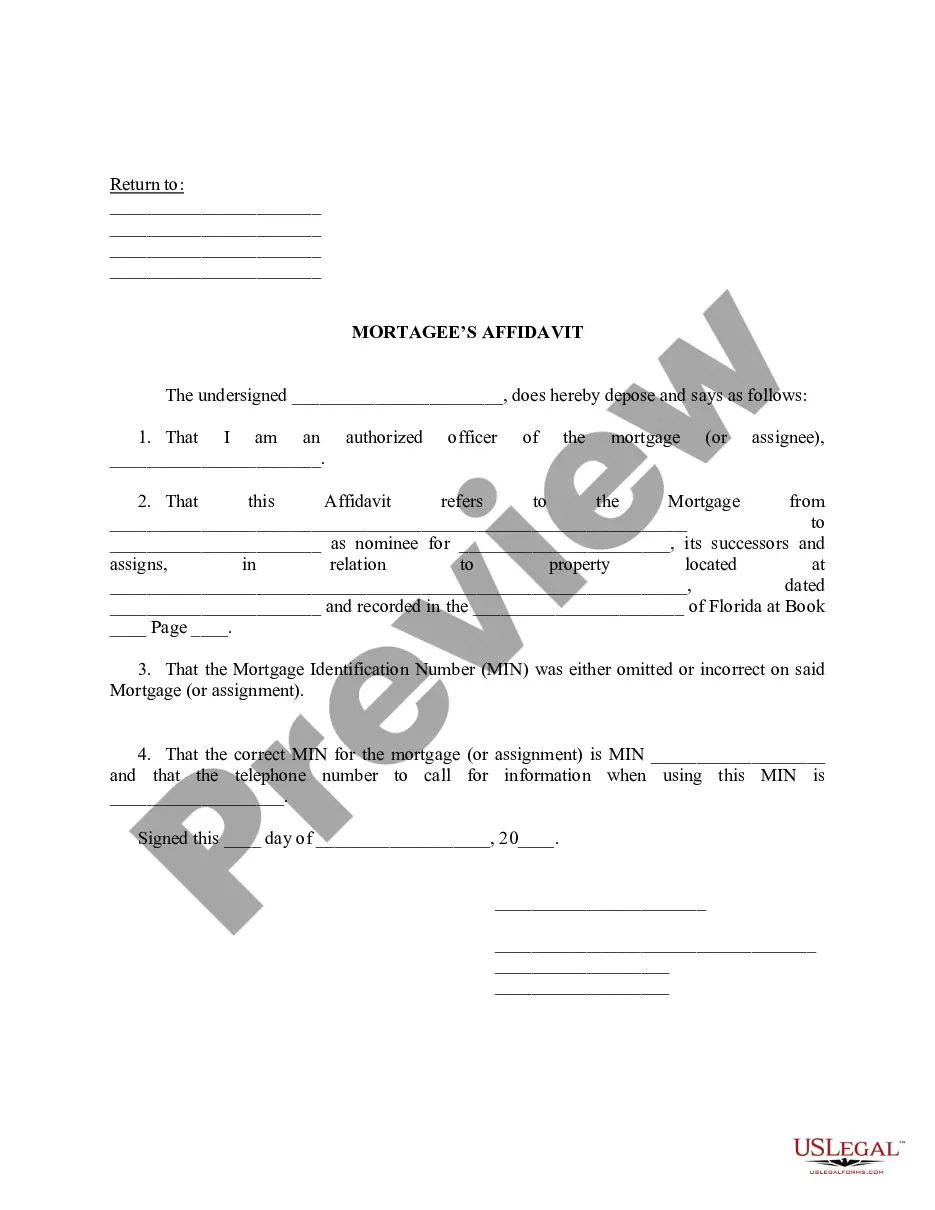

Orange Florida Mortgagee's Affidavit is a legal document that serves as evidence of a mortgagee's claim on a property located in Orange County, Florida. This affidavit is typically prepared by the mortgagee (the lender) and signed under oath, affirming the accuracy of the information provided. The purpose of the Orange Florida Mortgagee's Affidavit is to establish the mortgagee's interest and rights in the property and to clarify any outstanding issues or potential challenges to the mortgage claim. It ensures that the mortgagee has a valid and enforceable lien on the property, which can be used as collateral in case of default on the mortgage payments. This affidavit contains various key elements, including the identification details of the mortgagee, mortgagor (borrower), and property in question. It also outlines the terms and conditions of the mortgage agreement, such as the loan amount, interest rate, repayment schedule, and any other relevant clauses. Moreover, the Orange Florida Mortgagee's Affidavit may include a description of the property's title history, confirming that there are no outstanding liens, encumbrances, or legal disputes that could jeopardize the mortgagee's claim. If there are any outstanding issues, they must be disclosed in the affidavit to give notice to all parties involved. Different types of Orange Florida Mortgagee's Affidavit may include: 1. Original Mortgagee's Affidavit: This is typically used when a mortgage is initially established on a property in Orange County, Florida. It confirms the mortgagee's interest from the outset and serves as the foundation for the mortgage agreement. 2. Assignment Mortgagee's Affidavit: If the mortgage is transferred or assigned to another party, an Assignment Mortgagee's Affidavit is used to document the transfer of rights and interest from the original mortgagee to the new mortgagee. This affidavit ensures clarity and transparency in the assignment process. 3. Satisfaction or Release Mortgagee's Affidavit: When a mortgage is fully paid off, the mortgagee must provide a Satisfaction or Release Mortgagee's Affidavit. This document attests that the mortgage has been satisfied, releasing the mortgagee's claim on the property. It is crucial for the mortgagor to obtain this affidavit as proof of the mortgage's discharge. In conclusion, the Orange Florida Mortgagee's Affidavit is a significant legal document that secures the mortgagee's rights and interest in a property located in Orange County, Florida. Whether it is an original mortgagee's affidavit, an assignment affidavit, or a satisfaction/release affidavit, these documents play a crucial role in ensuring the enforceability and transparency of mortgage transactions within the county.

Orange Florida Mortagee's Affidavit

Description

How to fill out Orange Florida Mortagee's Affidavit?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person with no law education to create this sort of paperwork from scratch, mainly because of the convoluted terminology and legal nuances they come with. This is where US Legal Forms can save the day. Our platform provides a huge collection with more than 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you need the Orange Florida Mortagee's Affidavit or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Orange Florida Mortagee's Affidavit in minutes employing our reliable platform. In case you are already a subscriber, you can proceed to log in to your account to get the needed form.

However, if you are a novice to our library, make sure to follow these steps before obtaining the Orange Florida Mortagee's Affidavit:

- Be sure the form you have chosen is suitable for your area since the regulations of one state or area do not work for another state or area.

- Review the document and read a brief outline (if provided) of scenarios the document can be used for.

- In case the form you picked doesn’t meet your requirements, you can start over and look for the needed document.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account login information or register for one from scratch.

- Select the payment gateway and proceed to download the Orange Florida Mortagee's Affidavit once the payment is done.

You’re all set! Now you can proceed to print out the document or fill it out online. In case you have any issues locating your purchased forms, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.