The Hillsborough Florida Complex Will with Credit Shelter Marital Trust for Large Estates is a legal document designed to ensure the smooth distribution of assets and wealth for individuals with substantial estates in Hillsborough, Florida. This comprehensive estate planning strategy incorporates various provisions to minimize taxes, protect assets, and provide for loved ones after the individual's passing. The use of relevant keywords helps to understand the scope and complexity of this planning tool effectively. Keywords: Hillsborough Florida, complex will, credit shelter marital trust, large estates, legal document, distribution of assets, substantial estates, estate planning strategy, minimize taxes, protect assets, provide for loved ones, passing. Types of Hillsborough Florida Complex Will with Credit Shelter Marital Trust for Large Estates: 1. Irrevocable Credit Shelter Marital Trust: This type of trust establishes a separate legal entity where a certain portion of the estate is held for the benefit of the surviving spouse while the remainder passes into a credit shelter trust. The surviving spouse can access the income generated by the trust while preserving the principal for the beneficiaries upon their passing. 2. Revocable Credit Shelter Marital Trust: This option gives the individual more control as it can be modified or revoked during the lifetime. It allows the individual to retain access to both the income and principal of the trust while providing for the surviving spouse's financial well-being. 3. Generation-Skipping Credit Shelter Marital Trust: This trust is designed to bypass a generation, typically the children, in order to transfer the assets directly to grandchildren or future generations. It provides significant tax advantages and protects the assets from estate taxes at each generational level. 4. Dynasty Credit Shelter Marital Trust: This type of trust allows for the preservation and growth of wealth for multiple generations. By using generation-skipping transfer tax exemptions, this trust can mitigate estate taxes over time, ensuring the wealth remains within the family. 5. Qualified Terminable Interest Trust (TIP): A TIP trust allows an individual to provide for their surviving spouse while maintaining control over the ultimate distribution of assets. It ensures that after the surviving spouse's passing, the beneficiaries named by the original individual receive the remaining assets. These various types of Hillsborough Florida Complex Will with Credit Shelter Marital Trusts cater to the unique needs and objectives of individuals with large estates. Seeking professional advice from experienced estate planning attorneys is paramount to ensure compliance with state laws, maximize tax benefits, and secure the financial well-being of family and loved ones.

Hillsborough Florida Complex Will with Credit Shelter Marital Trust for Large Estates

Category:

State:

Florida

County:

Hillsborough

Control #:

FL-COMPLEX2

Format:

Word;

Rich Text

Instant download

Description

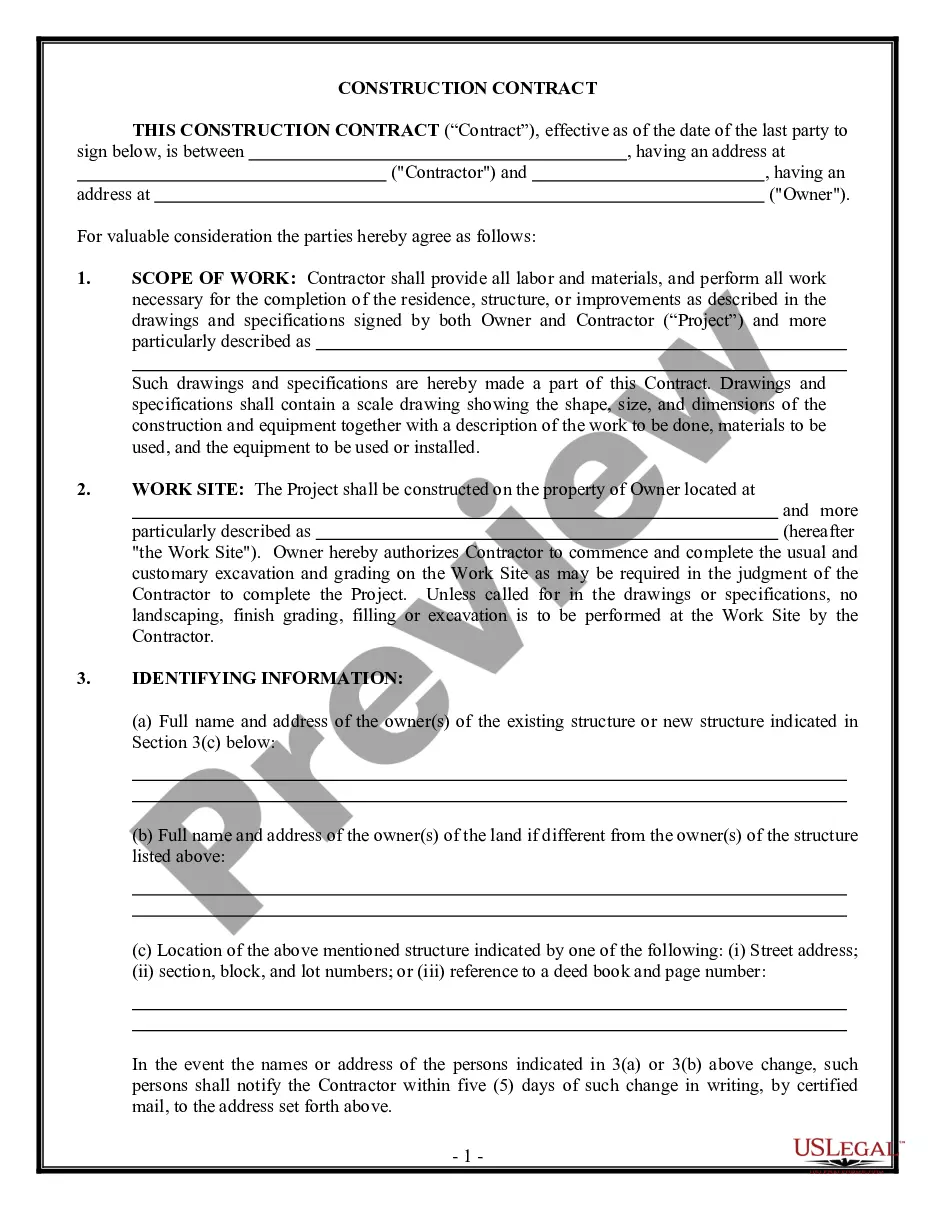

This Complex Will with Credit Shelter Trust for Large Estates form is a complex Will designed to enable a couple to maximize the amount of property that can pass free of estate taxes. The Will leaves the maximum tax free amount allowed (i.e. 1,000,000.00 as of 2001) to a trust and the remainder of property to the surviving spouse. All of the property passing to the Spouse is estate tax free. Therefore, no estate taxes are due at the death of the first Spouse. Since the trust has 1 million dollars that can pass to the children tax free, the surviving spouse can also leave 1 million to a similar trust or children and thereby enable 2 million dollars instead of 1 to pass to the children estate tax free. Income from the trust can be disbursed to the surviving spouse and children.

The Hillsborough Florida Complex Will with Credit Shelter Marital Trust for Large Estates is a legal document designed to ensure the smooth distribution of assets and wealth for individuals with substantial estates in Hillsborough, Florida. This comprehensive estate planning strategy incorporates various provisions to minimize taxes, protect assets, and provide for loved ones after the individual's passing. The use of relevant keywords helps to understand the scope and complexity of this planning tool effectively. Keywords: Hillsborough Florida, complex will, credit shelter marital trust, large estates, legal document, distribution of assets, substantial estates, estate planning strategy, minimize taxes, protect assets, provide for loved ones, passing. Types of Hillsborough Florida Complex Will with Credit Shelter Marital Trust for Large Estates: 1. Irrevocable Credit Shelter Marital Trust: This type of trust establishes a separate legal entity where a certain portion of the estate is held for the benefit of the surviving spouse while the remainder passes into a credit shelter trust. The surviving spouse can access the income generated by the trust while preserving the principal for the beneficiaries upon their passing. 2. Revocable Credit Shelter Marital Trust: This option gives the individual more control as it can be modified or revoked during the lifetime. It allows the individual to retain access to both the income and principal of the trust while providing for the surviving spouse's financial well-being. 3. Generation-Skipping Credit Shelter Marital Trust: This trust is designed to bypass a generation, typically the children, in order to transfer the assets directly to grandchildren or future generations. It provides significant tax advantages and protects the assets from estate taxes at each generational level. 4. Dynasty Credit Shelter Marital Trust: This type of trust allows for the preservation and growth of wealth for multiple generations. By using generation-skipping transfer tax exemptions, this trust can mitigate estate taxes over time, ensuring the wealth remains within the family. 5. Qualified Terminable Interest Trust (TIP): A TIP trust allows an individual to provide for their surviving spouse while maintaining control over the ultimate distribution of assets. It ensures that after the surviving spouse's passing, the beneficiaries named by the original individual receive the remaining assets. These various types of Hillsborough Florida Complex Will with Credit Shelter Marital Trusts cater to the unique needs and objectives of individuals with large estates. Seeking professional advice from experienced estate planning attorneys is paramount to ensure compliance with state laws, maximize tax benefits, and secure the financial well-being of family and loved ones.

Free preview

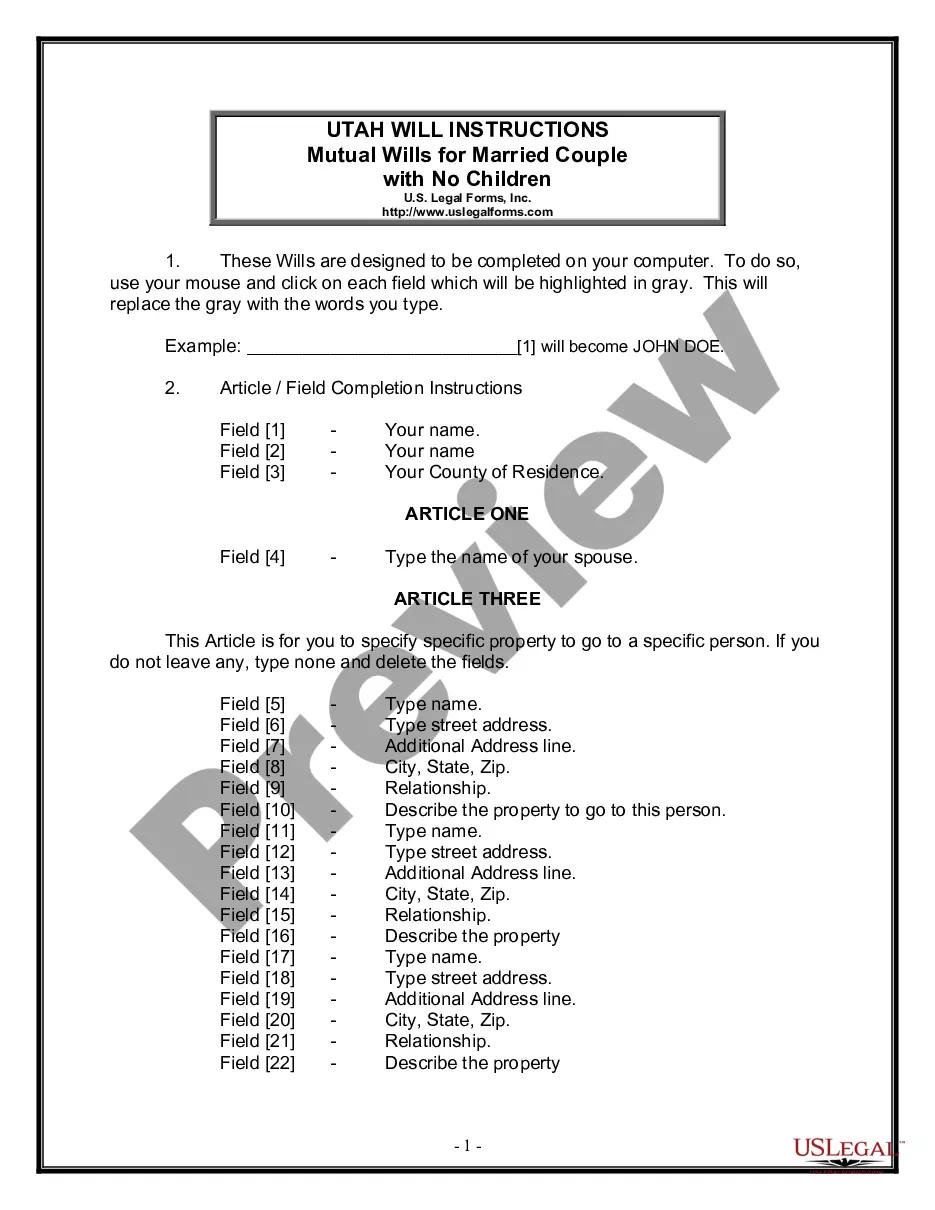

How to fill out Hillsborough Florida Complex Will With Credit Shelter Marital Trust For Large Estates?

If you’ve already used our service before, log in to your account and download the Hillsborough Florida Complex Will with Credit Shelter Marital Trust for Large Estates on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Hillsborough Florida Complex Will with Credit Shelter Marital Trust for Large Estates. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!