The Miami-Dade Florida Affidavit of Occupancy and Financial Status is a legal document that verifies both the occupancy status and financial stability of an individual or entity within Miami-Dade County, Florida. It serves as proof of the occupant's ability to financially support themselves or achieve specific financial goals in accordance with the local regulations and requirements. This affidavit is a critical component in various situations, including renting or leasing a property, securing a loan, obtaining a business license, and even participating in certain government programs. By completing this document, individuals and businesses showcase their capacity to fulfill financial obligations and demonstrate their responsible occupancy in compliance with local laws. The Miami-Dade Florida Affidavit of Occupancy and Financial Status typically includes the following information: 1. Personal Details: The affidavit will require the occupant's full name, address, contact information, social security number, and other identifying details. 2. Occupancy Information: This section outlines the occupancy status of the individual or entity, stating whether they are the property owner, tenant, or lessee. 3. Financial Status: The affidavit requires the disclosure of detailed financial information including income, assets, liabilities, tax returns, and bank statements. These details help assess the individual or entity's ability to meet financial responsibilities. 4. Authorization and Certification: The affidavit must be signed and dated by the occupant, certifying that all the information provided is accurate and truthful. Failure to provide accurate information may result in legal consequences. It's worth noting that while there is no specific mention of different types of Miami-Dade Florida Affidavit of Occupancy and Financial Status, variations may exist based on the purpose or context for which they are required. For instance, a rental-oriented affidavit may focus more on the tenant's financial ability to pay rent regularly, while a loan-oriented affidavit may place greater emphasis on demonstrating stable income and creditworthiness. In conclusion, the Miami-Dade Florida Affidavit of Occupancy and Financial Status is a critical document that verifies an individual or entity's occupancy and financial stability within the county. It highlights the importance of responsible occupancy and financial accountability for various purposes such as renting, leasing, obtaining loans, and complying with local regulations.

Certificate Of Occupancy Miami Dade

Description

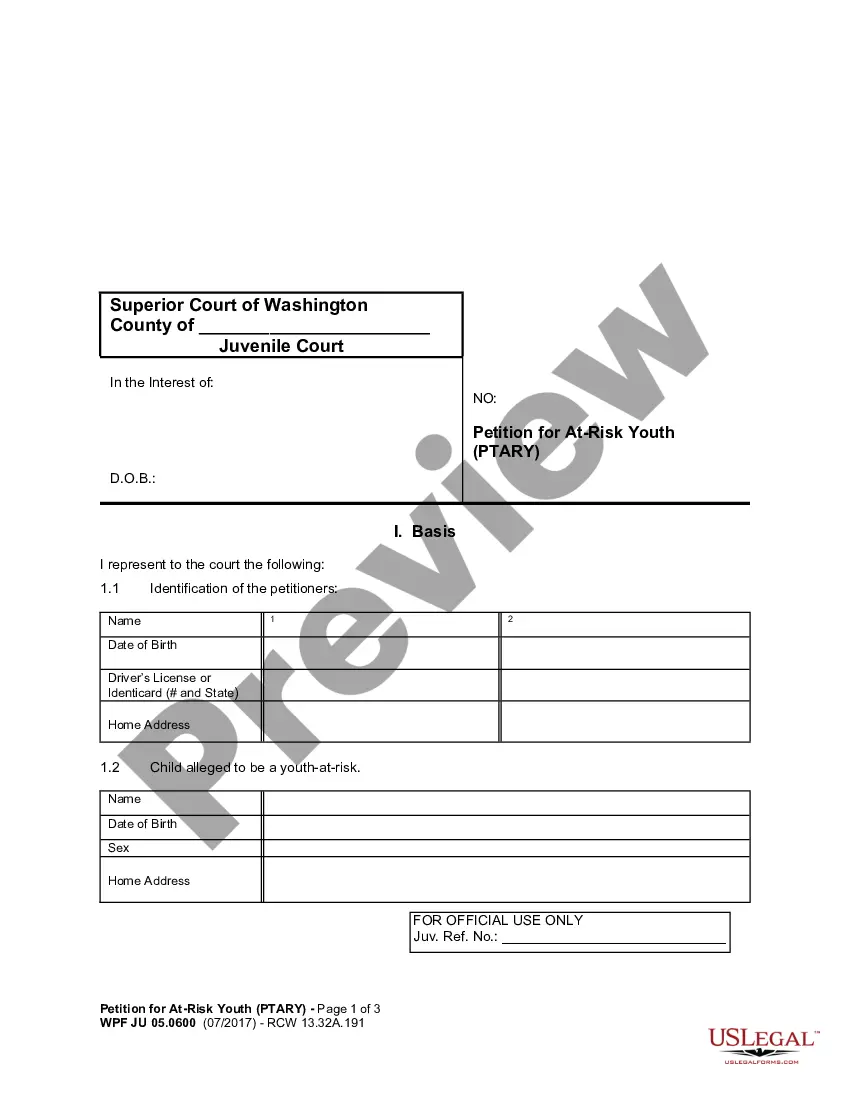

How to fill out Miami-Dade Florida Affidavit Of Occupancy And Financial Status?

If you are looking for a valid form, it’s difficult to choose a more convenient platform than the US Legal Forms website – probably the most considerable libraries on the web. With this library, you can find a huge number of form samples for business and personal purposes by types and regions, or key phrases. With our advanced search feature, getting the most up-to-date Miami-Dade Florida Affidavit of Occupancy and Financial Status is as easy as 1-2-3. In addition, the relevance of each and every document is verified by a team of skilled attorneys that regularly check the templates on our platform and revise them according to the most recent state and county laws.

If you already know about our platform and have a registered account, all you should do to receive the Miami-Dade Florida Affidavit of Occupancy and Financial Status is to log in to your profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the instructions below:

- Make sure you have chosen the sample you require. Look at its information and utilize the Preview option to see its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to find the proper record.

- Affirm your decision. Select the Buy now button. Next, pick the preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Get the template. Choose the file format and save it to your system.

- Make changes. Fill out, edit, print, and sign the received Miami-Dade Florida Affidavit of Occupancy and Financial Status.

Every single template you save in your profile does not have an expiration date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you want to have an extra duplicate for enhancing or creating a hard copy, you can return and export it once again anytime.

Take advantage of the US Legal Forms professional collection to get access to the Miami-Dade Florida Affidavit of Occupancy and Financial Status you were looking for and a huge number of other professional and state-specific samples on one platform!

Form popularity

FAQ

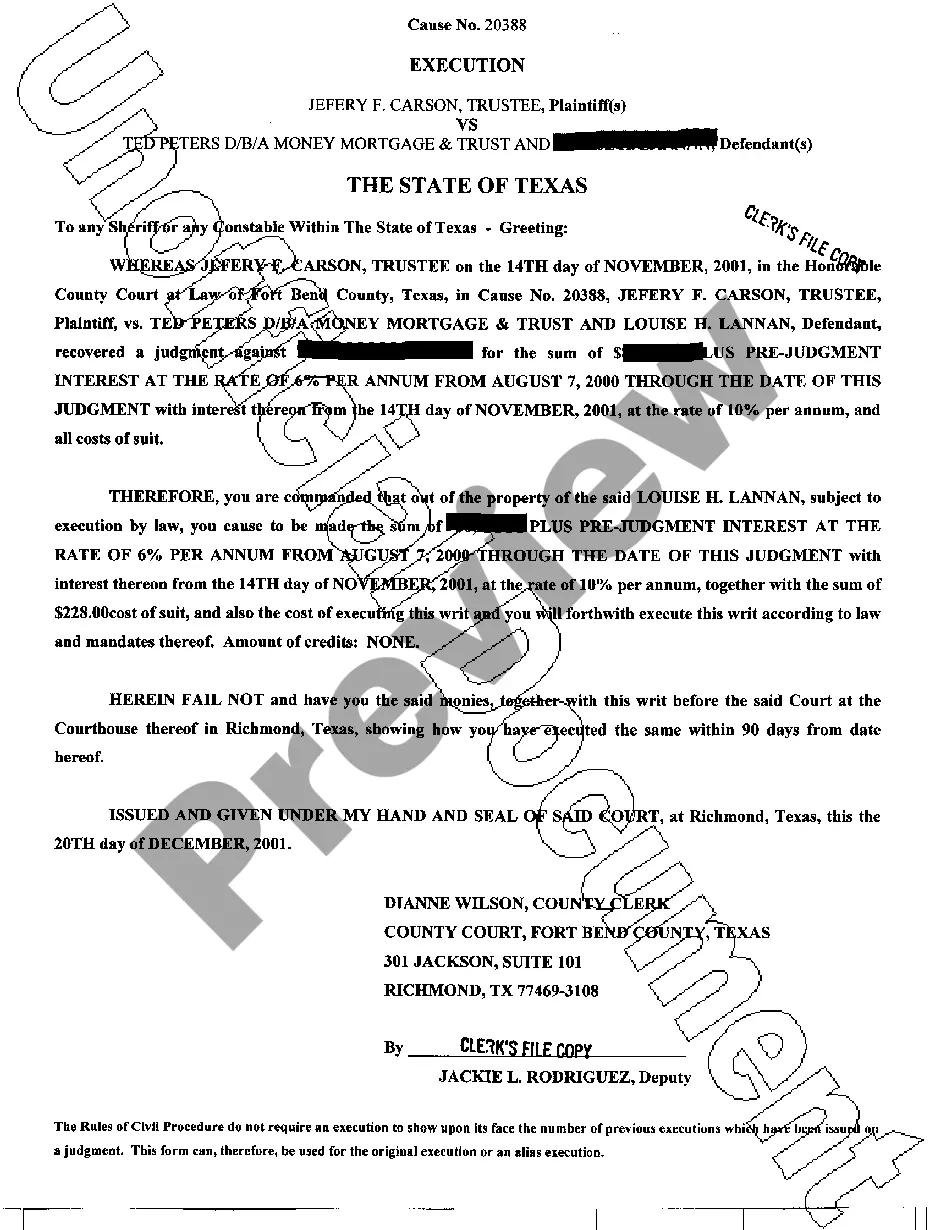

In most cases, a Certificate of Occupancy is not required to sell your home. Not having a C of O doesn't mean that you can't sell your home; it just means that the new owner can't live in the house until proper repairs have been made and it passes a home inspection.

I. OFFICE OF BUILDING OFFICIAL (OBO) Filled up Certificate of Completion Form. Filled up Certificate of final Electrical Inspection and Completion Form. Filled up and duly notarized Certificate of Occupancy Application Form. Filled up Sanitary Completion Form. Logbook of Construction.

The quickest way to get your certificate is to submit via the portal. A completed Application for Certificate of Use. For assistance, contact RER-CUINFO@miamidade.gov or 786-315-2660. A non-refundable upfront fee is required upon submittal of the application.The following information is required:

IMPORTANT NOTE: Failure to obtain a Certificate of Re-Occupancy prior to closing a property in the City of North Miami may result in enforcement action being taken by the City against the SELLER and/or BUYER, which may include fines, court costs, administrative costs and additional Re-Occupancy inspection costs.

The building official will issue you a Certificate of Occupancy (CO) after the building or structure has received a final inspection and no violations are found to the provisions of the building codes, life safety and applicable laws.

IMPORTANT NOTE: Failure to obtain a Certificate of Re-Occupancy prior to closing a property in the City of North Miami may result in enforcement action being taken by the City against the SELLER and/or BUYER, which may include fines, court costs, administrative costs and additional Re-Occupancy inspection costs.

Forms and Documents for Selling a House in Florida 2 Forms of ID. Copy of Purchase Agreement and Any Addendums. Closing Statement. Signed Deed. Bill of Sale. Affidavit of Title. Agreement Related to Property Taxes.

Certificates of Occupancy will be issued within ten (10) working days. Under no circumstances may any building be occupied or used until a Certificate of Occupancy / Approval is issued.

After a house or a building has been built out and a Certificate of Occupancy has been issued and if the property is later resold, Florida does not have a requirement to obtain another Certificate of Occupancy like some other states, such as New York, is concerned.

The building official will issue you a Certificate of Occupancy (CO) after the building or structure has received a final inspection and no violations are found to the provisions of the building codes, life safety and applicable laws.

More info

Building permit application must be filled out completely. When should this form be used? Dade County, Florida. Permit Required: Section 105. State of Florida product approval or; Miami-Dade County Notice of Acceptance. Please refer to the Florida Administrative Code for the following: Chapter 120 — Florida Administrative Code. ▽. I am applying for a building permit pursuant to an exemption in the Florida Building code set forth in the. Florida Building Code Change. Building permit application must be filled out completely. When should this form be used? Dade County, Florida. Permit Required: Section 105 State of Florida product approval. Please refer to the Florida Administrative Code for the following: Chapter 120 — Florida Administrative Code. ▽. Is my construction contract signed? For a building permit to be issued, both parties to the contract must sign the form and pay a 50 per page fee. ▽. Are my plans approved?

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.