A Jacksonville Florida Complex Will with Credit Shelter Marital Trust for Large Estates is a legally binding document that outlines detailed instructions for the distribution of assets and properties upon the death of an individual with a significant estate. This type of will utilize a combination of complex estate planning tools, including a credit shelter trust and a marital trust, to maximize tax benefits and protect the assets of the estate. The credit shelter trust, also known as a bypass trust or a family trust, is created to ensure that the maximum amount of the estate is sheltered from estate taxes at the death of the first spouse. It allows the deceased spouse's unused estate tax exemption to transfer to the surviving spouse, thereby preserving the exemption and reducing the estate tax burden on the estate as a whole. This trust typically holds assets equal to the value of the estate owner's available estate tax exemption. On the other hand, a marital trust, often referred to as a TIP (Qualified Terminable Interest Property) trust, is designed to provide for the financial needs of the surviving spouse while still maintaining control over the ultimate distribution of the trust assets. The key benefit of this trust is that it defers the estate taxes until the death of the surviving spouse, allowing for potential tax savings and increased control over the disposition of assets. A Jacksonville Florida Complex Will with Credit Shelter Marital Trust for Large Estates can be further categorized into different types based on the specific needs and circumstances of the estate owner. These may include: 1. Irrevocable Trust: This type of trust cannot be modified or revoked once it is established, ensuring the permanence and security of the assets held within the trust. It may offer additional tax benefits and asset protection. 2. Revocable Trust: Unlike an irrevocable trust, a revocable trust allows the estate owner to modify or revoke the trust during their lifetime. This provides flexibility and the ability to make changes as circumstances evolve. 3. Testamentary Trust: Rather than being established during the estate owner's lifetime, a testamentary trust is created within the will itself and only takes effect upon the death of the estate owner. It allows for the distribution of assets after the probate process. In summary, a Jacksonville Florida Complex Will with Credit Shelter Marital Trust for Large Estates is a comprehensive estate planning tool that combines the benefits of a credit shelter trust and a marital trust to optimize tax advantages and protect substantial assets. Different types of this will may include irrevocable, revocable, and testamentary trusts, each catering to specific requirements.

Jacksonville Florida Complex Will with Credit Shelter Marital Trust for Large Estates

Description

How to fill out Jacksonville Florida Complex Will With Credit Shelter Marital Trust For Large Estates?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Jacksonville Florida Complex Will with Credit Shelter Marital Trust for Large Estates gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Jacksonville Florida Complex Will with Credit Shelter Marital Trust for Large Estates takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

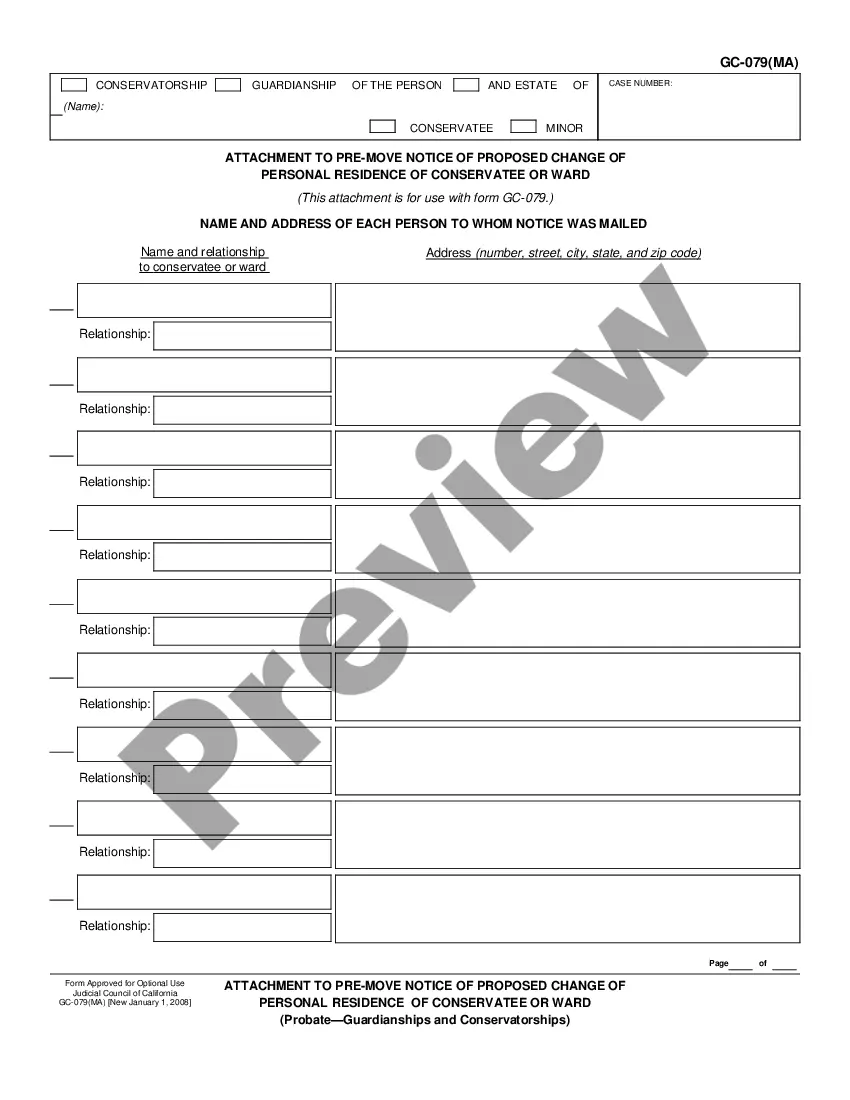

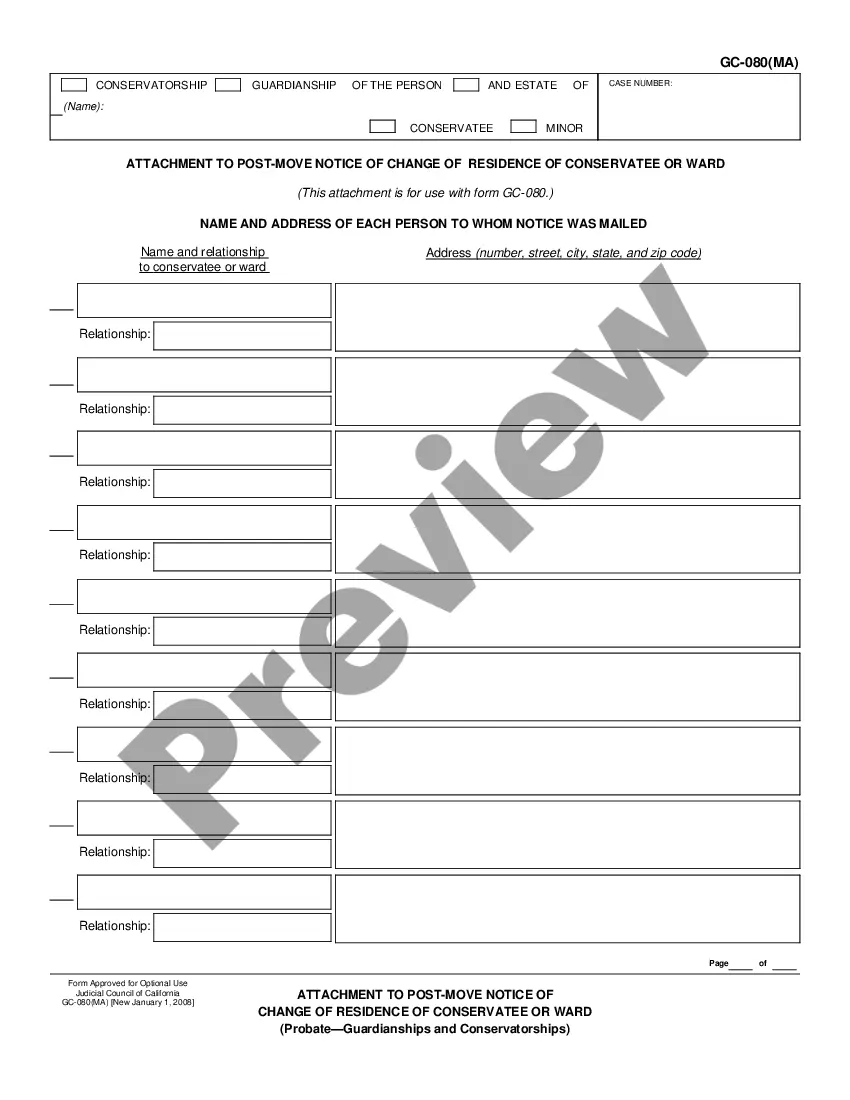

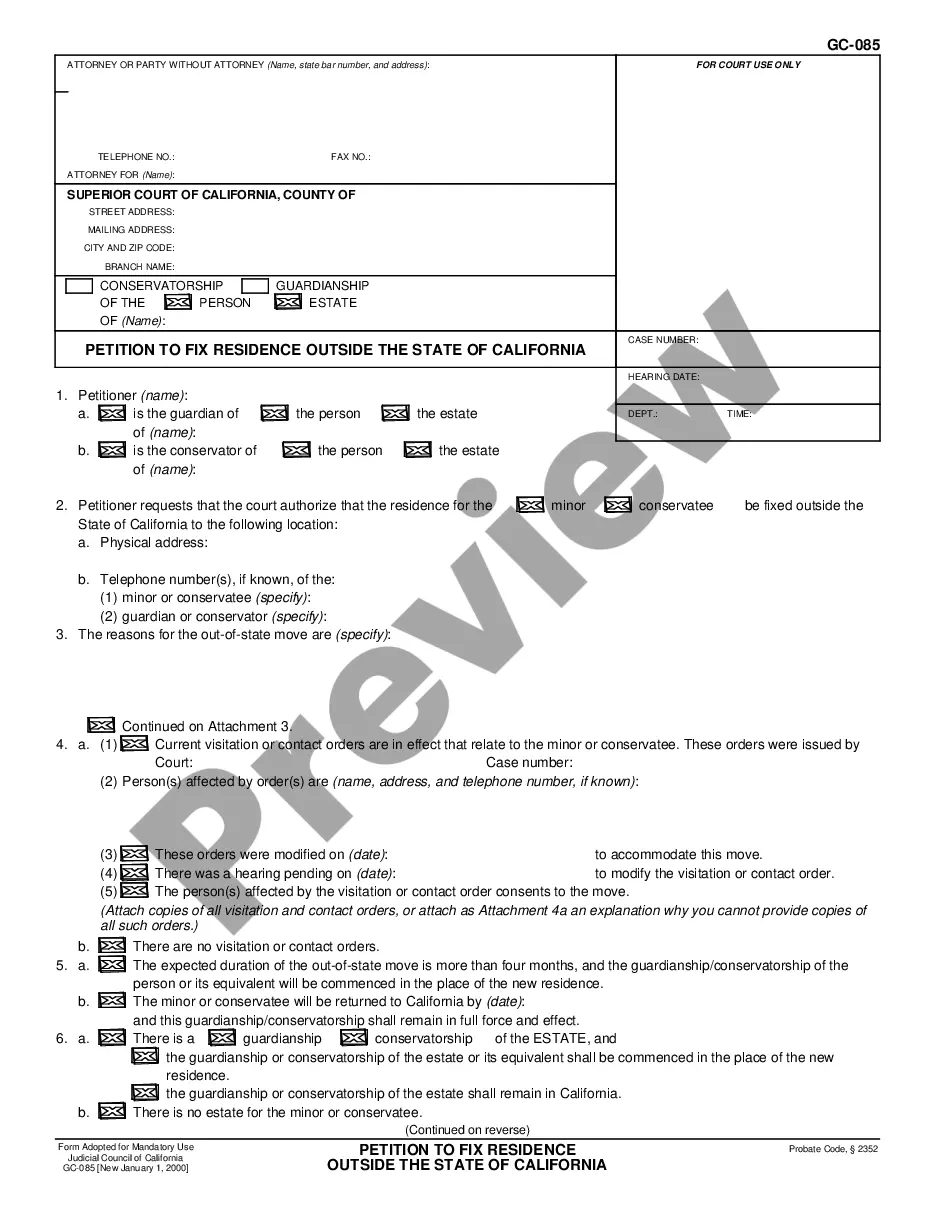

- Check the Preview mode and form description. Make certain you’ve picked the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Jacksonville Florida Complex Will with Credit Shelter Marital Trust for Large Estates. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!