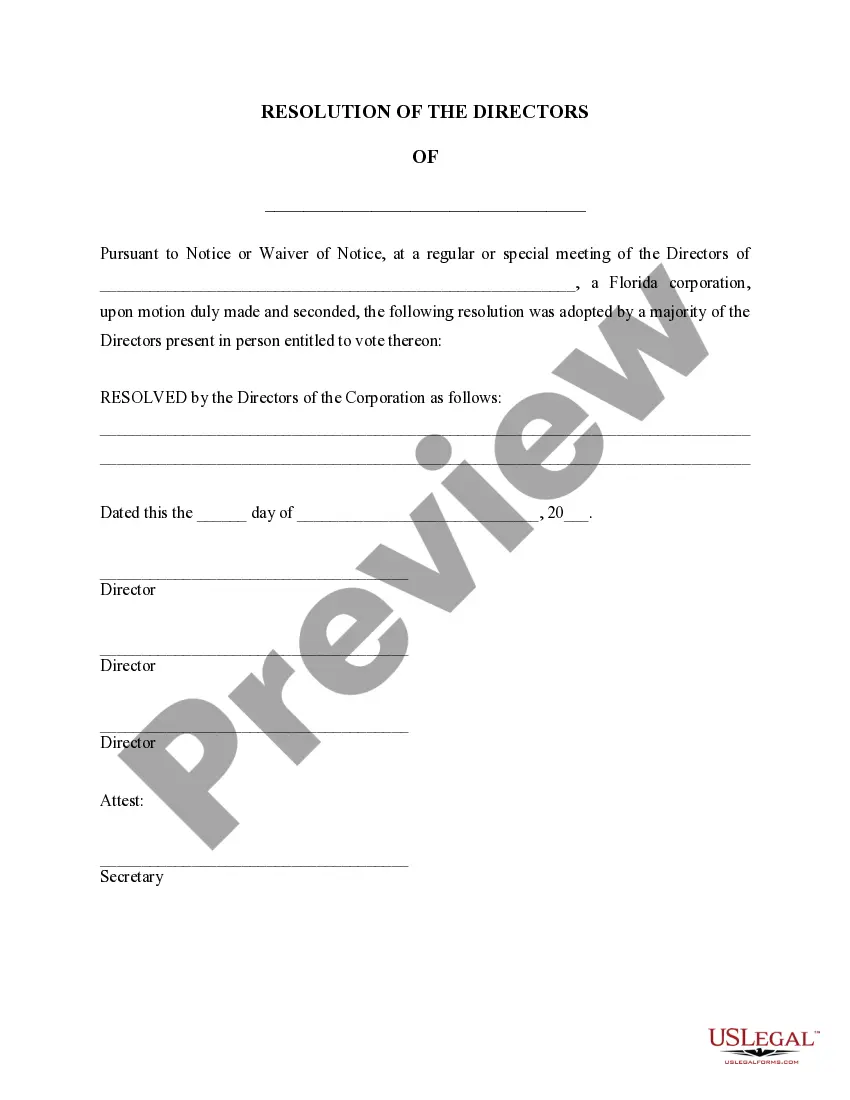

Orange Florida Dissolution Package to Dissolve Corporation: A Comprehensive Solution for Dissolving Your Corporation If you are a business owner in Orange, Florida considering dissolving your corporation, the Orange Florida Dissolution Package to Dissolve Corporation is the perfect solution for you. Our package provides a comprehensive and streamlined process to ensure a smooth transition from an active corporation to one that is dissolved. With years of experience and expertise in corporate law, our team has meticulously prepared the Orange Florida Dissolution Package, tailored specifically to meet the requirements and regulations of Orange County, Florida. This all-inclusive package covers all the necessary paperwork, filings, and legal documentation needed to dissolve your corporation, saving you time, effort, and potential headaches. What does the Orange Florida Dissolution Package include? 1. Dissolution Document Preparation: Our professionals will prepare all the necessary dissolution documents such as the Certificate of Dissolution, Articles of Dissolution, and any additional required forms. We ensure accurate completion of these documents to meet Orange County's legal requirements. 2. Filing Assistance: Filing documents with the appropriate state and local agencies can be confusing and time-consuming. Our package includes assistance with filing your dissolution paperwork with the Orange County Clerk's Office and any other relevant state agencies. 3. Legal Guidance: Dissolving a corporation involves navigating complex legal procedures and requirements. Our team of experienced corporate attorneys will provide expert guidance throughout the process and address any legal questions or concerns you may have. 4. Notices and Compliance: As part of the dissolution process, it may be necessary to provide notices to creditors, shareholders, and other interested parties. Our package includes the drafting and distribution of required notices, ensuring compliance with legal obligations. 5. Tax Filings: Dissolving a corporation often involves specific tax considerations. Our package provides assistance with filing final tax returns and proper documentation to fulfill tax obligations with the relevant tax authorities. Different Types of Orange Florida Dissolution Packages: 1. Standard Dissolution Package: This is our basic package that includes all the essential services required for the dissolution process. It covers document preparation, filing assistance, legal guidance, notices, and compliance. 2. Expedited Dissolution Package: If you require a faster dissolution process, our expedited package prioritizes your filing and ensures quicker processing times with the Orange County Clerk's Office. 3. Dissolution Package with Tax Services: This package includes all the features of the standard package and adds comprehensive tax filing assistance. Our team will guide you through the necessary tax filings, ensuring compliance with tax laws and regulations. Choose the Orange Florida Dissolution Package to Dissolve Corporation for a seamless and hassle-free dissolution process. Our expertise, attention to detail, and commitment to customer satisfaction make us the trusted choice for business owners in Orange, Florida. Let us handle the legal complexities while you focus on the next steps in your business journey.

Orange Florida Dissolution Package to Dissolve Corporation

Description

How to fill out Orange Florida Dissolution Package To Dissolve Corporation?

Are you looking for a reliable and inexpensive legal forms provider to buy the Orange Florida Dissolution Package to Dissolve Corporation? US Legal Forms is your go-to choice.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, locate the needed form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Orange Florida Dissolution Package to Dissolve Corporation conforms to the laws of your state and local area.

- Go through the form’s details (if available) to learn who and what the form is good for.

- Start the search over in case the form isn’t good for your specific situation.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Orange Florida Dissolution Package to Dissolve Corporation in any available format. You can get back to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time learning about legal papers online for good.