Miramar Florida Living Trust for Husband and Wife with No Children

Description

How to fill out Florida Living Trust For Husband And Wife With No Children?

If you are looking for an authentic form, it’s challenging to discover a superior platform compared to the US Legal Forms website – likely the most extensive online collections.

With this collection, you can obtain a vast array of document examples for organizational and personal use by categories and regions, or keywords.

Through our sophisticated search feature, locating the most recent Miramar Florida Living Trust for Husband and Wife with No Children is as simple as 1-2-3.

Complete the payment transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Select the format and save it on your device. Edit as needed. Complete, modify, print, and sign the acquired Miramar Florida Living Trust for Husband and Wife with No Children.

- Furthermore, the accuracy of each document is verified by a team of expert attorneys who regularly review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to obtain the Miramar Florida Living Trust for Husband and Wife with No Children is to sign in to your account and select the Download option.

- If you are utilizing US Legal Forms for the first time, just follow the guidelines outlined below.

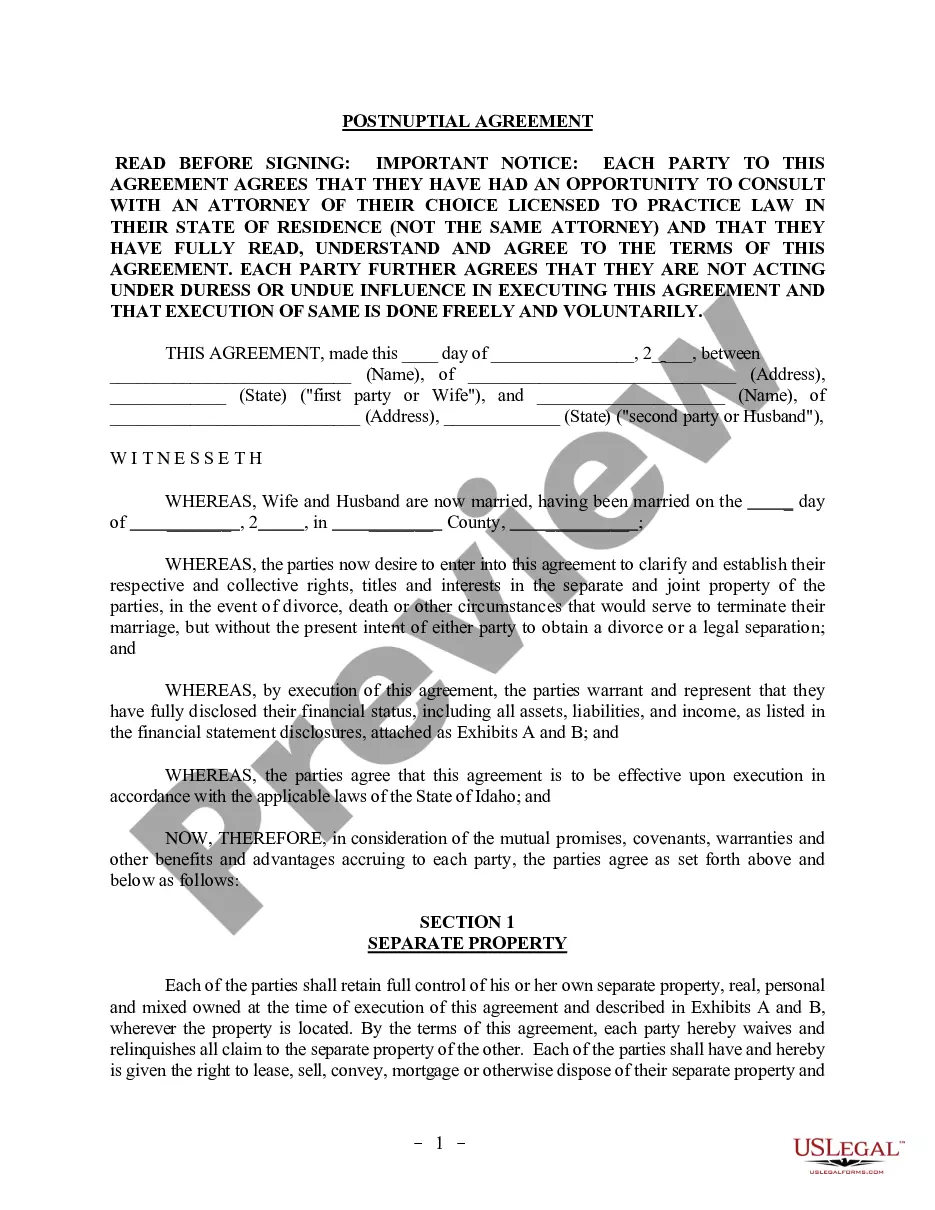

- Ensure that you have selected the form you desire. Review its details and use the Preview feature to view its contents. If it does not fulfill your needs, utilize the Search function at the top of the page to find the required form.

- Verify your decision. Choose the Buy now option. Afterward, select your preferred payment plan and provide the necessary information to set up an account.

Form popularity

FAQ

A Miramar Florida Living Trust for Husband and Wife with No Children is an ideal choice for married couples looking to manage their assets effectively. This trust not only allows for seamless management during their lifetimes but also provides clear guidance for asset distribution upon death. If privacy and avoiding probate are priorities, this type of trust delivers significant advantages. Utilizing platforms like uslegalforms can simplify the process of creating and managing such trusts.

Married couples often benefit from having a Miramar Florida Living Trust for Husband and Wife with No Children, which typically combines their assets into one trust. However, in certain situations, separate trusts may be beneficial, especially if there are significant individual assets or unique family dynamics. This separation can offer protection and individual control over personal assets. Ultimately, couples should assess their unique circumstances when deciding on the best approach.

For a married couple without children, a Miramar Florida Living Trust for Husband and Wife with No Children is often the best option. This type of trust allows both spouses to jointly control their assets while ensuring a smooth transfer of wealth upon death. It simplifies the estate settlement process and provides flexibility in managing assets during their lives. Consulting with an estate planning attorney can help customize the trust to meet specific needs.

You can certainly create your own living trust in Florida, as long as you follow the proper guidelines. A Miramar Florida Living Trust for Husband and Wife with No Children allows for straightforward management of shared assets. While DIY is possible, using platforms like UsLegalForms can simplify the process and ensure compliance with state laws. It's worth considering professional assistance for peace of mind and accuracy.

Yes, even a single person with no children can benefit from having a trust. A Miramar Florida Living Trust for Husband and Wife with No Children can help manage assets efficiently and specify beneficiaries according to your wishes. Plus, a trust can provide clear guidelines for asset distribution and reduce potential legal complications in the future. Exploring options that suit your needs is always advisable.

Yes, you can prepare your own living trust in Florida. However, it is essential to ensure that it meets all legal requirements. A well-structured Miramar Florida Living Trust for Husband and Wife with No Children can help protect your assets and ease the process for your loved ones. If you have doubts, consider using resources like UsLegalForms to navigate the complexities.

Even if you are married with no children, having a will remains important. It works alongside a Miramar Florida Living Trust for Husband and Wife with No Children, ensuring that all your wishes regarding asset distribution are formalized. A will can also designate guardianship for any pets or other dependents. In conjunction, these documents create a comprehensive estate plan that protects your interests.

In a marriage, a trust can be a powerful tool for managing assets effectively. Establishing a Miramar Florida Living Trust for Husband and Wife with No Children allows couples to create clear directives for their assets, reducing uncertainty and conflict in the event of a spouse's passing. While a trust is not mandatory, it often simplifies estate planning and ensures that both partners' wishes are respected.

While many couples benefit from a trust, some may choose not to establish one due to costs or perceived complexity. A Miramar Florida Living Trust for Husband and Wife with No Children may seem unnecessary if assets are minimal or easily transferred without a formal trust. However, couples need to assess their specific situations and long-term plans carefully, considering the potential advantages a trust can offer in asset protection and management.

While this question specifically concerns parents, it's essential to acknowledge that similar mistakes can occur for couples without children. One common oversight is failing to update the Miramar Florida Living Trust for Husband and Wife with No Children after significant life changes. Regularly reviewing and adjusting trust provisions ensures that it aligns with current wishes and circumstances. Couples often overlook this critical aspect, potentially leading to complications later.