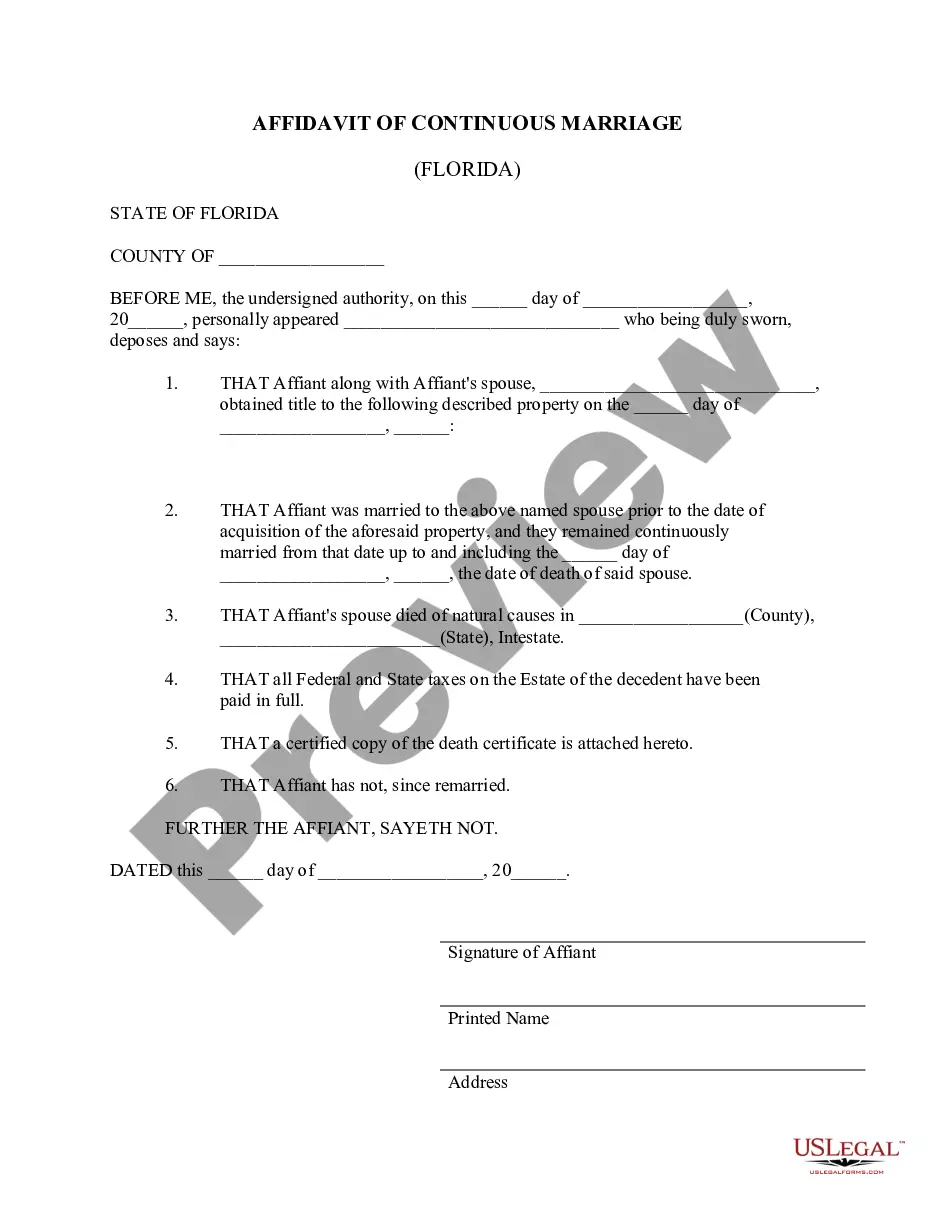

This form is an Affidavit of Continuous Marriage for use when acting to remove deceased spouse form land title. This deed complies with all state statutory laws.

Orlando Florida Affidavit of Continuous Marriage - Deceased Spouse

Description

How to fill out Orlando Florida Affidavit Of Continuous Marriage - Deceased Spouse?

Obtaining verified forms that adhere to your local regulations can be difficult unless you utilize the US Legal Forms repository.

This is an online compilation of over 85,000 legal documents catering to both personal and professional requirements and a variety of real-world scenarios.

All the papers are accurately organized by category and jurisdiction, making it as straightforward as possible to locate the Orlando Florida Affidavit of Continuous Marriage - Deceased Spouse.

Maintaining organized paperwork that meets legal standards is critically important. Leverage the US Legal Forms library to consistently have essential document templates readily available for all your needs!

- Examine the Preview mode and form description.

- Ensure that you have selected the appropriate template that fulfills your needs and aligns with your local jurisdiction stipulations.

- Seek another template, if necessary.

- If you encounter any discrepancies, utilize the Search tab above to discover the suitable document.

- Once satisfied, proceed to the next stage.

Form popularity

FAQ

If the property is owned as joint tenants with rights of survivorship or as tenants by the entirety, the deceased owner's interest passes automatically to the surviving co-owner by operation of law. Generally, it is not necessary to have a new deed prepared removing the deceased co-owner.

Florida law gives a surviving spouse at minimum a life estate in a homestead property previously titled solely in the name of the deceased spouse. A life estate gives the surviving spouse the right to live in the homestead for the remainder of their life.

When one spouse dies without a will, the surviving spouse is entitled to 100% of the decedent's estate if: The deceased spouse has no lineal descendants (i.e., children, grandchildren, great-grandchildren); or. All lineal descendants of either spouse are descendants of both.

You will have to file an application to the land registry. They will require evidence of death, i.e. death certificate or a will. You will have to go to the office of revenue officer and submit an application to transfer title in the surviving co-owners name or surviving heirs name.

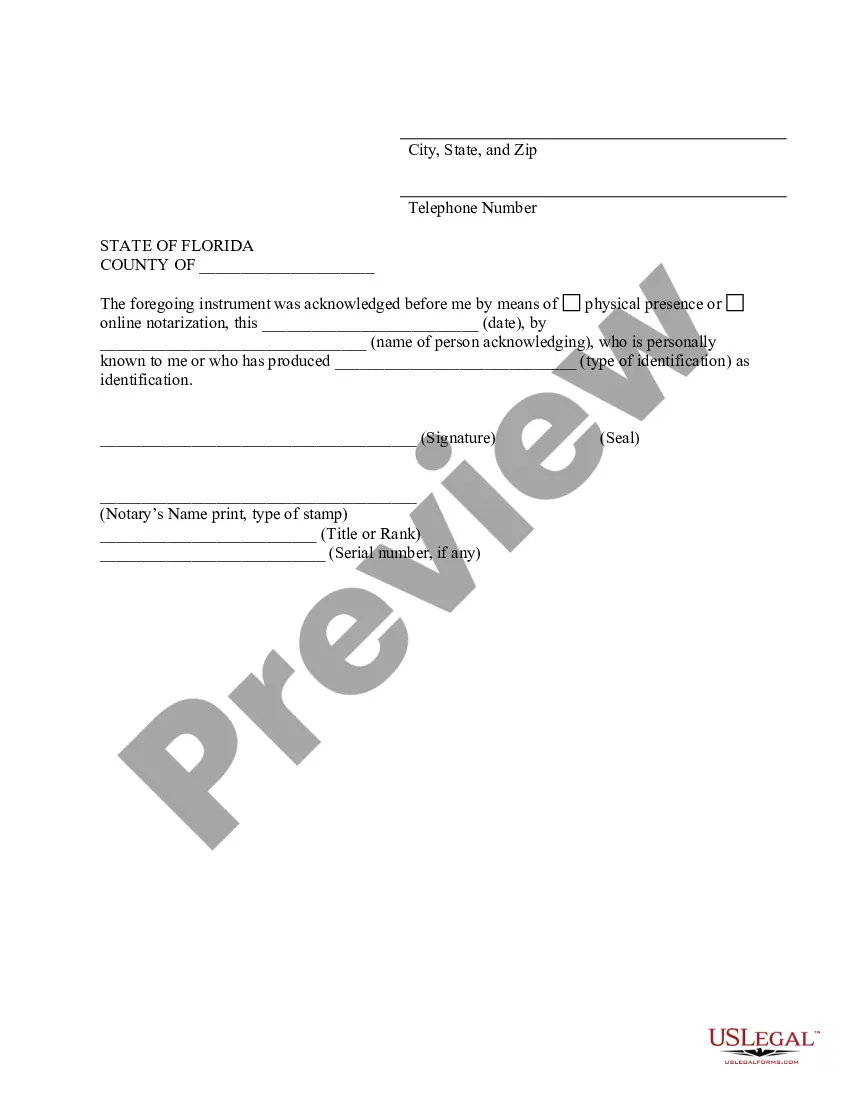

Most often, a copy of the deceased spouse's death certificate, the notarized death affidavit, and a legal description of the property are required. Once these steps are complete, your deceased spouse will have been removed and you will be the sole owner on the deed.

Create a Survivorship Affidavit to Remove a Deceased Owner A survivorship affidavit (sometimes called an affidavit of death or affidavit of continuous marriage) is a legal document used to remove a deceased owner from title to property by recording evidence of the deceased owner's death in the land records.

No, Florida is not a community property state. In a community property state, any assets acquired by either spouse during the marriage are considered marital property and therefore owned by both spouses.

Yes. Florida uses TOD (Transfer-on-Death) and POD (Payable-on-Death) designations which allows the beneficiary (or beneficiaries) to automatically receive the specified asset upon the death of the current owner. TOD designations are often used to transfer the funds in an IRA or brokerage account to a beneficiary.

This Act states, in summary, that one-half of any property acquired as community property shall not be subject to devise by decedent and shall pass to the surviving spouse, in addition to an elective share claim by surviving spouse, Section 732.219, Florida Statutes.