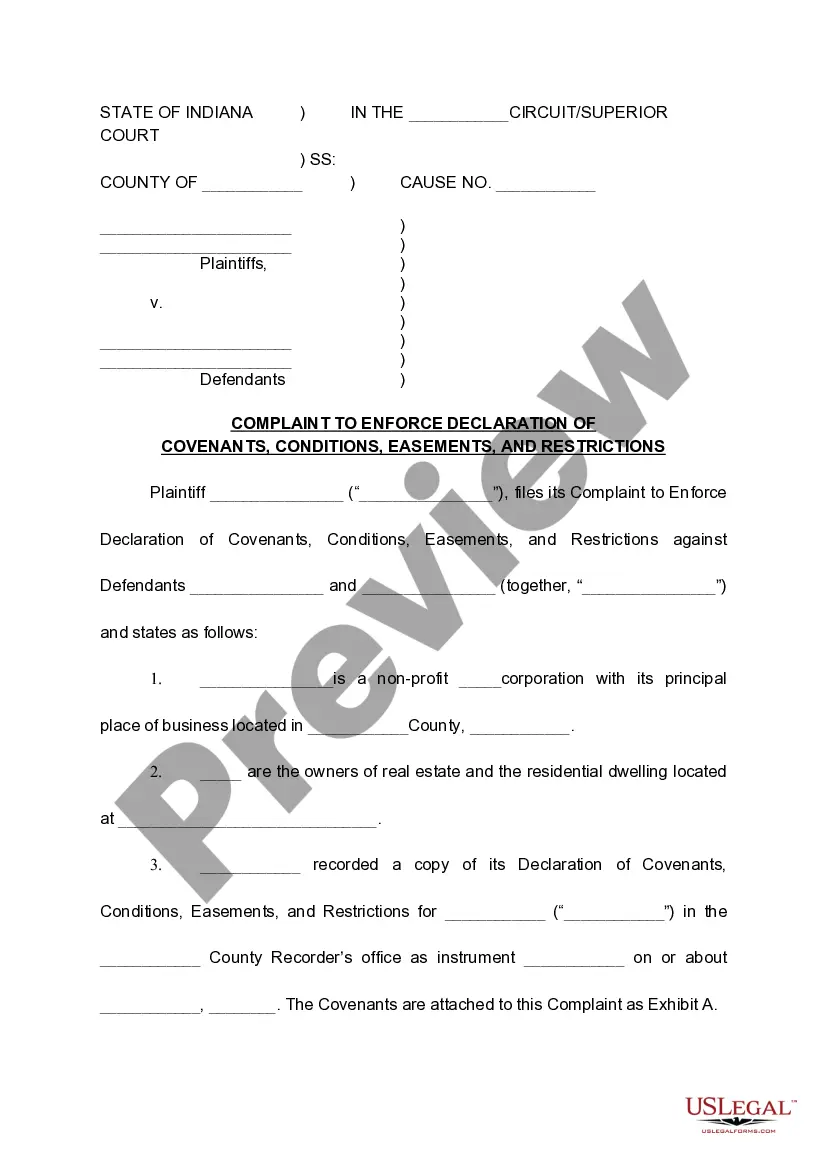

Orlando Florida Notice of Revocation of Election to be Exempt is a legal document that allows individuals or businesses in Orlando, Florida, to cancel their exemption status for certain taxes or liabilities. By submitting this notice, the taxpayer declares their decision to no longer claim exemption and agrees to comply with the applicable tax laws and regulations. Keywords: Orlando Florida, Notice of Revocation, Election to be Exempt, legal document, taxes, liabilities, exemption status, taxpayer, tax laws, regulations. There are various types of Orlando Florida Notice of Revocation of Election to be Exempt, including: 1. Orlando Florida Notice of Revocation of Election to be Exempt for Property Taxes: This type of notice applies to individuals or businesses that previously claimed exemption from property taxes but now wish to revoke that status. 2. Orlando Florida Notice of Revocation of Election to be Exempt for Sales Taxes: This type of notice pertains to individuals or businesses that previously elected to be exempt from collecting or remitting sales taxes and now choose to revoke that exemption. 3. Orlando Florida Notice of Revocation of Election to be Exempt for Income Taxes: This type of notice applies to individuals or businesses that previously claimed exemption from income taxes but wish to cancel that status and become liable for paying taxes on their income. 4. Orlando Florida Notice of Revocation of Election to be Exempt for Business License Taxes: This type of notice is relevant for individuals or businesses that previously elected to be exempt from business license taxes and now wish to revoke that exemption. 5. Orlando Florida Notice of Revocation of Election to be Exempt for Tourist Development Taxes: This type of notice pertains to individuals or businesses that previously claimed exemption from tourist development taxes but now choose to revoke that exemption status. It is important to note that each type of Orlando Florida Notice of Revocation of Election to be Exempt has specific requirements and procedures to follow. Taxpayers should carefully review the instructions provided by the Orlando tax authorities or seek professional advice to ensure compliance with all legal obligations.

Orlando Florida Notice of Revocation of Election to be Exempt

State:

Florida

City:

Orlando

Control #:

FL-DWC-250-R-WC

Format:

PDF

Instant download

Public form

Description

Notice of Revocation of Election to be Exempt

Orlando Florida Notice of Revocation of Election to be Exempt is a legal document that allows individuals or businesses in Orlando, Florida, to cancel their exemption status for certain taxes or liabilities. By submitting this notice, the taxpayer declares their decision to no longer claim exemption and agrees to comply with the applicable tax laws and regulations. Keywords: Orlando Florida, Notice of Revocation, Election to be Exempt, legal document, taxes, liabilities, exemption status, taxpayer, tax laws, regulations. There are various types of Orlando Florida Notice of Revocation of Election to be Exempt, including: 1. Orlando Florida Notice of Revocation of Election to be Exempt for Property Taxes: This type of notice applies to individuals or businesses that previously claimed exemption from property taxes but now wish to revoke that status. 2. Orlando Florida Notice of Revocation of Election to be Exempt for Sales Taxes: This type of notice pertains to individuals or businesses that previously elected to be exempt from collecting or remitting sales taxes and now choose to revoke that exemption. 3. Orlando Florida Notice of Revocation of Election to be Exempt for Income Taxes: This type of notice applies to individuals or businesses that previously claimed exemption from income taxes but wish to cancel that status and become liable for paying taxes on their income. 4. Orlando Florida Notice of Revocation of Election to be Exempt for Business License Taxes: This type of notice is relevant for individuals or businesses that previously elected to be exempt from business license taxes and now wish to revoke that exemption. 5. Orlando Florida Notice of Revocation of Election to be Exempt for Tourist Development Taxes: This type of notice pertains to individuals or businesses that previously claimed exemption from tourist development taxes but now choose to revoke that exemption status. It is important to note that each type of Orlando Florida Notice of Revocation of Election to be Exempt has specific requirements and procedures to follow. Taxpayers should carefully review the instructions provided by the Orlando tax authorities or seek professional advice to ensure compliance with all legal obligations.

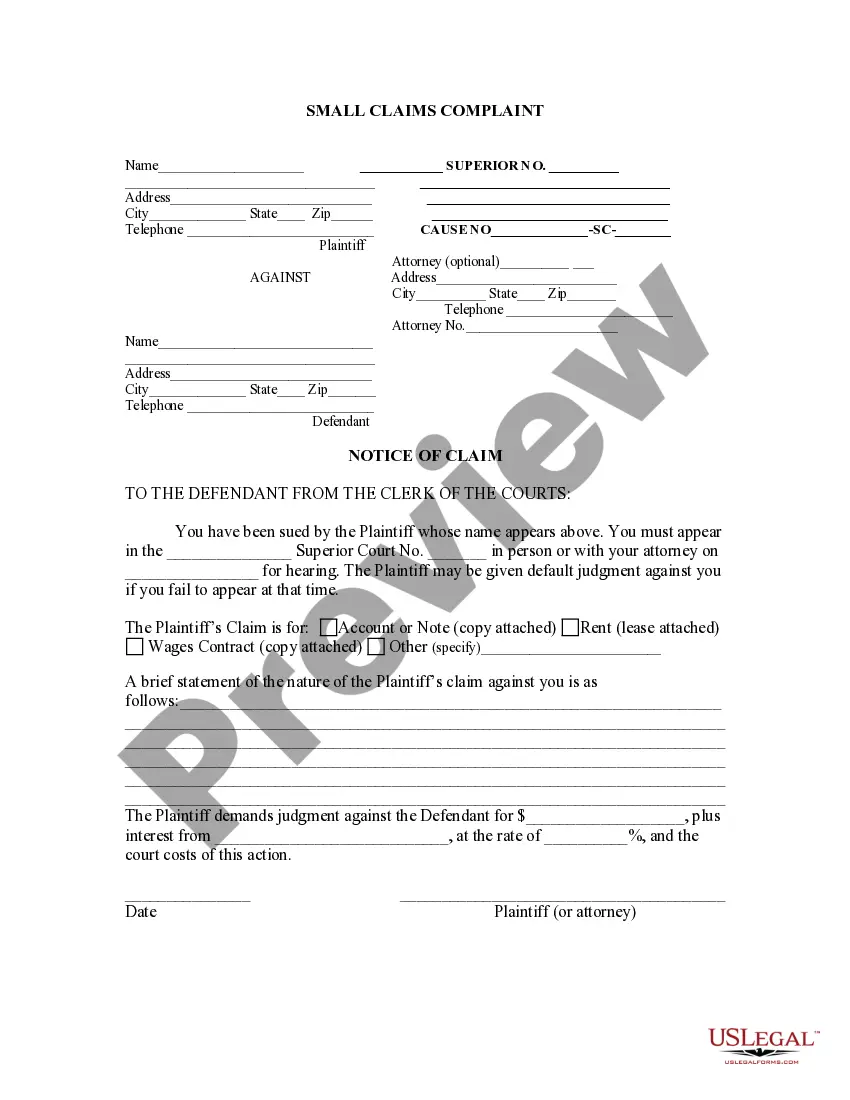

How to fill out Orlando Florida Notice Of Revocation Of Election To Be Exempt?

If you’ve already used our service before, log in to your account and save the Orlando Florida Notice of Revocation of Election to be Exempt on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make sure you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Orlando Florida Notice of Revocation of Election to be Exempt. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!