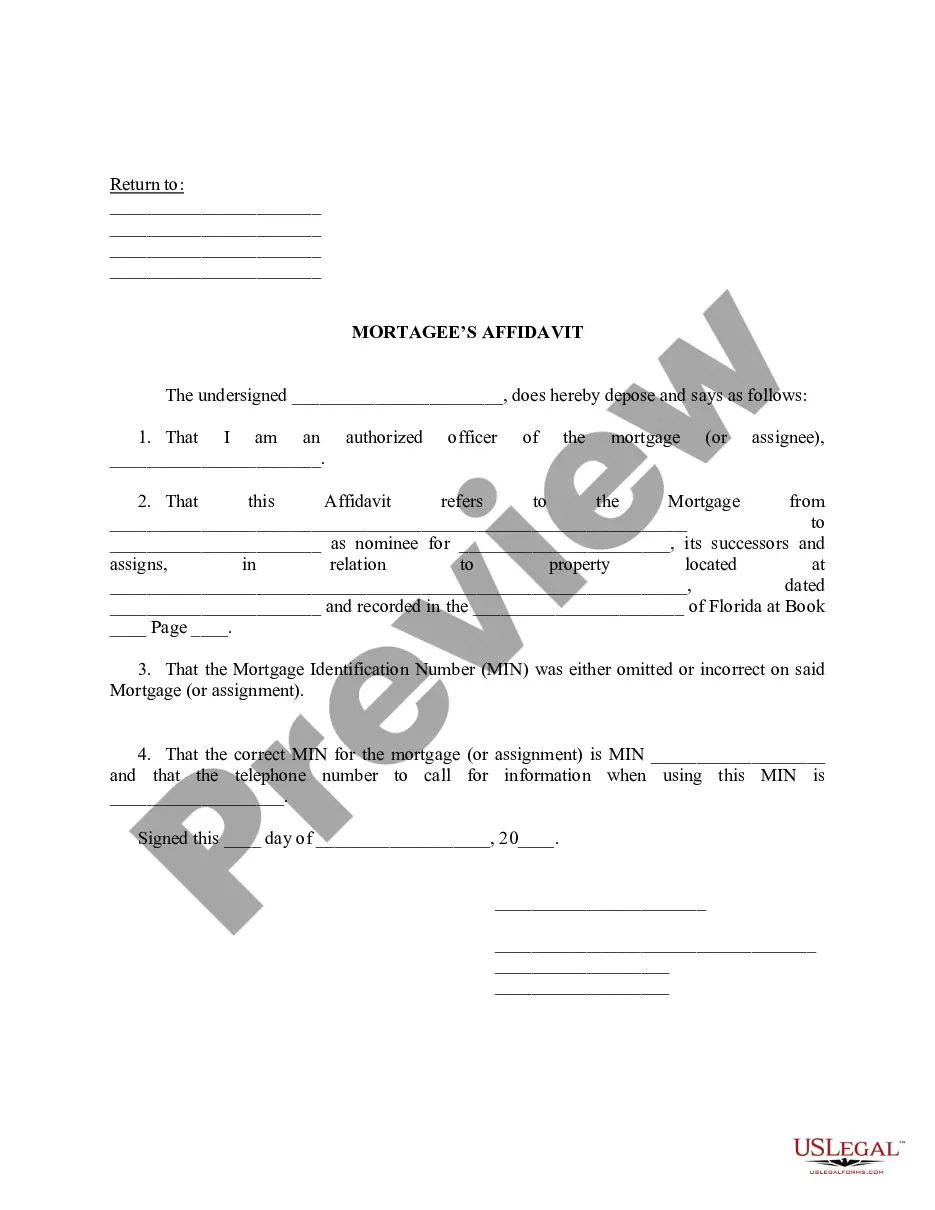

Gainesville Florida Mortgagee's Affidavit is a legal document required during the mortgage process in Gainesville, Florida. It serves as proof that the mortgagee (the lender) has a valid and enforceable mortgage lien on the property in question. This affidavit is crucial when a property owner wants to sell, refinance, or transfer ownership of the property. The Gainesville Florida Mortgagee's Affidavit contains several key elements. Firstly, it identifies the parties involved, including the mortgagee and mortgagor (the borrower). It outlines the terms and conditions of the mortgage, such as the loan amount, interest rate, and repayment schedule. The affidavit also includes a detailed description of the property being mortgaged. This description usually includes the property's legal description, address, and any relevant parcel numbers. This information helps ensure that the correct property is associated with the mortgage. Furthermore, the Gainesville Florida Mortgagee's Affidavit includes statements affirming that the mortgagee has a lawful and valid mortgage interest in the property. The affidavit may also include statements regarding the mortgagee's legal right to enforce the mortgage, including the ability to foreclose on the property in case of default. It is important to note that there might be different types or variations of Gainesville Florida Mortgagee's Affidavits, depending on specific circumstances. These could include: 1. Mortgagee's Affidavit of Ownership: This type of affidavit is used when the mortgagee wants to establish their ownership rights over the property. It includes documentation proving the mortgagee's legal title or interest in the property. 2. Mortgagee's Affidavit of Default: This affidavit is utilized when the mortgage is in default, meaning the mortgagor has failed to meet the agreed-upon terms of the loan. It typically contains a statement detailing the reasons for default, the amount owed, and any actions taken by the mortgagee to remedy the situation. 3. Mortgagee's Affidavit of Satisfaction: This affidavit is employed once the mortgage has been fully paid or when the loan has been satisfied. It serves as evidence that the mortgage has been released, relieving the property from the lien. In conclusion, the Gainesville Florida Mortgagee's Affidavit is a vital document in the mortgage process, affirming the mortgagee's legal rights and interest in the property. Different types or variations of this affidavit may exist, addressing specific situations such as ownership, default, or satisfaction of the mortgage.

Gainesville Florida Mortagee's Affidavit

Description

How to fill out Gainesville Florida Mortagee's Affidavit?

We always strive to minimize or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for attorney solutions that, usually, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of an attorney. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Gainesville Florida Mortagee's Affidavit or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Gainesville Florida Mortagee's Affidavit complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Gainesville Florida Mortagee's Affidavit would work for your case, you can pick the subscription plan and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!