Fort Lauderdale Florida Complex Will with Credit Shelter Marital Trust for Large Estates

Description

How to fill out Florida Complex Will With Credit Shelter Marital Trust For Large Estates?

If you have previously employed our service, sign in to your account and retrieve the Fort Lauderdale Florida Complex Will with Credit Shelter Marital Trust for Large Estates on your device by selecting the Download button. Ensure your subscription is current. If not, renew it according to your payment schedule.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to access it again. Leverage the US Legal Forms service to efficiently find and download any template for your personal or professional requirements!

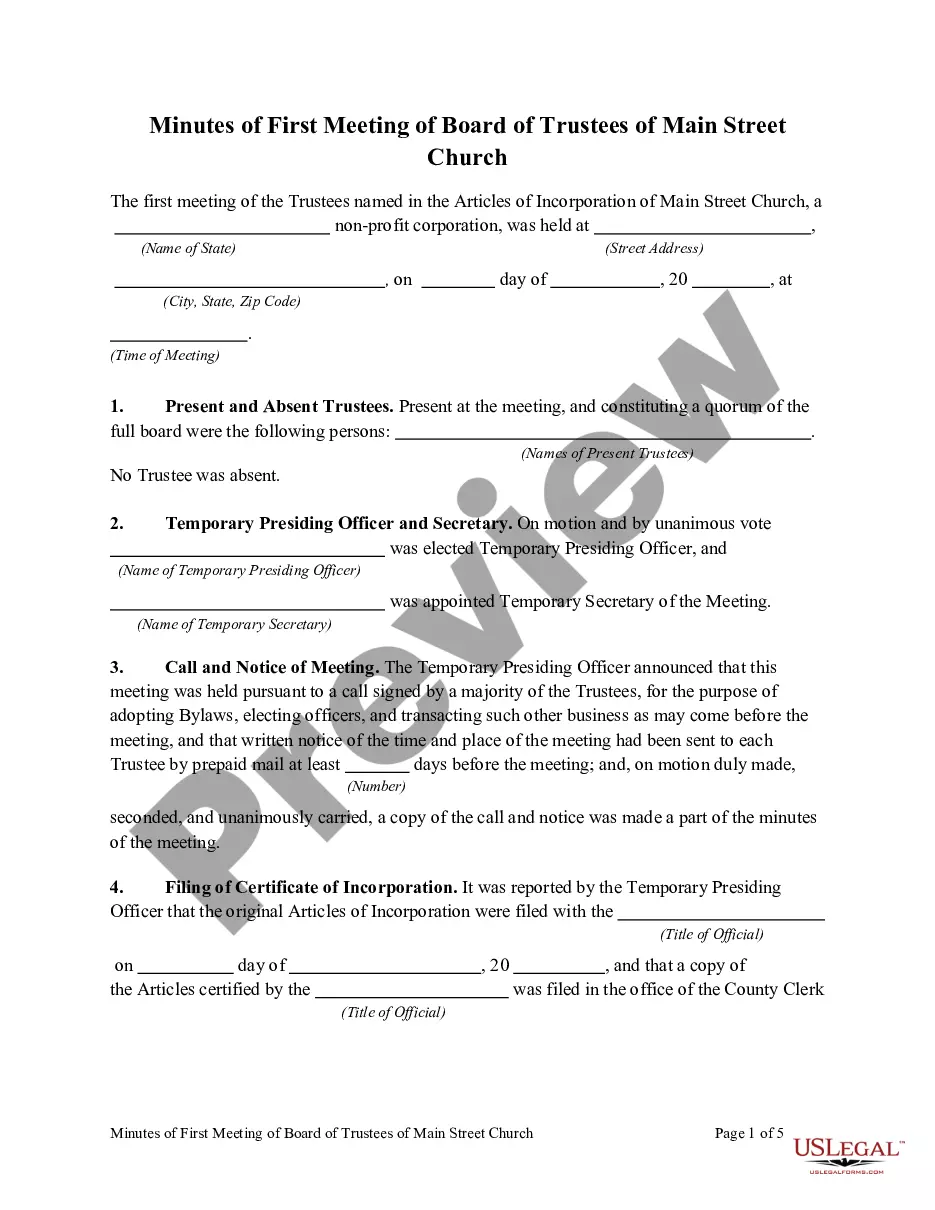

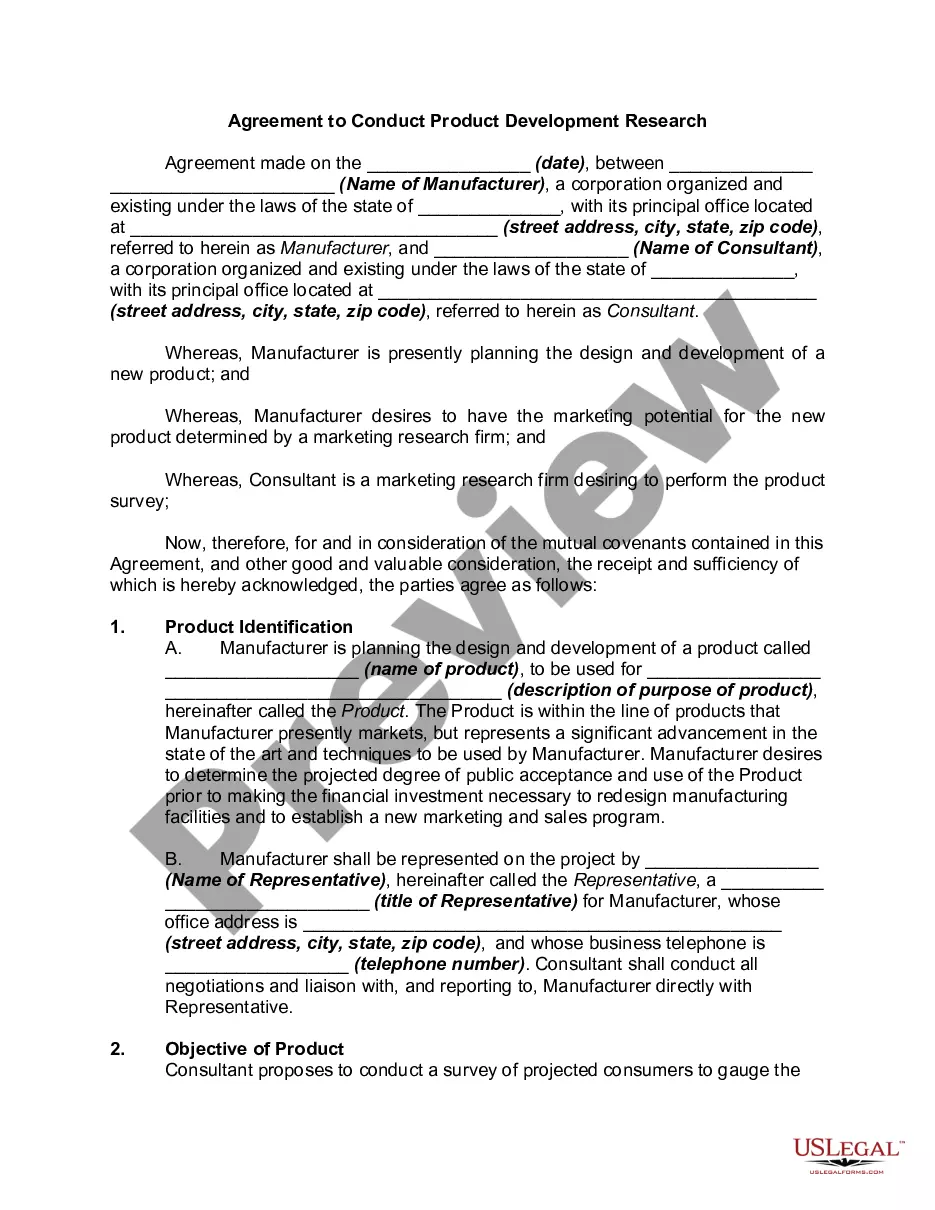

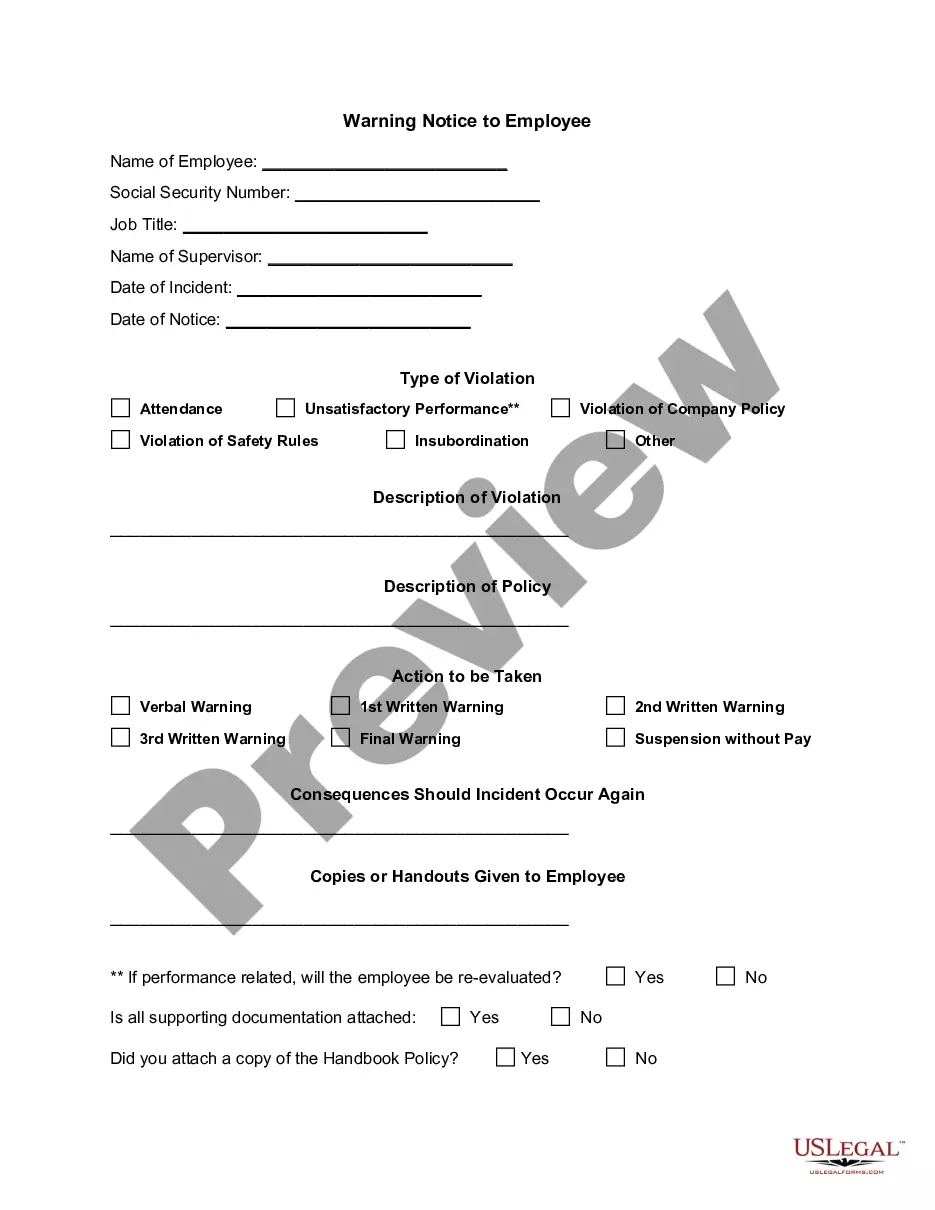

- Make sure you have found a suitable document. Review the description and utilize the Preview feature, if available, to see if it fulfills your needs. If it doesn't meet your expectations, use the Search tab above to discover the right one.

- Purchase the template. Click the Buy Now button and choose between a monthly or yearly subscription plan.

- Create an account and process the payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Fort Lauderdale Florida Complex Will with Credit Shelter Marital Trust for Large Estates. Select the file format for your document and store it on your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

For many married couples, a joint revocable living trust is often the best choice. This type of trust allows both spouses to manage assets during their lifetime and enables smooth transfer of property upon death. By considering a Fort Lauderdale Florida Complex Will with Credit Shelter Marital Trust for Large Estates, you can better protect your family's financial future and streamline the complexities of inheritance.

In Florida, a living trust does not require recording as it is a private document. However, if the trust includes real estate, that property must be titled in the name of the trust to effectively transfer ownership. Establishing a Fort Lauderdale Florida Complex Will with Credit Shelter Marital Trust for Large Estates can simplify property management and ensure your assets are distributed according to your wishes.

A marital trust is also referred to as an A Trust or QTIP trust. This type of trust allows a surviving spouse to benefit from the trust assets while ensuring that the remaining assets go to your chosen beneficiaries after their passing. Incorporating a Fort Lauderdale Florida Complex Will with Credit Shelter Marital Trust for Large Estates can provide peace of mind, knowing your spouse and heirs are protected.

While it is possible to create a living trust without an attorney, it is highly recommended to seek legal assistance to ensure compliance with Florida laws. An attorney can help draft the trust documents accurately and tailor them to your specific needs. Utilizing a Fort Lauderdale Florida Complex Will with Credit Shelter Marital Trust for Large Estates ensures your estate plan is structured correctly and protects your interests and those of your beneficiaries.

A credit shelter trust is often known as a B Trust or Family Trust. This type of trust is commonly used to protect assets from estate taxes while ensuring that beneficiaries receive their inheritance. As you navigate the complexities of estate planning, a Fort Lauderdale Florida Complex Will with Credit Shelter Marital Trust for Large Estates can help ensure your assets are managed effectively and in line with your wishes.

A GRAT, or Grantor Retained Annuity Trust, allows the grantor to receive fixed payments for a specified period, with the remainder going to beneficiaries. On the other hand, a CRT, or Charitable Remainder Trust, provides income to the grantor for a period, after which the remainder goes to a charity. When considering your estate planning, especially with regard to a Fort Lauderdale Florida Complex Will with Credit Shelter Marital Trust for Large Estates, understanding these differences can guide you in your decision-making.

While credit shelter trusts offer significant tax benefits, they also have disadvantages to consider. These trusts require careful administration and can lead to complexities in asset management. Additionally, assets in a credit shelter trust may not receive a step-up in basis at the death of the surviving spouse, which can lead to higher capital gains taxes upon sale. Consulting with platforms like uslegalforms can help you navigate these challenges effectively.

A credit shelter trust is designed to take full advantage of estate tax exemption limits, thereby shielding a certain amount of assets from taxes. In contrast, a marital trust allows assets to be passed directly to a surviving spouse, potentially deferring taxes until their death. Understanding these distinctions is crucial when planning a Fort Lauderdale Florida Complex Will with Credit Shelter Marital Trust for Large Estates, as they serve different purposes in estate tax planning.

A credit shelter trust can effectively utilize the estate tax exemption and can hold substantial value, typically up to the individual exemption limit. This can significantly benefit estate planning under a Fort Lauderdale Florida Complex Will with Credit Shelter Marital Trust for Large Estates, where maximizing wealth transfer and minimizing taxes are key goals. Consultation with a tax professional is advisable for optimized estate planning.

In Florida, getting married does not automatically override a trust. However, if a trust is created after marriage, the trust may need to account for the spouse's rights to assets. Therefore, when drafting a Fort Lauderdale Florida Complex Will with Credit Shelter Marital Trust for Large Estates, it’s crucial to consider your marital status to ensure that both partners' interests are validly represented.