A Broward Florida Wage Statement is a formal document that contains detailed information about an employee's compensation and financial transactions for a specific pay period. It serves as a record of wages paid and deductions made by the employer to comply with labor laws and ensure transparent communication with the employee regarding their earnings. The Broward Florida Wage Statement typically includes essential details such as the employee's name, employee identification or social security number, pay period dates, and the name and address of the employer. Moreover, it provides a comprehensive breakdown of various elements related to the employee's compensation, such as regular hours worked, overtime hours (if applicable), rate of pay, and total wages earned. In addition to the basic earning details, the wage statement also enumerates specific deductions or withholding that may have been made from the employee's wages. These deductions could include federal, state, and local taxes, social security contributions, health insurance premiums, retirement plan contributions, or any other authorized payroll deductions. Furthermore, it may also include information about reimbursements or additional benefits received by the employee, such as travel expenses or bonuses. The state of Florida recognizes the importance of providing employees with an accurate and comprehensive wage statement to ensure fair payment practices. Apart from standard wage statements, there are specific types of Broward Florida Wage Statements that employers may issue based on specific circumstances. Some notable types include: 1. Regular Wage Statement: This is the most common type of wage statement provided to employees on a regular basis, usually with each paycheck, documenting their earnings, hours worked, and deductions made. 2. Final Wage Statement: When an employee leaves their job or is terminated, the employer is required to provide them with a final wage statement that outlines their final wages, accrued vacation or sick time, any unused benefits, and deductions. 3. Annual Wage Statement: Employers may issue an annual wage statement, also known as a W-2 form, at the end of the calendar year to summarize an employee's annual earnings and taxes withheld. This statement is used by employees for filing their income tax returns. In conclusion, a Broward Florida Wage Statement is a legally mandated document that serves as a detailed record of an employee's compensation, deductions, and additional benefits. It ensures transparency in payment matters and helps employees easily track their earnings and deductions. Employers must provide regular, final, and annual wage statements to comply with the wage and hour laws prevalent in Broward County, Florida.

Broward Florida Wage Statement

Description

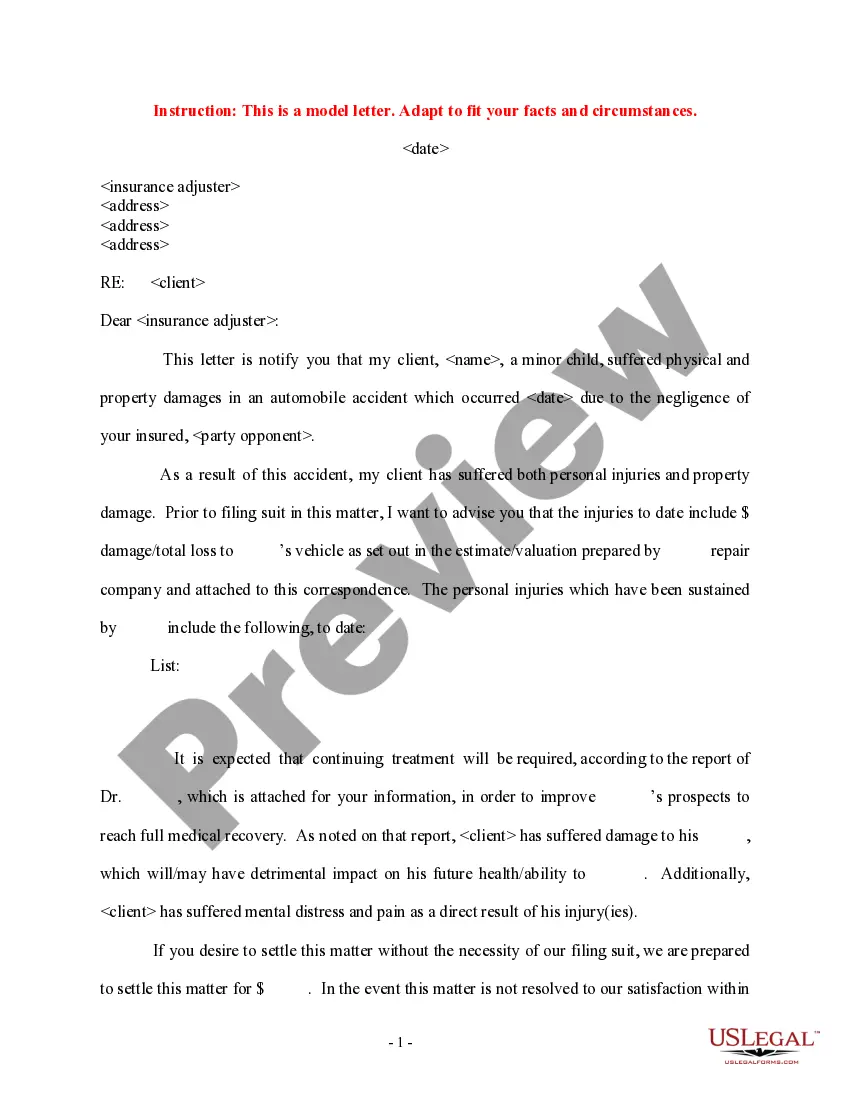

How to fill out Broward Florida Wage Statement?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Broward Florida Wage Statement becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Broward Florida Wage Statement takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Broward Florida Wage Statement. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

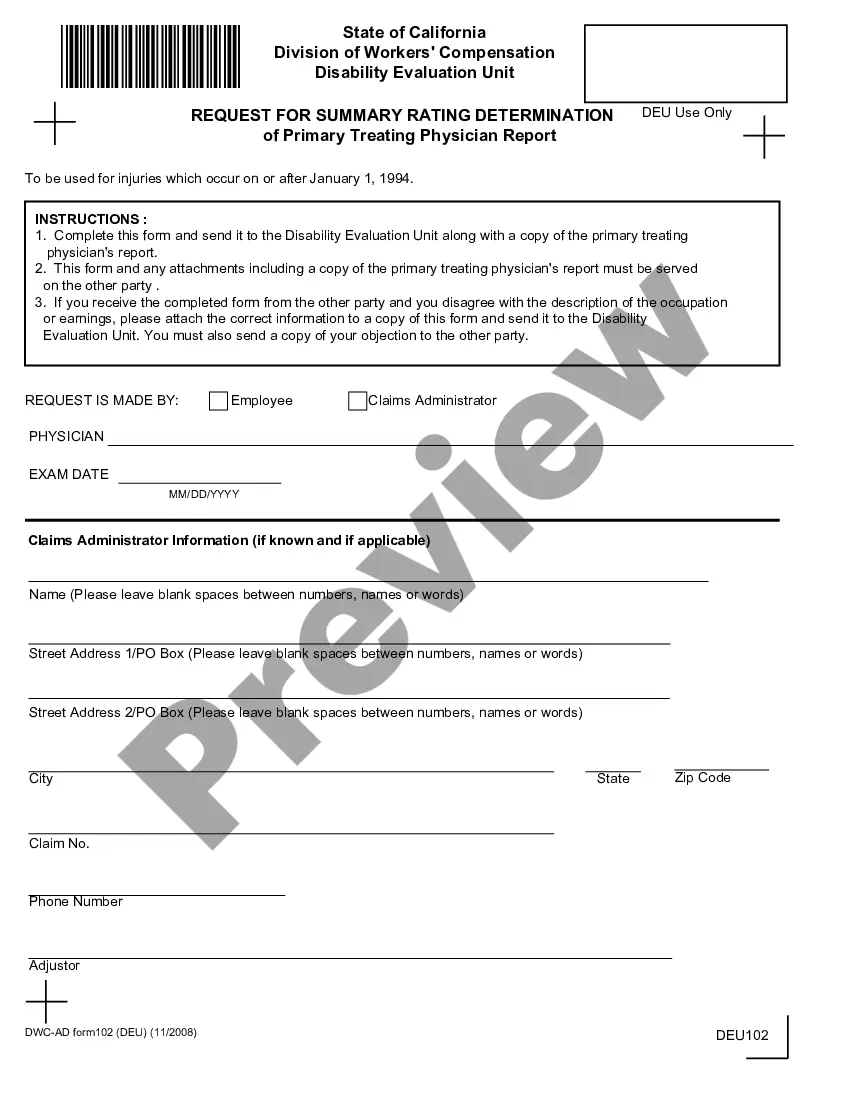

(Labor Code Section 226(a)(7)) The following information is required to be on your itemized statement: Gross wages earned. Total hours worked (not required for salaried exempt employees) The number of piece-rate units earned and any applicable piece rate if the employee is paid on a piece rate basis.

Wage Statements The employee's name and address. The hours worked by the employee. The employee's wage rate. The overtime wage rate. The hours worked at the overtime rate. Any other payment to which the employee is entitled (e.g., a bonus) The amount and purpose of all deductions.

IRS Definition A wage and income transcript shows data from information returns the IRS receives, such as Forms W-2, 1099, 1098 and Form 5498. Current tax year information may not be complete until July. This transcript is available for up to 10 prior years using Get Transcript Online or Form 4506-T.

FLORIDA DEPARTMENT OF FINANCIAL SERVICES.RECEIVED BY CLAIMS-REQUEST FOR WAGE LOSS/TEMPORARY PARTIAL BENEFITS. 1-800-342-1741 or contact your local office for assistance. COMPLETE ALL APPLICABLE SECTIONS BEFORE FILING WITH THE DIVISION.EMPLOYEE: You must complete one of these forms every two weeks.

According to the California labor code, an itemized wage statement must have the following: Gross wages earned. Total hours worked (not required for salaried exempt employees). The number of piece-rate units earned and any applicable piece rate if the employee is paid on a piece-rate basis.

(Labor Code Section 226(a)(7)) The following information is required to be on your itemized statement: Gross wages earned. Total hours worked (not required for salaried exempt employees) The number of piece-rate units earned and any applicable piece rate if the employee is paid on a piece rate basis.

The information in the payroll records must include: Employee's name, date of birth, occupation, telephone number, and residential address. The date on which the employee began employment with that employer. The employee's wage rate. The hours worked on each day. The benefits paid to the employee.

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

More info

I have never seen so many laws and rules (I am from New Jersey×. Official website of the Department of Justice. This website displays the laws relating to criminal and civil offenses and allows for users to track their cases and conduct searches of criminal databases and court cases. I've lost all my documentation! This information is important to you, but you need it now! A Florida State Prison Legal Assistance Program is seeking to provide free legal help to prisoners and others at risk of incarceration whose financial obligations prevent them from complying with legal processes. Florida State Prison Legal Counsel's website allows prisoners, parolees, family members and other interested parties to view a database of case and court documents. The website contains the state and court forms to fill out and access case information in a simple-to-use interface. Online court transcripts are now available!

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.