In Jacksonville, Florida, a closing statement refers to a crucial document that summarizes the financial and legal aspects of a real estate transaction when purchasing or selling a property. It serves as a detailed account of the financial obligations and rights of each party involved in the transaction and is typically prepared by a closing agent or an attorney. The purpose of the Jacksonville Florida closing statement is to provide a comprehensive breakdown of all the financial components associated with the transaction, ensuring transparency and clarity for both the buyer and the seller. The statement itemizes various fees, costs, and expenses incurred during the closing process, such as loan origination fees, title search charges, attorney fees, property taxes, homeowner's insurance, and any other relevant costs. The Jacksonville Florida closing statement typically consists of three sections: the buyer's section, the seller's section, and the cash requirements section. Each section outlines the financial responsibilities of the corresponding party. The buyer's section will indicate the purchase price, the amount of the loan, and any additional costs the buyer must cover. The seller's section outlines the sale price, any outstanding mortgages, and other costs borne by the seller. The cash requirements section details the total amount of money needed for the completion of the transaction, including the down payment, closing costs, and expenses. Different types of Jacksonville Florida closing statements may vary based on the type of property being bought or sold. For instance, if the transaction involves a condominium, special assessments, maintenance fees, or association dues may be included in the statement. Similarly, if the purchase involves a new construction property, expenses related to builder's fees, impact fees, or permits may be included. Overall, the Jacksonville Florida closing statement is a crucial document that ensures all parties are aware of their financial obligations, protects their rights, and facilitates a smooth and transparent real estate transaction.

Jacksonville Closing

Description

How to fill out Jacksonville Florida Closing Statement?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Jacksonville Florida Closing Statement becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Jacksonville Florida Closing Statement takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

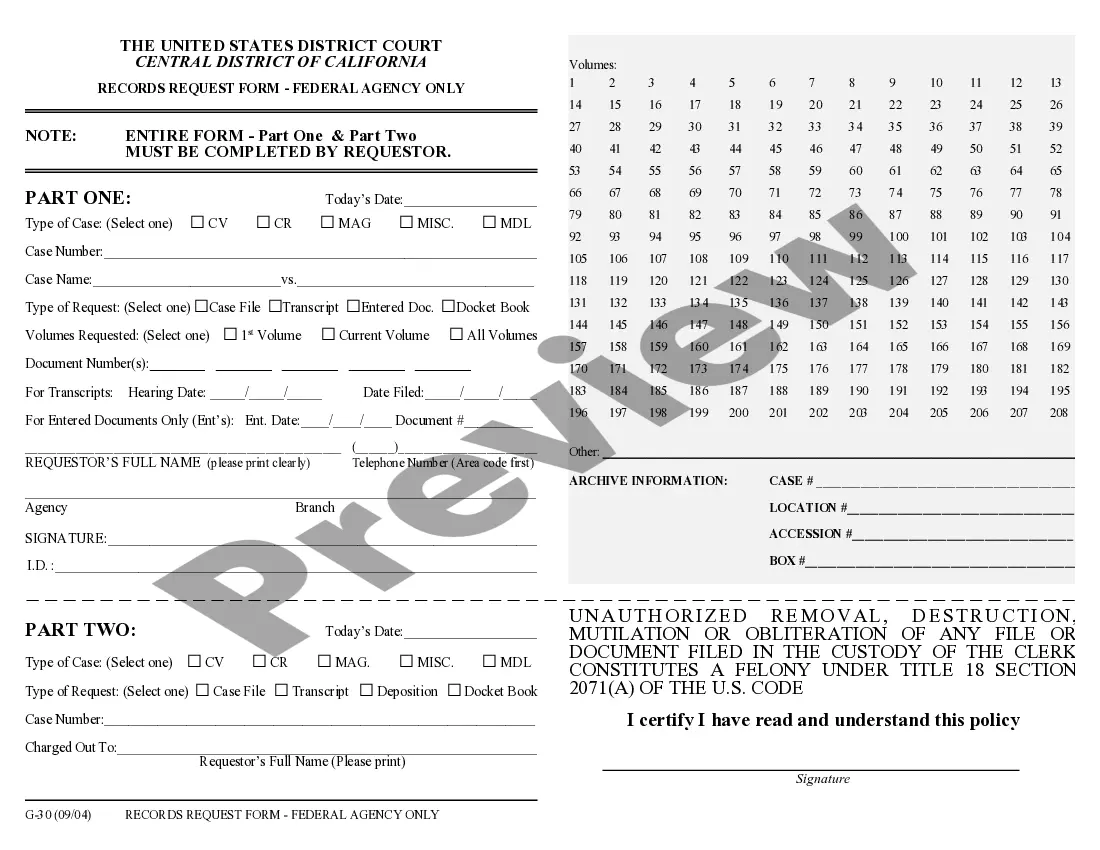

- Look at the Preview mode and form description. Make certain you’ve chosen the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Jacksonville Florida Closing Statement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!