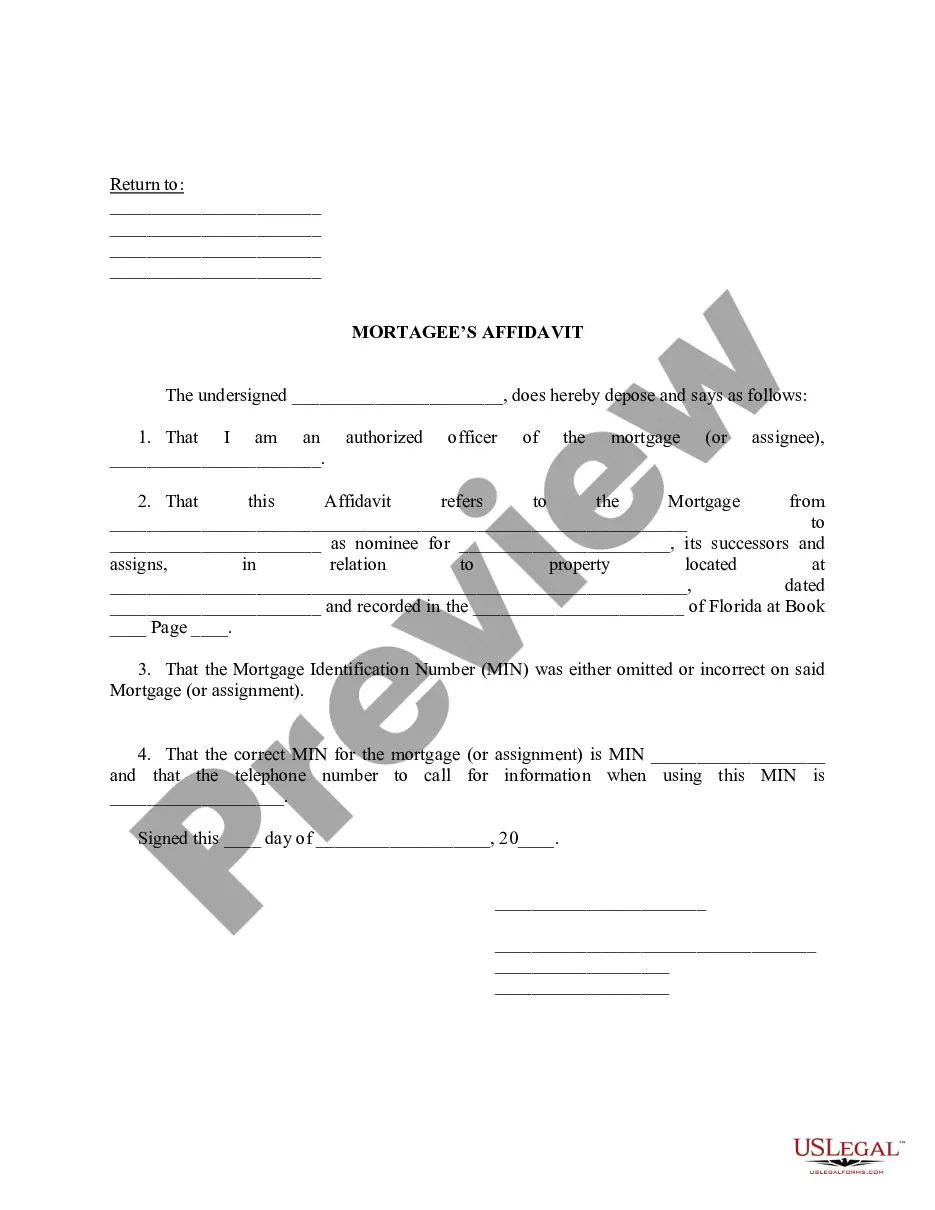

A Fort Lauderdale Florida Mortgagee's Affidavit is a legal document used in mortgage transactions in the city of Fort Lauderdale, Florida. This document serves as a notarized statement from the mortgagee (the lender) affirming specific details related to the mortgage loan. The Mortgagee's Affidavit includes essential information about the mortgage, providing evidence that the lender has complied with all necessary requirements in the loan process. It serves as a declaration confirming the accuracy and validity of the information provided by the mortgagee. Some key details typically included in a Fort Lauderdale Florida Mortgagee's Affidavit are: 1. Loan Information: The affidavit states the loan's principal amount, interest rate, repayment terms, and other relevant loan details. 2. Borrower Information: It includes the name, address, and contact information of the borrowers (mortgagors) who obtained the loan. 3. Property Information: The affidavit specifies the property's legal description, address, and other pertinent details. 4. Mortgage Documents: It lists the various mortgage documents executed by the parties involved, such as promissory note, mortgage deed, and any other relevant legal instruments. 5. Compliance Confirmation: The affidavit attests that the mortgagee has complied with all applicable state and federal laws, regulations, and mortgage requirements. 6. Mortgagee's Statement: The document states that the mortgagee has a legal interest in the mortgage and is entitled to payments, interests, and other financial obligations as agreed upon in the loan agreement. 7. Notarization: A Fort Lauderdale Florida Mortgagee's Affidavit must be notarized by a licensed notary public to verify its authenticity and legal standing. Types of Fort Lauderdale Florida Mortgagee's Affidavits: 1. Initial Mortgagee's Affidavit: This affidavit is prepared and executed at the beginning of the loan process, affirming the essential loan details and compliance requirements. 2. Supplemental Mortgagee's Affidavit: In some cases, additional information or documents may be required throughout the loan process. A supplemental affidavit is prepared to provide the necessary information whenever these situations arise. 3. Final Mortgagee's Affidavit: This affidavit is executed at the conclusion of the mortgage transaction, confirming that all requirements have been met, and the mortgage is in compliance with state and federal regulations. A Fort Lauderdale Florida Mortgagee's Affidavit is a crucial legal document that protects the rights of both the mortgagee and the borrower. It ensures transparency and compliance with the established loan terms, providing a solid foundation for the agreed-upon mortgage transaction in Fort Lauderdale, Florida.

Fort Lauderdale Florida Mortagee's Affidavit

Category:

State:

Florida

City:

Fort Lauderdale

Control #:

FL-CL010

Format:

Word;

Rich Text

Instant download

Description

A mortgage affidavit is a written statement signed by a party in a real estate transaction under penalties of perjury that attests to certain conditions of the property.

A Fort Lauderdale Florida Mortgagee's Affidavit is a legal document used in mortgage transactions in the city of Fort Lauderdale, Florida. This document serves as a notarized statement from the mortgagee (the lender) affirming specific details related to the mortgage loan. The Mortgagee's Affidavit includes essential information about the mortgage, providing evidence that the lender has complied with all necessary requirements in the loan process. It serves as a declaration confirming the accuracy and validity of the information provided by the mortgagee. Some key details typically included in a Fort Lauderdale Florida Mortgagee's Affidavit are: 1. Loan Information: The affidavit states the loan's principal amount, interest rate, repayment terms, and other relevant loan details. 2. Borrower Information: It includes the name, address, and contact information of the borrowers (mortgagors) who obtained the loan. 3. Property Information: The affidavit specifies the property's legal description, address, and other pertinent details. 4. Mortgage Documents: It lists the various mortgage documents executed by the parties involved, such as promissory note, mortgage deed, and any other relevant legal instruments. 5. Compliance Confirmation: The affidavit attests that the mortgagee has complied with all applicable state and federal laws, regulations, and mortgage requirements. 6. Mortgagee's Statement: The document states that the mortgagee has a legal interest in the mortgage and is entitled to payments, interests, and other financial obligations as agreed upon in the loan agreement. 7. Notarization: A Fort Lauderdale Florida Mortgagee's Affidavit must be notarized by a licensed notary public to verify its authenticity and legal standing. Types of Fort Lauderdale Florida Mortgagee's Affidavits: 1. Initial Mortgagee's Affidavit: This affidavit is prepared and executed at the beginning of the loan process, affirming the essential loan details and compliance requirements. 2. Supplemental Mortgagee's Affidavit: In some cases, additional information or documents may be required throughout the loan process. A supplemental affidavit is prepared to provide the necessary information whenever these situations arise. 3. Final Mortgagee's Affidavit: This affidavit is executed at the conclusion of the mortgage transaction, confirming that all requirements have been met, and the mortgage is in compliance with state and federal regulations. A Fort Lauderdale Florida Mortgagee's Affidavit is a crucial legal document that protects the rights of both the mortgagee and the borrower. It ensures transparency and compliance with the established loan terms, providing a solid foundation for the agreed-upon mortgage transaction in Fort Lauderdale, Florida.

Free preview

How to fill out Fort Lauderdale Florida Mortagee's Affidavit?

If you’ve already used our service before, log in to your account and save the Fort Lauderdale Florida Mortagee's Affidavit on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Fort Lauderdale Florida Mortagee's Affidavit. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!