Pompano Beach Florida Closing Statement

Description

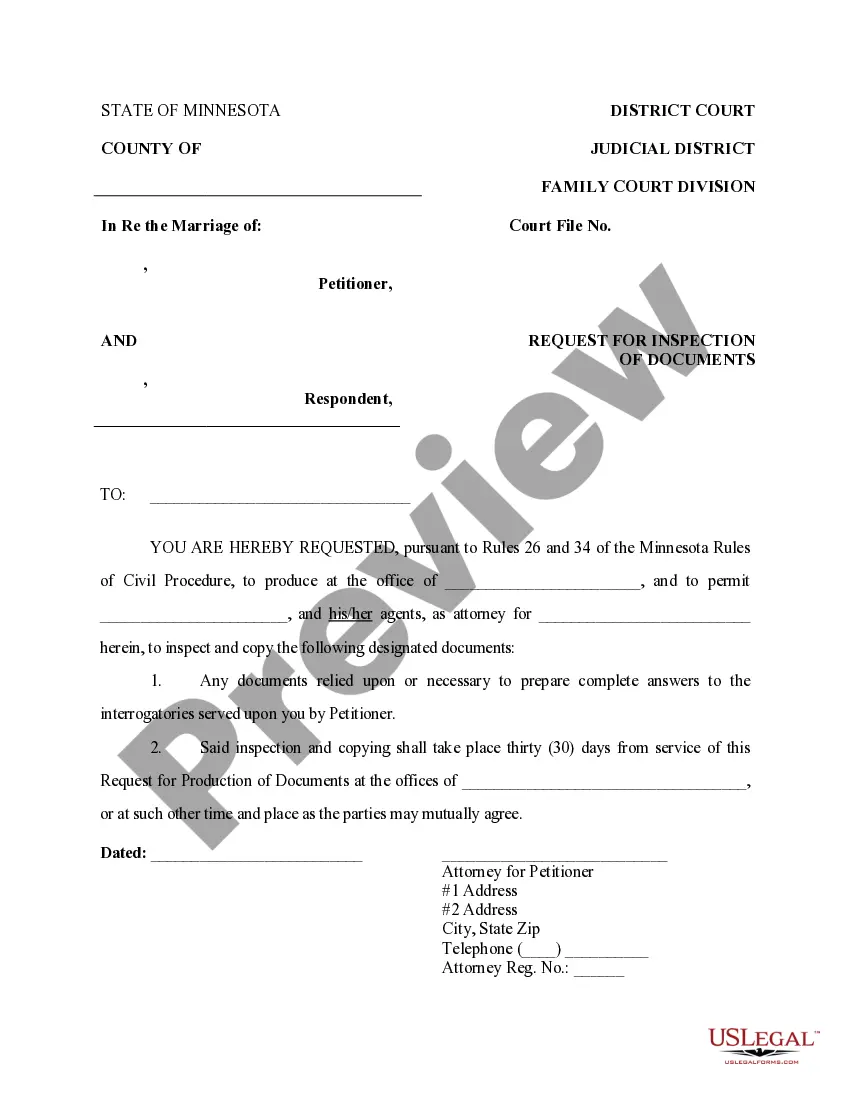

How to fill out Florida Closing Statement?

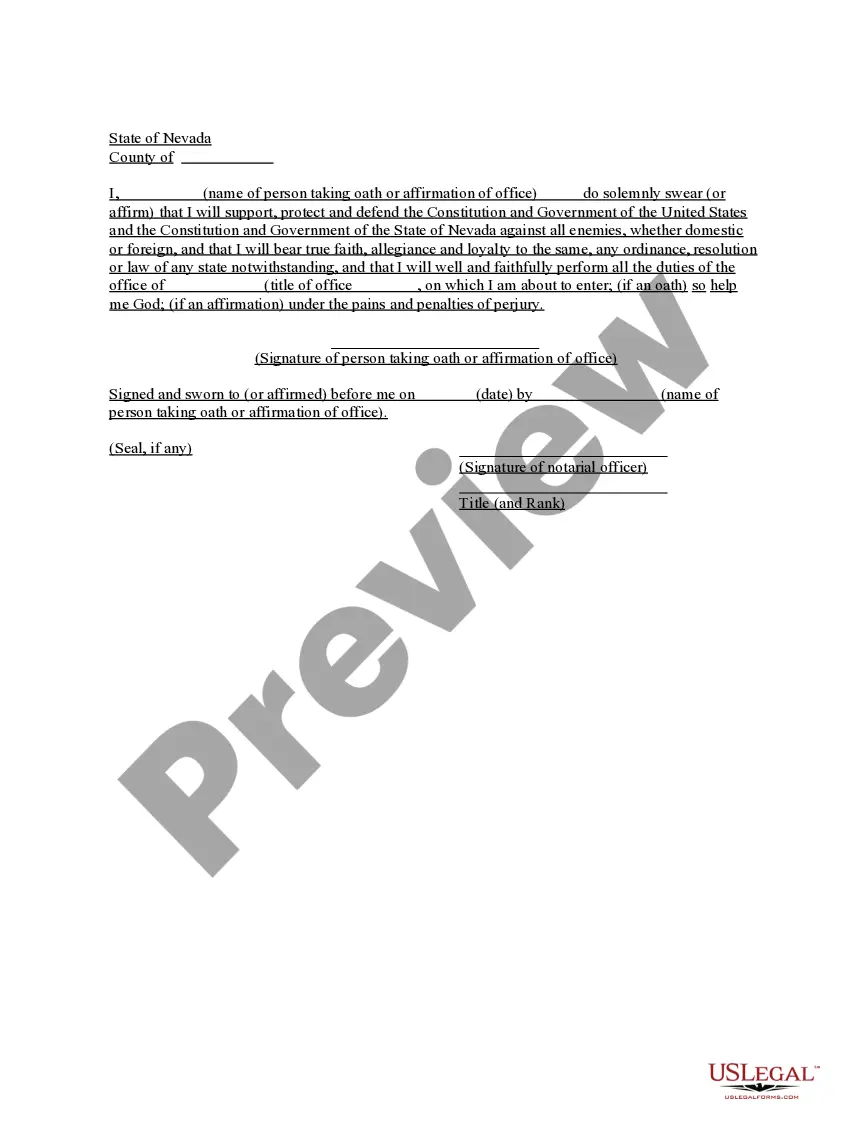

Utilize the US Legal Forms and gain immediate access to any form template that you require.

Our effective platform, featuring a vast array of templates, simplifies the process of locating and acquiring nearly any document sample you need.

You can download, fill out, and sign the Pompano Beach Florida Closing Statement in just a few minutes rather than spending hours online searching for a suitable template.

Using our collection is an excellent way to enhance the security of your form submissions.

- Our experienced attorneys routinely examine all documents to ensure that the templates are pertinent to a specific area and comply with recent laws and regulations.

- Our comprehensive platform offers a plethora of resources that can assist you in any legal matter, including downloading the Pompano Beach Florida Closing Statement.

- Access our user-friendly service to streamline your document management process.

Form popularity

FAQ

No, you do not receive a copy of your deed at closing in Florida. Instead, the closing agent will ensure that the deed is recorded with the appropriate authorities after closing is completed. You can request a copy later from the county's clerk office, making it easier to keep track of important documents related to your Pompano Beach Florida closing statement.

To start water service in Pompano Beach, you can fill out an application on the city’s utility services website. Having your address and a valid ID ready is essential for a smooth process. To make this easier, clearly indicate any specific requirements mentioned in your Pompano Beach Florida closing statement while applying.

You can contact customer service in Pompano Beach by visiting the city's official website for contact information. Most inquiries can be addressed through phone or email as provided on their site. If you aim to understand local legal processes, including the Pompano Beach Florida closing statement, their customer service can guide you.

To get your deed in Florida, wait for the closing company to prepare and record it after closing. They handle the legalities to ensure your ownership is documented appropriately. Once recorded, you can obtain a copy from your county's clerk office. This process is standardized in the Pompano Beach Florida closing statement protocol.

No, in Florida, you do not receive your deed at the closing ceremony. The deed is held by the title company or closing agent until everything is finalized. Once all steps are completed, the deed will be recorded in public records, which secures your property in line with your Pompano Beach Florida closing statement.

You will not receive a copy of your deed during the actual closing in Florida. However, once the deed is recorded, you can request a copy from the county clerk's office. It's important to have a copy for your records, and following the guidelines in your Pompano Beach Florida closing statement will help you understand this process.

In Florida, you do not receive the deed at closing. Instead, the closing company will hold the deed until all conditions are met. After the necessary paperwork is signed, they will record the deed publicly. This process ensures your ownership is legally recognized and completes the Pompano Beach Florida closing statement.

The closing process in Florida involves several critical steps, such as reviewing documents, signing papers, and transferring funds. Typically, this process culminates in a closing meeting where all parties finalize the sale. During this meeting, you'll receive your Pompano Beach Florida Closing Statement, which outlines all costs and credits associated with the transaction. Engaging with experienced professionals can help you navigate the closing seamlessly.

Closing on a house in Florida typically takes between 30 to 60 days. This timeline can vary based on several factors, including the complexity of the sale and any potential issues that may arise. To ensure a smooth process, it is essential to prepare in advance and collect all necessary documentation. For a detailed understanding of your closing process, including your Pompano Beach Florida Closing Statement, consider using US Legal’s resources.

Typically, at closing in Florida, the buyer, the seller, and any lenders involved need to be present. Real estate agents may also attend to assist with the process. In some cases, third-party representatives or attorneys may be involved as well. It is essential to review your Pompano Beach Florida Closing Statement to confirm attendance requirements specific to your situation.