Miami Gardens Florida Living Trust for Husband and Wife with No Children

Description

How to fill out Florida Living Trust For Husband And Wife With No Children?

If you have previously utilized our service, sign in to your account and store the Miami Gardens Florida Living Trust for Husband and Wife with No Children on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have lifelong access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to reference it again. Utilize the US Legal Forms service to swiftly locate and store any template for your personal or business purposes!

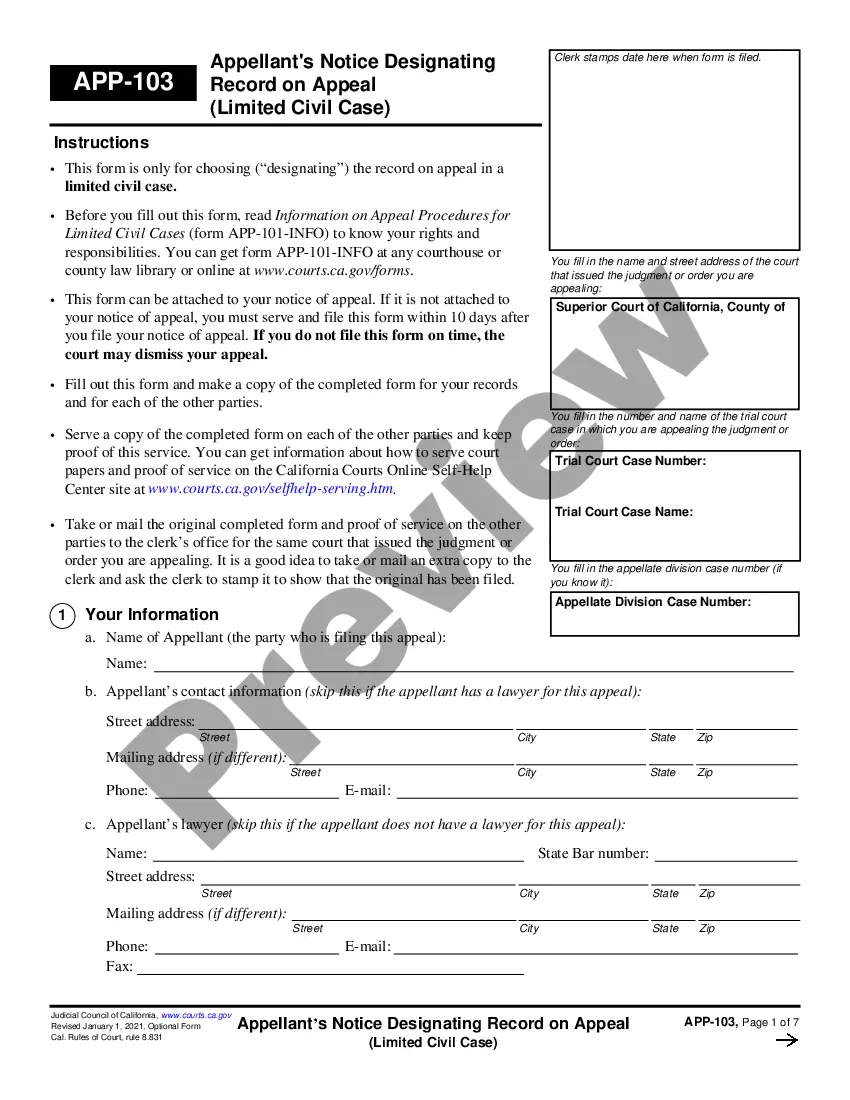

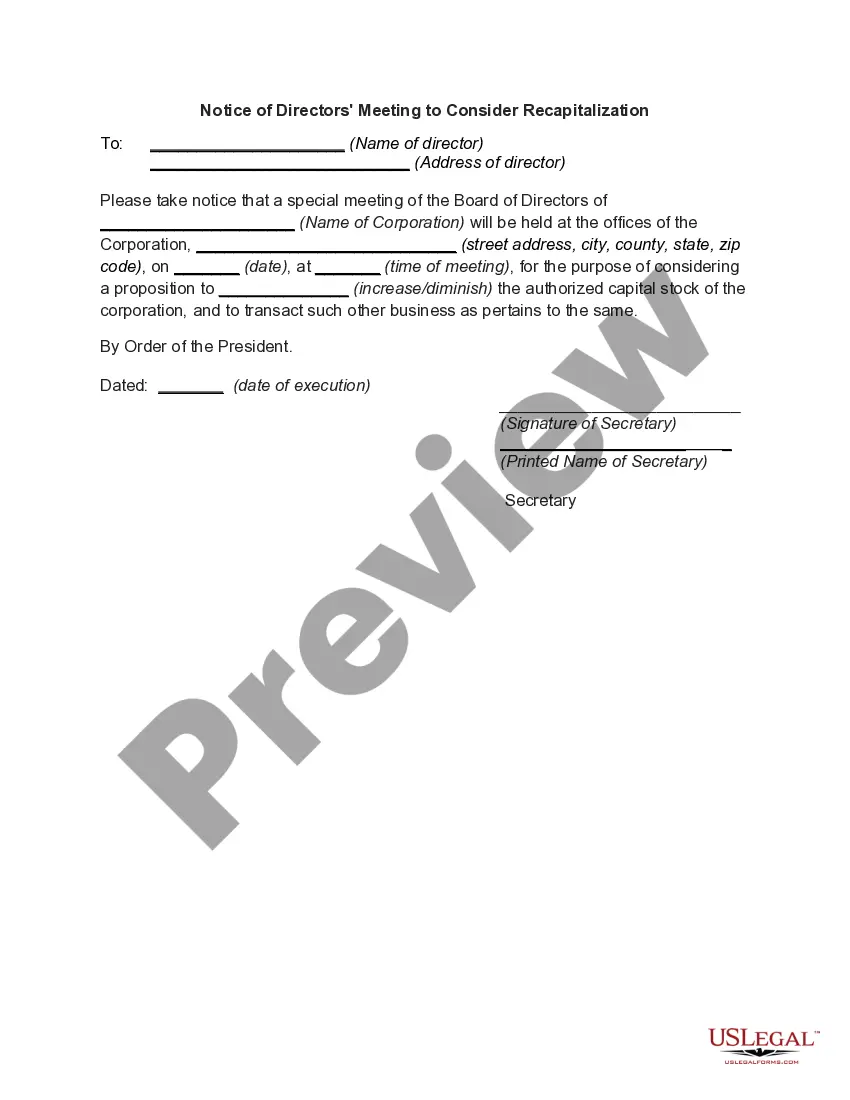

- Make sure you’ve found the correct document. Read the description and use the Preview feature, if available, to see if it fits your needs. If it doesn’t meet your criteria, utilize the Search tab above to discover the suitable one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and complete your payment. Use your credit card information or the PayPal option to finish the transaction.

- Receive your Miami Gardens Florida Living Trust for Husband and Wife with No Children. Choose the file format for your document and store it on your device.

- Finalize your document. Print it or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Creating a Miami Gardens Florida Living Trust for Husband and Wife with No Children can have some disadvantages. One major concern is the upfront costs, including legal fees, to establish the trust. Additionally, transferring your house into a trust may complicate mortgage arrangements or home equity loans. It's important to weigh these factors and consult with a professional to ensure that a trust aligns with your overall estate planning goals.

Placing your house in a trust can be a smart move for many Floridians, especially couples without children seeking a Miami Gardens Florida Living Trust for Husband and Wife with No Children. This strategy can streamline the transfer of ownership upon death, eliminating the probate process and providing more privacy for your estate. It's important to consider, though, how this move affects your property taxes and mortgage. Consulting with a professional can help ensure that you make the best choice for your situation.

While a living trust offers numerous benefits, such as avoiding probate, there are downsides to consider. The initial setup for a Miami Gardens Florida Living Trust for Husband and Wife with No Children can be complex and might involve higher legal fees than a simple will. Additionally, once established, you must actively manage and fund the trust to ensure it functions as intended. If assets are not transferred into the trust, you may still face probate for those items.

Creating separate living trusts can be beneficial for some couples, especially in the context of a Miami Gardens Florida Living Trust for Husband and Wife with No Children. Separate trusts allow each spouse to have control over their assets and to establish unique terms tailored to their individual wishes. This setup can provide clarity and simplify management if one spouse passes away or becomes incapacitated. However, many couples find that a joint trust offers more convenience and ease in managing shared assets.

In Florida, co-trustees are generally required to act together, which ensures that both parties have a say in the administration of the trust. However, it is possible to structure the Miami Gardens Florida Living Trust for Husband and Wife with No Children to allow for certain actions to be taken independently by one trustee. This flexibility can be beneficial, but it is essential to clearly outline these provisions in the trust document, ideally with legal assistance for clarity and compliance.

While you are not legally required to hire an attorney to create a trust in Florida, it is highly advisable, especially for a Miami Gardens Florida Living Trust for Husband and Wife with No Children. An attorney can provide crucial guidance, helping you navigate the legal intricacies and ensuring your trust aligns with your specific needs. Furthermore, having professional assistance can help you avoid common pitfalls, ultimately protecting your assets more effectively.

Yes, you can write your own living trust in Florida. When you create your Miami Gardens Florida Living Trust for Husband and Wife with No Children, you have the flexibility to outline the terms that best reflect your wishes. While it's possible to do this on your own, using a service like uslegalforms can provide peace of mind, ensuring you meet all legal requirements. It is wise to review your trust with a legal professional to avoid any pitfalls.

In Florida, a trust does not need to be filed with the court to be valid. This means you can create your Miami Gardens Florida Living Trust for Husband and Wife with No Children privately. However, if you want legal recognition for the trust, especially in matters of property distribution, consider working with an attorney to ensure everything is compliant. By keeping the trust private, you maintain more control over your assets without public disclosure.