St. Petersburg Florida Complex Will with Credit Shelter Marital Trust for Large Estates is a specialized estate planning tool designed to help individuals with substantial assets protect their wealth and provide for their loved ones after their passing. This comprehensive legal arrangement is tailored specifically for high-net-worth individuals residing in the St. Petersburg, Florida area. The St. Petersburg Florida Complex Will with Credit Shelter Marital Trust for Large Estates offers several key advantages and features, including: 1. Tax Mitigation: One of the primary objectives of this complex will is to minimize estate taxes and maximize the wealth transferred to future generations. By utilizing a credit shelter marital trust, the estate's assets can be shielded from unnecessary tax burdens, potentially saving significant sums of money. 2. Asset Protection: Large estates often involve various valuable assets, such as real estate properties, investments, businesses, and personal possessions. This estate planning tool helps safeguard these assets by establishing a trust structure that offers protection from creditors, lawsuits, and potential disputes. 3. Preserving Family Wealth: With large estates, it is crucial to develop a comprehensive plan that ensures the preservation and smooth transfer of wealth to future generations. The St. Petersburg Florida Complex Will with Credit Shelter Marital Trust for Large Estates enables individuals to outline their exact wishes regarding the distribution of their assets and wealth, ensuring that their loved ones are financially secure. 4. Flexibility: Different estates have different dynamics, objectives, and family circumstances. Therefore, this complex will allows individuals to customize the terms and provisions based on their specific needs. Flexibility can be crucial in navigating potential changes in tax laws, family dynamics, and financial situations. It is worth noting that within the realm of St. Petersburg Florida Complex Will with Credit Shelter Marital Trust for Large Estates, there may be different variations or specific types based on individual preferences or requirements. Some of these variations include: 1. Testamentary Credit Shelter Marital Trust: This type of complex will establishes a marital trust upon the death of the first spouse. The surviving spouse can receive income or other benefits from the trust while preserving the principal for the beneficiaries. 2. Revocable Credit Shelter Marital Trust: With this type of complex will, the individual maintains control over the assets within the trust during their lifetime. It offers flexibility and the ability to make changes or amendments as needed. 3. Irrevocable Credit Shelter Marital Trust: A more permanent arrangement, the assets transferred to this trust become irrevocable, and the individual relinquishes control over them. This trust offers enhanced asset protection and potentially greater tax savings. 4. Generation-Skipping Credit Shelter Marital Trust: This type of complex will is specifically designed for individuals who want to leave assets to their grandchildren while still providing for the surviving spouse. It can help minimize estate taxes for future generations. In summary, the St. Petersburg Florida Complex Will with Credit Shelter Marital Trust for Large Estates is an intricate and robust estate planning tool that empowers individuals with substantial assets to protect their wealth, minimize taxes, and ensure a seamless transfer of assets to their loved ones. Through different variations and types, this legal arrangement can be tailored to suit specific family dynamics, financial goals, and the unique circumstances of each individual's large estate.

St. Petersburg Florida Complex Will with Credit Shelter Marital Trust for Large Estates

Description

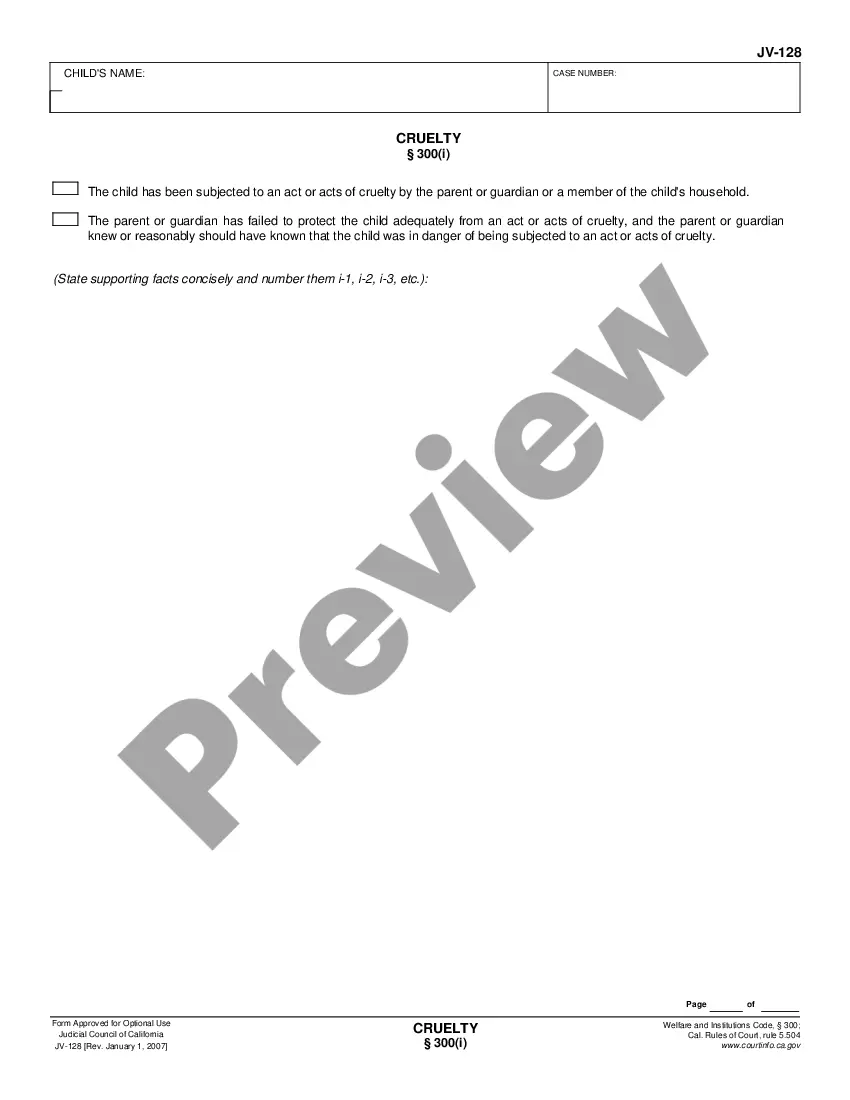

How to fill out St. Petersburg Florida Complex Will With Credit Shelter Marital Trust For Large Estates?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone with no legal education to create this sort of papers cfrom the ground up, mostly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service offers a massive catalog with more than 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you require the St. Petersburg Florida Complex Will with Credit Shelter Marital Trust for Large Estates or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the St. Petersburg Florida Complex Will with Credit Shelter Marital Trust for Large Estates quickly using our reliable service. In case you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, in case you are a novice to our platform, ensure that you follow these steps before downloading the St. Petersburg Florida Complex Will with Credit Shelter Marital Trust for Large Estates:

- Ensure the template you have found is suitable for your location since the regulations of one state or county do not work for another state or county.

- Preview the document and go through a brief description (if available) of scenarios the document can be used for.

- In case the form you picked doesn’t meet your needs, you can start again and look for the necessary document.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your login information or register for one from scratch.

- Pick the payment method and proceed to download the St. Petersburg Florida Complex Will with Credit Shelter Marital Trust for Large Estates as soon as the payment is done.

You’re all set! Now you can go ahead and print out the document or fill it out online. If you have any issues getting your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.