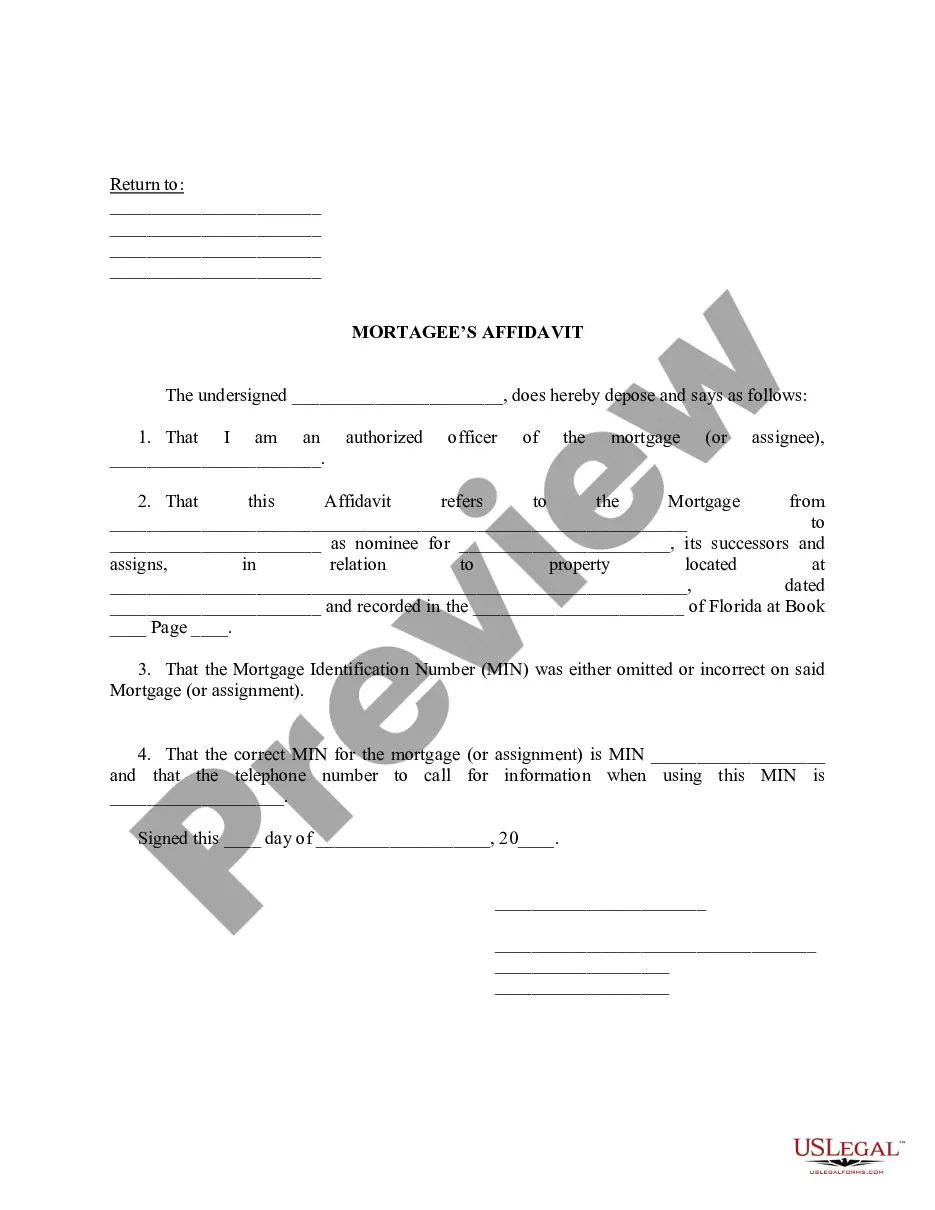

Pembroke Pines, Florida Mortgagee's Affidavit is a legal document that serves as evidence for the validity of a mortgage lien. This affidavit is often required in real estate transactions involving mortgage lenders in Pembroke Pines, Florida. It is an essential part of the loan closing process, ensuring that all necessary information is provided and attested by the mortgagee. The Pembroke Pines Mortgagee's Affidavit typically includes important details about the mortgage, the lender, and the borrower. It ensures compliance with state and local regulations, offering protection to the lender and the mortgage's legal validity. This affidavit is notarized and submitted to the concerned authorities and parties involved in the mortgage transaction. Keywords: Pembroke Pines, Florida, mortgagee's affidavit, legal document, mortgage lien, real estate transactions, loan closing process, required, mortgage lender, attested, compliance, state regulations, local regulations, protection, legal validity, notarized, submitted. Different types of Pembroke Pines, Florida Mortgagee's Affidavit may include: 1. Subordination Mortgagee's Affidavit: This affidavit is used when a new mortgage is issued, and there is an already existing mortgage on the property. It confirms that the new mortgage will be subordinate to the existing mortgage, outlining the new payment terms and any changes to the lien priority. 2. Satisfaction Mortgagee's Affidavit: This affidavit is used when the mortgage has been fully paid off, releasing the lien from the property. It asserts that the mortgage obligation has been satisfied, and the lender no longer holds any interest in the property. 3. Assignment Mortgagee's Affidavit: This affidavit is used when the mortgage lender transfers the rights and interest in the mortgage to another party. It confirms the assignment of the mortgage and provides details about the new mortgagee. 4. Lost Note Affidavit: This affidavit is used when the original promissory note associated with the mortgage is lost or misplaced. It affirms the loss and provides details regarding the efforts made to locate the original note. Keywords: Subordination, satisfaction, assignment, lost note, promissory note, new mortgage, existing mortgage, lien priority, payment terms, fully paid off, release lien, transferred rights, interest, mortgagee, lost, misplaced, original note, efforts. Understanding these different types of Pembroke Pines, Florida Mortgagee's Affidavit is crucial to ensure the accuracy and compliance of the affidavit in any specific mortgage transaction. It is recommended to consult with legal professionals or qualified individuals to obtain the correct and appropriate version of the affidavit required for each unique situation.

Pembroke Pines Florida Mortagee's Affidavit

Description

How to fill out Pembroke Pines Florida Mortagee's Affidavit?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Pembroke Pines Florida Mortagee's Affidavit? US Legal Forms is your go-to solution.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of specific state and area.

To download the form, you need to log in account, find the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Pembroke Pines Florida Mortagee's Affidavit conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the form is good for.

- Restart the search in case the template isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Pembroke Pines Florida Mortagee's Affidavit in any available format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online for good.