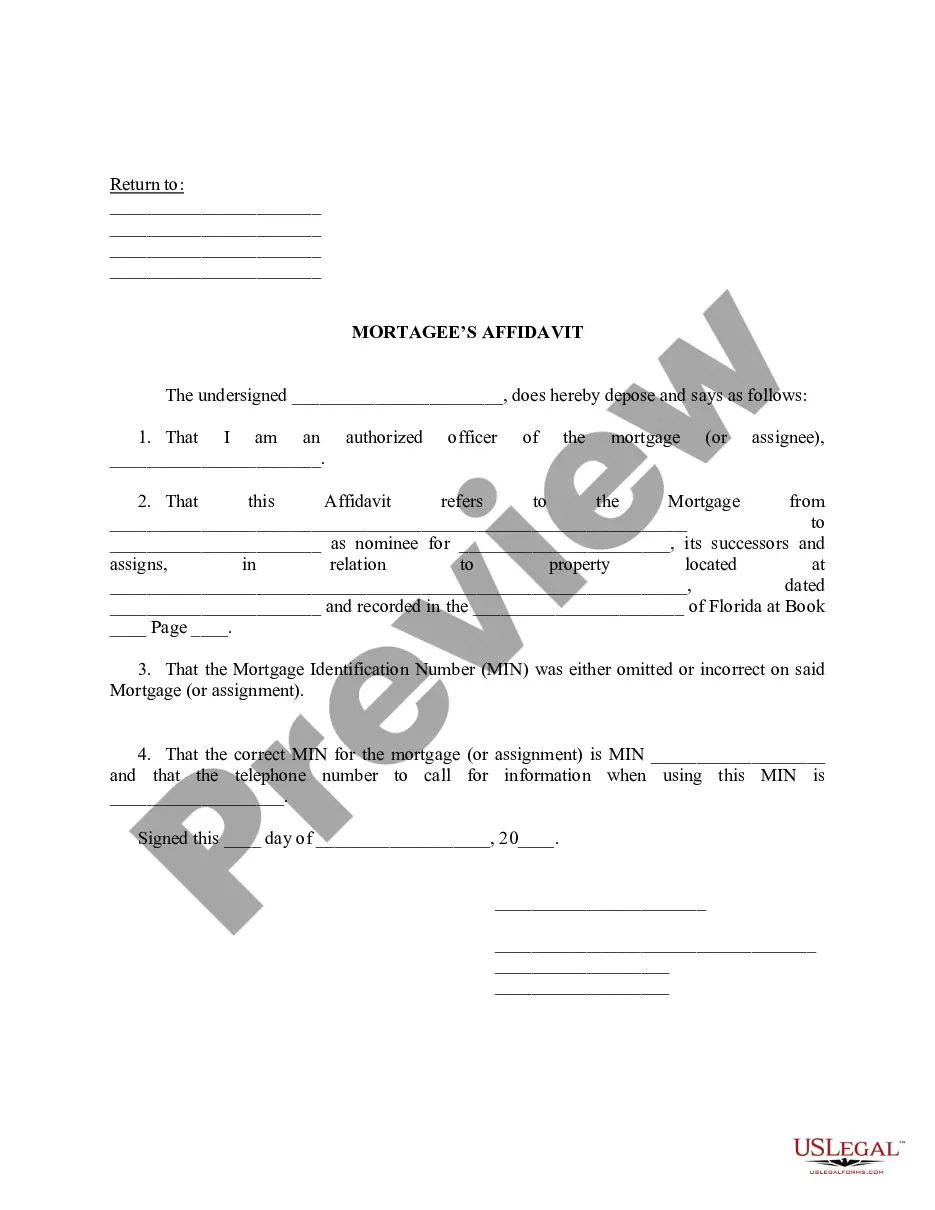

A Jacksonville Florida Mortgagee's Affidavit refers to a legal document that serves as evidence for the mortgagee, i.e., the lender, to validate certain facts related to a mortgage agreement in Jacksonville, Florida. This affidavit is often required during the real estate transaction process to ensure that all legal requirements and obligations are met. The purpose of the Mortgagee's Affidavit is to provide a sworn statement from the lender, affirming various essential details related to the mortgage. It helps establish the legitimacy and accuracy of information pertaining to the loan, property, and borrower. Some key elements typically included in a Jacksonville Florida Mortgagee's Affidavit are: 1. Loan Details: The affidavit states the loan amount, interest rate, term duration, and any other specific conditions agreed upon between the borrower and the lender. 2. Borrower Information: It outlines the borrower's complete details, including their name, address, contact information, social security number, and other relevant identifiers. 3. Property Description: The Mortgagee's Affidavit includes a detailed description of the property being financed. This includes the address, legal description, and any other necessary property identification information. 4. Legal Compliance: The affidavit assures that the lender has complied with all the applicable laws, regulations, and guidelines concerning the mortgage transaction. This ensures that the lender has adhered to all necessary obligations and requirements during the lending process. 5. Mortgage Validity: The affidavit confirms that the mortgage being pledged by the borrower is valid and enforceable. It provides assurance that all necessary legal documents related to the mortgage have been obtained, reviewed, and approved. 6. Payment Status: The affidavit may include information about the borrower's payment history, stating whether the borrower is up to date with their mortgage payments or if any defaults or delinquencies have occurred. In Jacksonville, Florida, there may not be specific types of Mortgagee's Affidavits that differ from those used elsewhere. However, there can be variations in format and specific requirements based on the unique regulations and practices in the state. It is essential to consult with a real estate attorney or legal professional to ensure the Mortgagee's Affidavit complies with all relevant laws and guidelines in Jacksonville, Florida.

Jacksonville Florida Mortagee's Affidavit

Description

How to fill out Jacksonville Florida Mortagee's Affidavit?

If you are looking for a valid form template, it’s extremely hard to find a more convenient service than the US Legal Forms website – probably the most comprehensive libraries on the internet. With this library, you can get a large number of templates for organization and personal purposes by types and states, or keywords. Using our high-quality search function, finding the newest Jacksonville Florida Mortagee's Affidavit is as easy as 1-2-3. In addition, the relevance of every record is proved by a group of expert lawyers that regularly review the templates on our website and update them in accordance with the most recent state and county demands.

If you already know about our platform and have a registered account, all you need to get the Jacksonville Florida Mortagee's Affidavit is to log in to your user profile and click the Download option.

If you use US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have discovered the sample you require. Check its description and utilize the Preview feature to explore its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to get the proper document.

- Confirm your decision. Click the Buy now option. After that, choose your preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Choose the file format and save it to your system.

- Make changes. Fill out, revise, print, and sign the acquired Jacksonville Florida Mortagee's Affidavit.

Every form you save in your user profile does not have an expiry date and is yours permanently. It is possible to access them using the My Forms menu, so if you want to have an extra copy for modifying or printing, feel free to return and download it once again at any moment.

Take advantage of the US Legal Forms extensive catalogue to get access to the Jacksonville Florida Mortagee's Affidavit you were seeking and a large number of other professional and state-specific templates in one place!