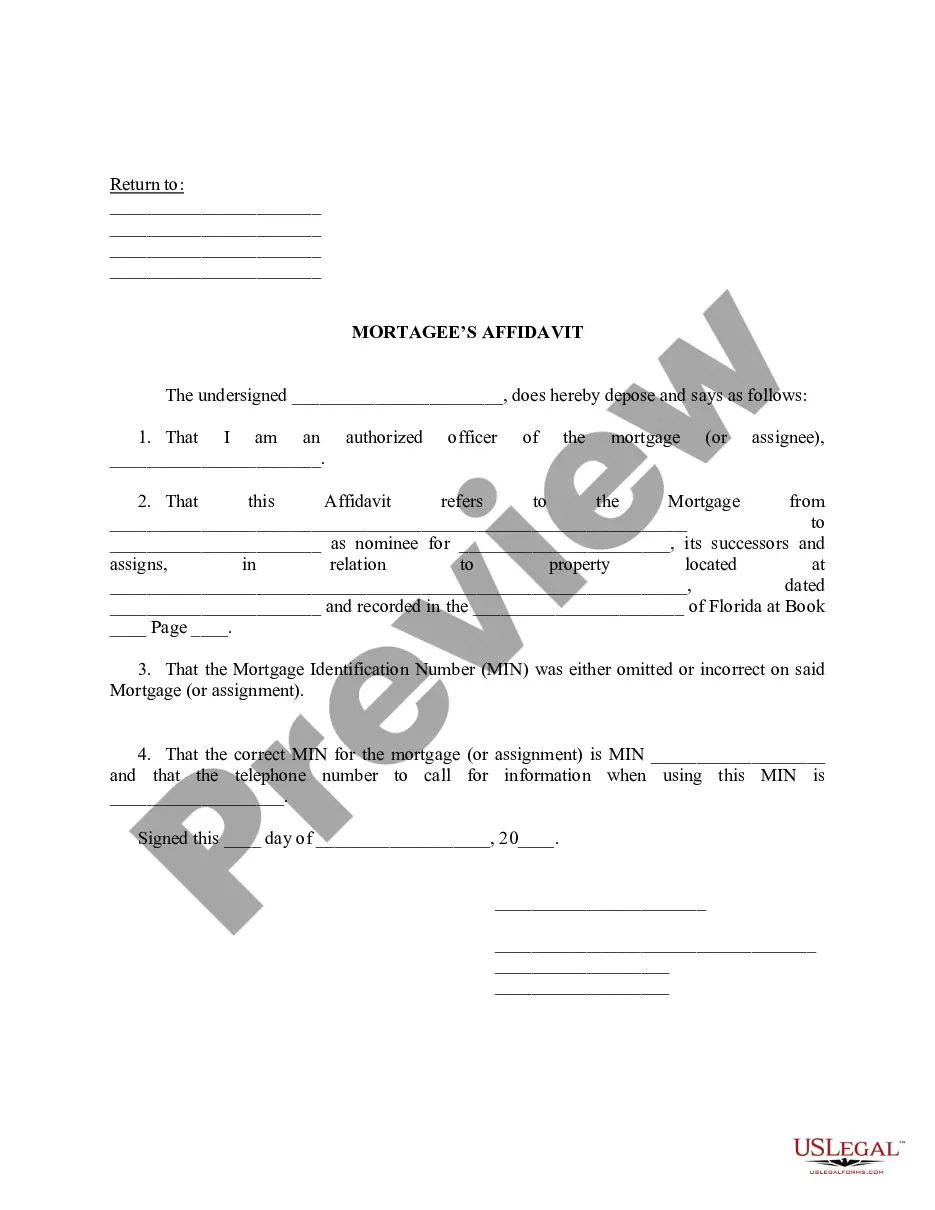

Broward Florida Mortgagee's Affidavit is a legal document designed to state facts related to a mortgage agreement in Broward County, Florida. It serves as a sworn statement by the mortgagee (the lender) regarding the loan transaction with the mortgagor (the borrower). This affidavit is often required in real estate transactions to ensure that all necessary information and requirements are met. The Broward Florida Mortgagee's Affidavit typically includes various details related to the mortgage loan, property, and parties involved. It outlines the terms and conditions of the mortgage agreement, including the loan amount, interest rate, repayment schedule, and any additional terms specific to the agreement. Keywords: Broward Florida Mortgagee's Affidavit, legal document, mortgage agreement, Broward County, Florida, sworn statement, lender, borrower, real estate transactions, loan transaction, property, terms and conditions, loan amount, interest rate, repayment schedule. Different types of Broward Florida Mortgagee's Affidavit may include: 1. Lien Release: This affidavit is used when a mortgage loan has been paid off in full by the borrower. It verifies that the lien on the property has been released and allows the owner to clear any encumbrances on the property title. 2. Default Affidavit: This affidavit is used when the borrower fails to meet the terms of the mortgage agreement, such as missing payments or breaching other contractual obligations. It states the default and may be used as evidence in legal proceedings. 3. Assumption Affidavit: This affidavit is used when a new borrower (referred to as the assumption) assumes the existing mortgage loan from the original borrower (mortgagor) with the consent of the lender. The affidavit contains information about the new borrower and verifies their intention to assume the loan's obligations. 4. Modification Affidavit: This affidavit is used when the terms of the original mortgage agreement are modified or amended between the lender and the borrower. It states the changes made to the original agreement and may require the borrower's acknowledgement and acceptance of the modified terms. 5. Satisfaction of Mortgage Affidavit: This affidavit is used when the mortgage loan has been fully paid off by the borrower, and the lender releases the mortgage lien from the property. It confirms the satisfaction of the mortgage, ensuring that the borrower has fulfilled their financial obligations. Keywords: Lien Release Affidavit, Default Affidavit, Assumption Affidavit, Modification Affidavit, Satisfaction of Mortgage Affidavit, paid off, default, assumption, modification, satisfaction.

Broward Florida Mortagee's Affidavit

Description

How to fill out Broward Florida Mortagee's Affidavit?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone without any legal background to draft this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform provides a huge catalog with more than 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time using our DYI forms.

Whether you want the Broward Florida Mortagee's Affidavit or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Broward Florida Mortagee's Affidavit quickly using our trusted platform. If you are presently an existing customer, you can go ahead and log in to your account to download the needed form.

Nevertheless, if you are a novice to our library, ensure that you follow these steps before obtaining the Broward Florida Mortagee's Affidavit:

- Be sure the template you have found is suitable for your area because the rules of one state or county do not work for another state or county.

- Review the document and read a quick description (if provided) of scenarios the paper can be used for.

- In case the one you selected doesn’t suit your needs, you can start again and search for the necessary form.

- Click Buy now and pick the subscription option you prefer the best.

- Access an account {using your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Broward Florida Mortagee's Affidavit once the payment is completed.

You’re all set! Now you can go ahead and print out the document or complete it online. If you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.