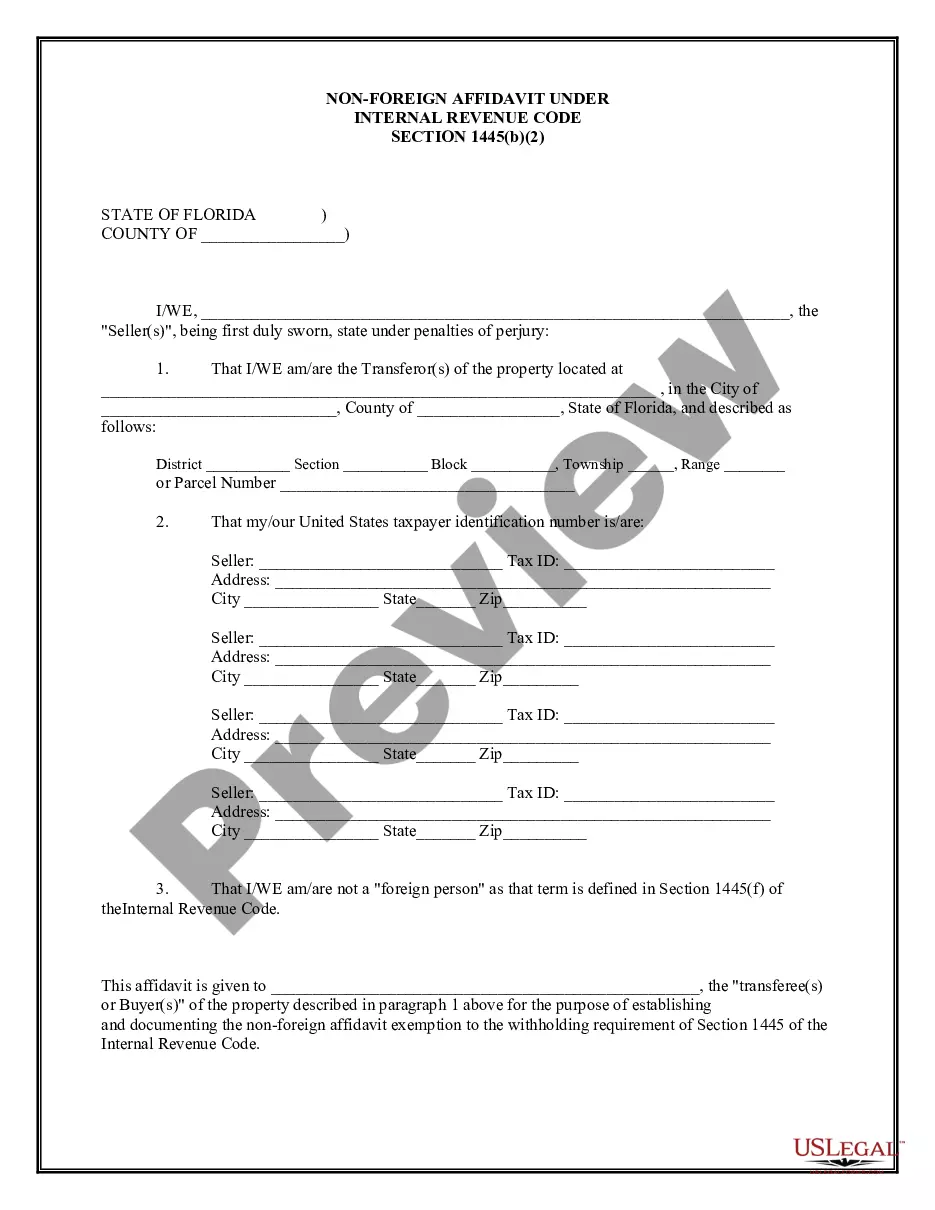

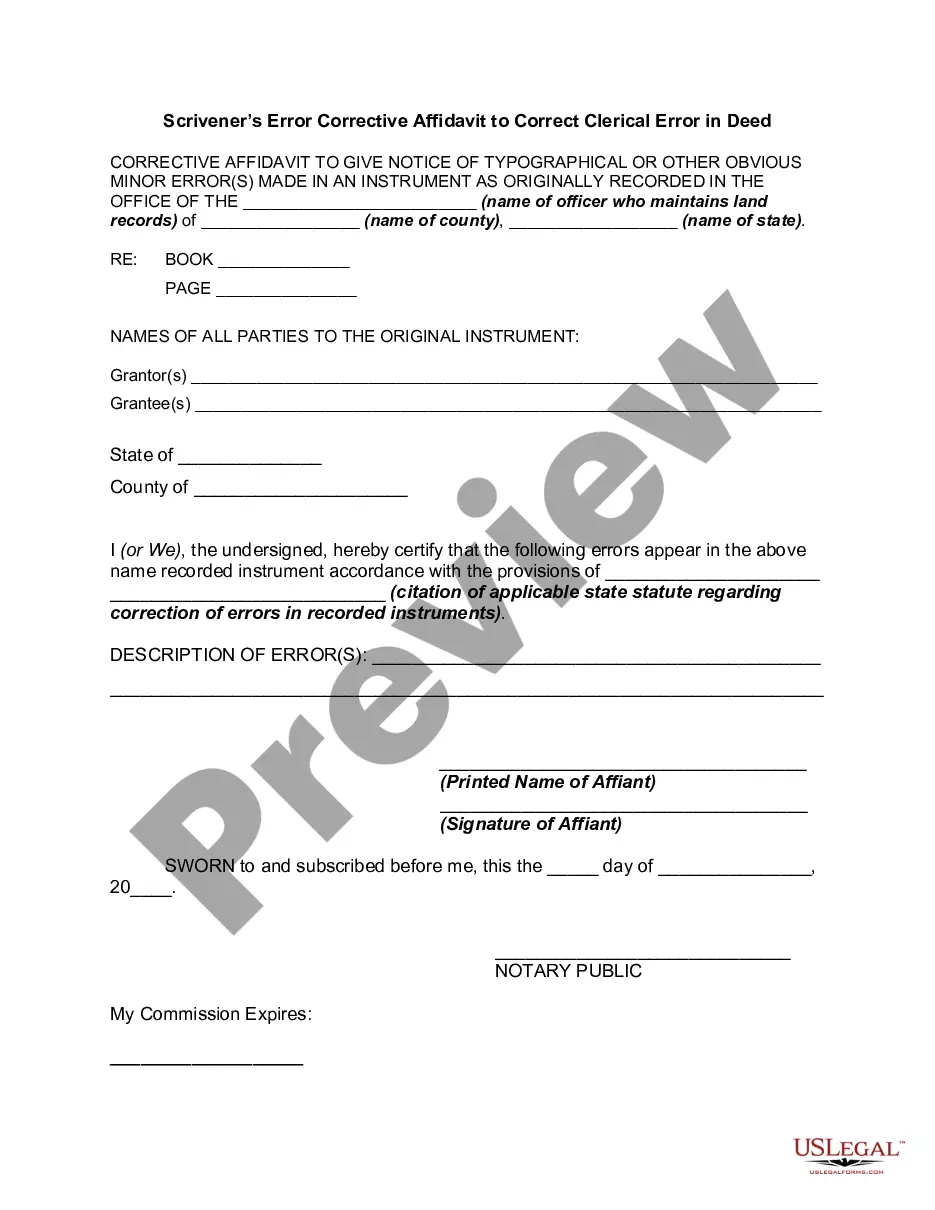

Palm Bay, Florida Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide Introduction: In the realm of real estate transactions, foreign sellers and buyers have certain tax obligations under the Internal Revenue Code (IRC) 1445. However, residents of Palm Bay, Florida who are deemed non-foreign individuals can qualify for an exemption from these tax requirements by completing a Non-Foreign Affidavit. This detailed description aims to provide you with an understanding of the Palm Bay, Florida Non-Foreign Affidavit under IRC 1445, including its purpose, requirements, and any potential variations or types. Purpose of the Non-Foreign Affidavit: The primary purpose of the Palm Bay, Florida Non-Foreign Affidavit under IRC 1445 is to establish the taxpayer's non-foreign status. By signing this document, the seller or buyer certifies their U.S. residency, ensuring certain tax obligations are waived or reduced. This affidavit acts as a declaration made under penalty of perjury, providing legal protection and assurance to both parties involved in the real estate transaction. Requirements for the Non-Foreign Affidavit: To qualify for the exemption under IRC 1445, the Palm Bay, Florida Non-Foreign Affidavit must fulfill several requirements. These typically include: 1. Identification: The affidavit should clearly state the full legal name, address, and taxpayer identification number (typically the individual's Social Security number). 2. Non-Foreign Status Certification: The affidavit must contain a statement confirming the declaring's non-foreign status, i.e., U.S. citizenship, lawful permanent residency, or substantial presence test criteria satisfaction. 3. Accuracy of Information: The declaring must certify that all the information provided in the affidavit is true, accurate, and complete to the best of their knowledge. 4. Withholding Certifications: The affidavit might also require declarations regarding any withholding tax exemptions or reduced rates applicable under tax treaties between the United States and the declaring's country of origin. 5. Signature and Date: The affidavit must be signed and dated by the declaring, preferably in the presence of a notary public to validate its authenticity. Types of Palm Bay, Florida Non-Foreign Affidavit (if applicable): 1. Residential Real Estate Non-Foreign Affidavit: This type of affidavit is used when selling or buying residential properties within Palm Bay, Florida. It ensures that the residential property sale is exempted from certain withholding tax obligations under IRC 1445. 2. Commercial Real Estate Non-Foreign Affidavit: In the case of commercial property transactions, this type of non-foreign affidavit is executed to exempt sellers or buyers from specified tax withholding obligations. It is applicable when non-foreign individuals are involved in purchasing or selling commercial properties in Palm Bay, Florida. Conclusion: Understanding the Palm Bay, Florida Non-Foreign Affidavit under IRC 1445 is crucial for individuals engaged in real estate transactions as it ensures compliance with tax regulations while exempting non-foreign residents from certain tax obligations. By fulfilling the requirements and submitting an accurately completed affidavit, individuals can enjoy a streamlined process and the associated benefits thereof. Always consult with a tax professional or legal expert to ensure the accuracy and validity of any legal documents, including the Palm Bay, Florida Non-Foreign Affidavit Under IRC 1445, to facilitate a smooth and legally compliant real estate transaction.

Palm Bay Florida Non-Foreign Affidavit Under IRC 1445

Description

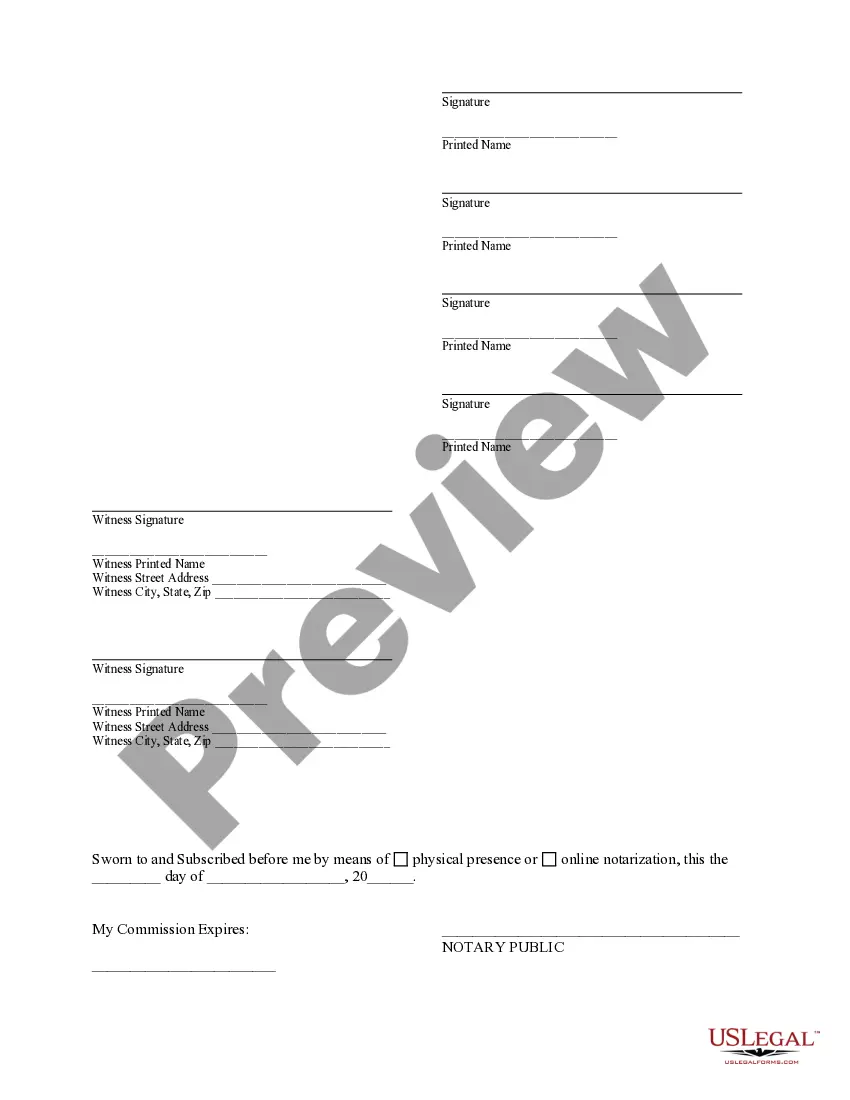

How to fill out Palm Bay Florida Non-Foreign Affidavit Under IRC 1445?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Palm Bay Florida Non-Foreign Affidavit Under IRC 1445 gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Palm Bay Florida Non-Foreign Affidavit Under IRC 1445 takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Palm Bay Florida Non-Foreign Affidavit Under IRC 1445. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!