Cape Coral Florida Mortgagee's Affidavit is a legal document used in mortgage transactions within the Cape Coral area of Florida. It is a sworn statement provided by the mortgagee, who is the lender or the person/entity who holds a mortgage against a property, confirming certain key information regarding the mortgage. This document is typically required during the closing process, as it serves as a declaration from the lender verifying the details of the mortgage. The Cape Coral Florida Mortgagee's Affidavit plays a crucial role in ensuring the accuracy and validity of the transaction, protecting both the lender and the borrower. The contents of the affidavit may vary depending on the specific requirements of the transaction and the lender's preferences. However, some common elements found in a Cape Coral Florida Mortgagee's Affidavit include: 1. Identification: The affidavit will typically start with the mortgagee's identification details, including their name, address, contact information, and any other relevant identification information. 2. Mortgage Details: This section will outline essential information about the mortgage being affirmed. It typically includes details such as the mortgage amount, the interest rate, the loan term, the date of the mortgage, and any additional terms or conditions associated with the loan. 3. Borrower Information: The affidavit will contain the borrower's name(s), address, and other necessary personal details. This ensures the lender acknowledges the correct individual(s) associated with the mortgage. 4. Loan Repayment: The affidavit will state if the borrower is current on their payments and, if not, whether the lender has taken any actions to address the delinquency. This section helps establish the loan's status and any potential issues or actions related to the borrower's payment history. 5. Collateral Description: The affidavit will describe the property associated with the mortgage, including its address, legal description, and any other pertinent details. This section helps establish the property that serves as collateral for the loan. 6. Liabilities and Encumbrances: The affidavit may include a statement confirming that there are no additional liens, encumbrances, or legal claims against the property, other than those specifically mentioned in the mortgage. This declaration assures the borrower, buyer, and other parties involved that the property being mortgaged is free of any potential disputes or claims. It is important to note that while Cape Coral Florida Mortgagee's Affidavit generally covers the above-mentioned areas, specific lenders or transactions may require additional information or clauses based on their unique requirements. Regarding different types of Cape Coral Florida Mortgagee's Affidavit, it is crucial to consult with a qualified legal professional or contact the lender directly to determine if there are any specific variations or specialized affidavits applicable to certain situations, such as refinancing, second mortgages, or foreclosure proceedings.

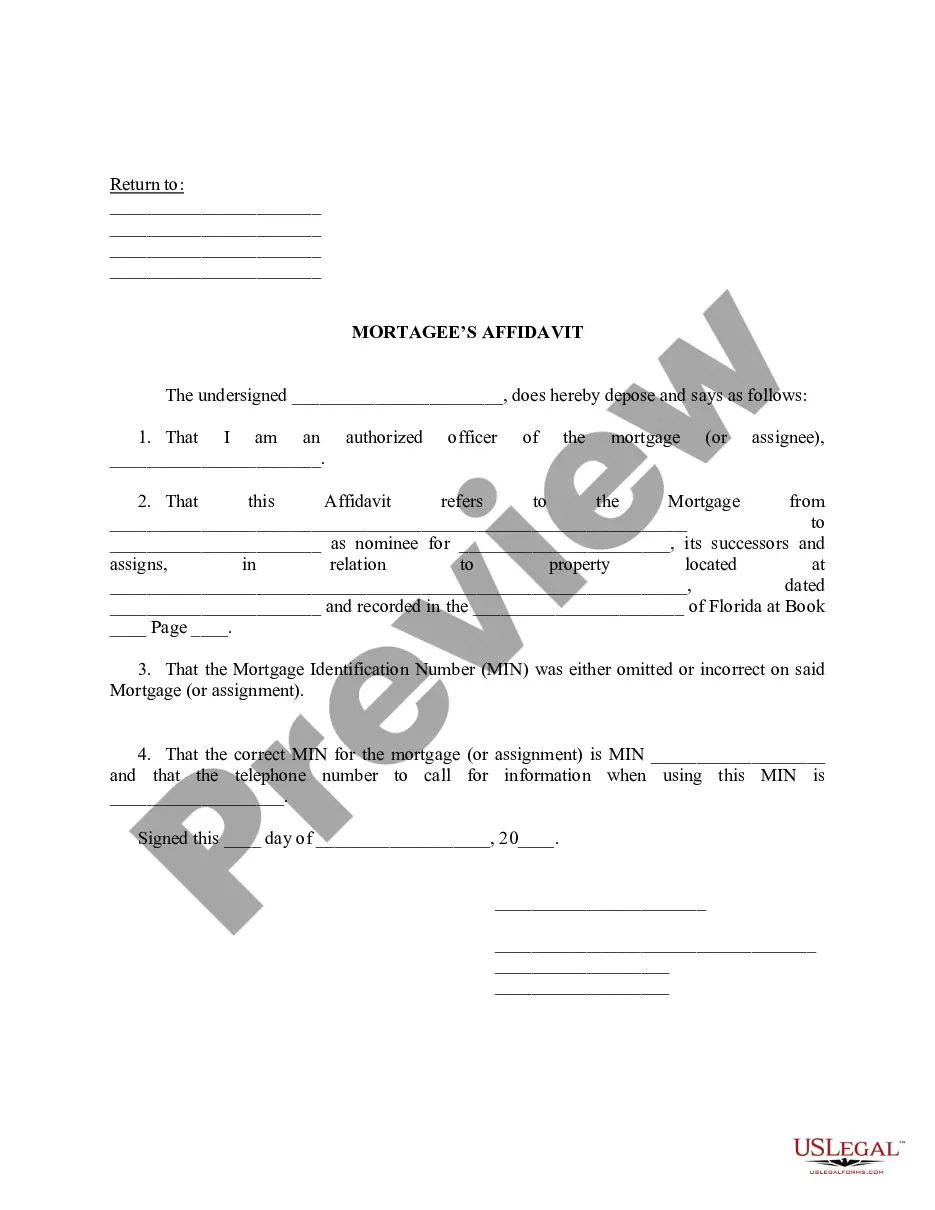

Cape Coral Florida Mortagee's Affidavit

Description

How to fill out Cape Coral Florida Mortagee's Affidavit?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Cape Coral Florida Mortagee's Affidavit becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Cape Coral Florida Mortagee's Affidavit takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve picked the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Cape Coral Florida Mortagee's Affidavit. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!