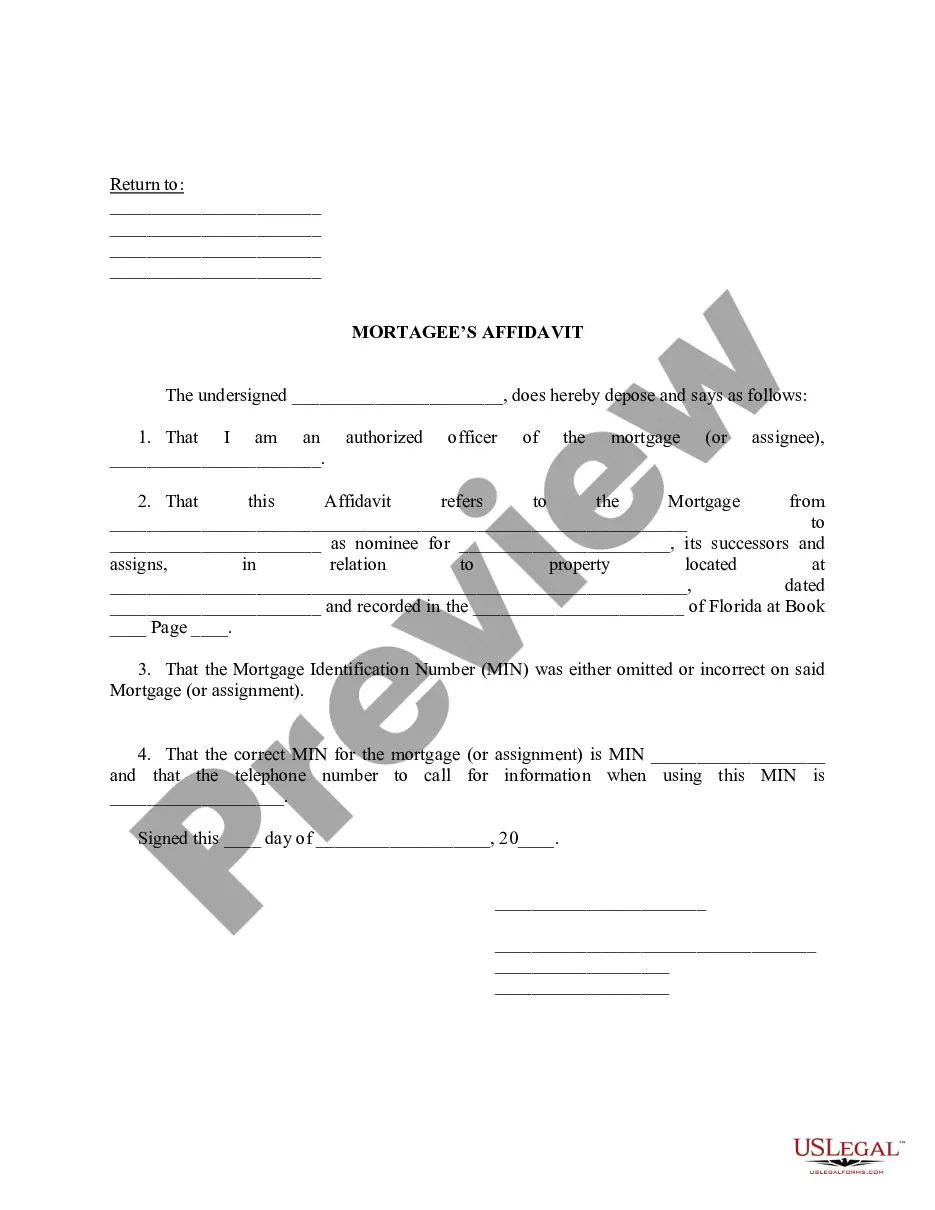

A Tallahassee Florida Mortgagee's Affidavit is a legal document used in real estate transactions specifically related to mortgages in the state of Florida. It serves as a sworn statement made by the mortgagee (lender) to confirm certain details regarding the mortgage and the property involved. This affidavit is crucial in ensuring the accuracy and transparency of the transaction. The Tallahassee Florida Mortgagee's Affidavit typically includes the following key information: 1. Identification: The affidavit starts by identifying the participating parties, including the mortgagee and mortgagor (borrower), as well as the legal description of the property. 2. Loan Details: This section outlines the specific details of the mortgage, such as the loan amount, interest rate, repayment terms, and any other conditions agreed upon between the parties. 3. Property Information: It includes an accurate and detailed description of the property, including its address, boundaries, and any relevant encumbrances or liens. 4. Title Verification: The affidavit confirms that the mortgagee holds a valid and enforceable lien against the property and that there are no other undisclosed liens or claims on the property. 5. Insurance and Taxes: Mortgagee's Affidavit may also require the mortgagee to confirm that appropriate insurance coverage is in place and that property taxes are paid and up to date. 6. Default Status: Additionally, the affidavit may address any default on the mortgage, indicating whether the mortgagor is currently in default or if any default has occurred in the past. 7. Signature and Notarization: A Tallahassee Florida Mortgagee's Affidavit requires the signature of the mortgagee, attesting to the truthfulness of the statements provided. The document must be notarized to affirm its validity. In Tallahassee, Florida, there might not be different types of Mortgagee's Affidavits specific to the city itself. However, certain variations may exist in terms of customizations made by individual lenders or based on the specific requirements of different real estate transactions. In conclusion, a Tallahassee Florida Mortgagee's Affidavit is an important legal document used in real estate transactions involving mortgages. It verifies the accuracy of mortgage-related details and confirms the mortgagee's lawful claim on the property. This affidavit plays a crucial role in ensuring the transparency and legal compliance of the mortgage process in Tallahassee, Florida.

Tallahassee Florida Mortagee's Affidavit

Category:

State:

Florida

City:

Tallahassee

Control #:

FL-CL010

Format:

Word;

Rich Text

Instant download

Description

A mortgage affidavit is a written statement signed by a party in a real estate transaction under penalties of perjury that attests to certain conditions of the property.

Free preview

How to fill out Tallahassee Florida Mortagee's Affidavit?

Irrespective of social or professional standing, fulfilling law-related documents is a regrettable requirement in the modern world.

Frequently, it's nearly impossible for someone lacking any legal experience to produce such documents from the ground up, primarily due to the intricate language and legal nuances they involve.

This is where US Legal Forms proves to be beneficial.

Make sure the form you selected is suitable for your location since the regulations of one state or county may not apply to another.

Review the form and read a short description (if available) of scenarios the document can be utilized for.

- Our service offers an extensive array of over 85,000 ready-to-use state-specific forms applicable for nearly any legal situation.

- US Legal Forms also acts as an excellent tool for associates or legal advisors aiming to increase their time efficiency using our DIY forms.

- Regardless of whether you require the Tallahassee Florida Mortagee's Affidavit or any other documentation that is valid in your state or county, US Legal Forms puts everything at your disposal.

- Here's how you can swiftly obtain the Tallahassee Florida Mortagee's Affidavit using our reliable service.

- If you are an existing subscriber, you can go ahead and Log In to your account to download the necessary form.

- However, if you are new to our platform, make sure to follow these steps before downloading the Tallahassee Florida Mortagee's Affidavit.