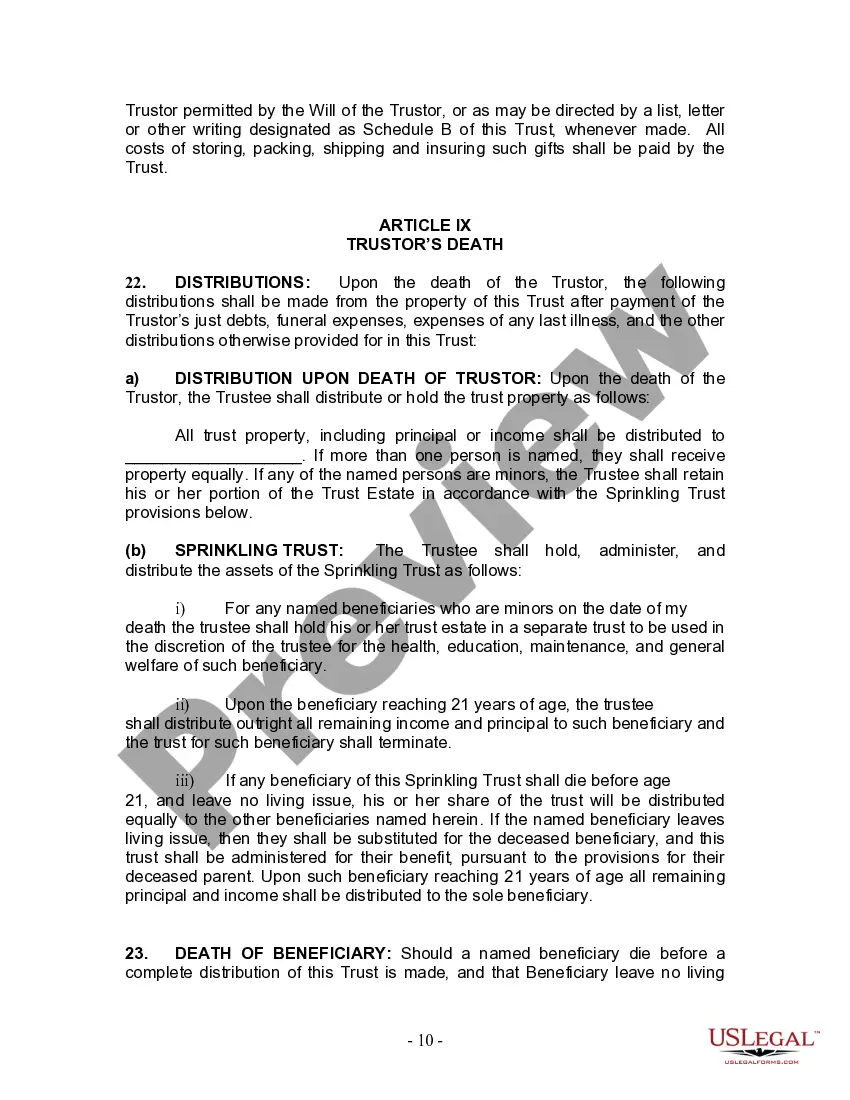

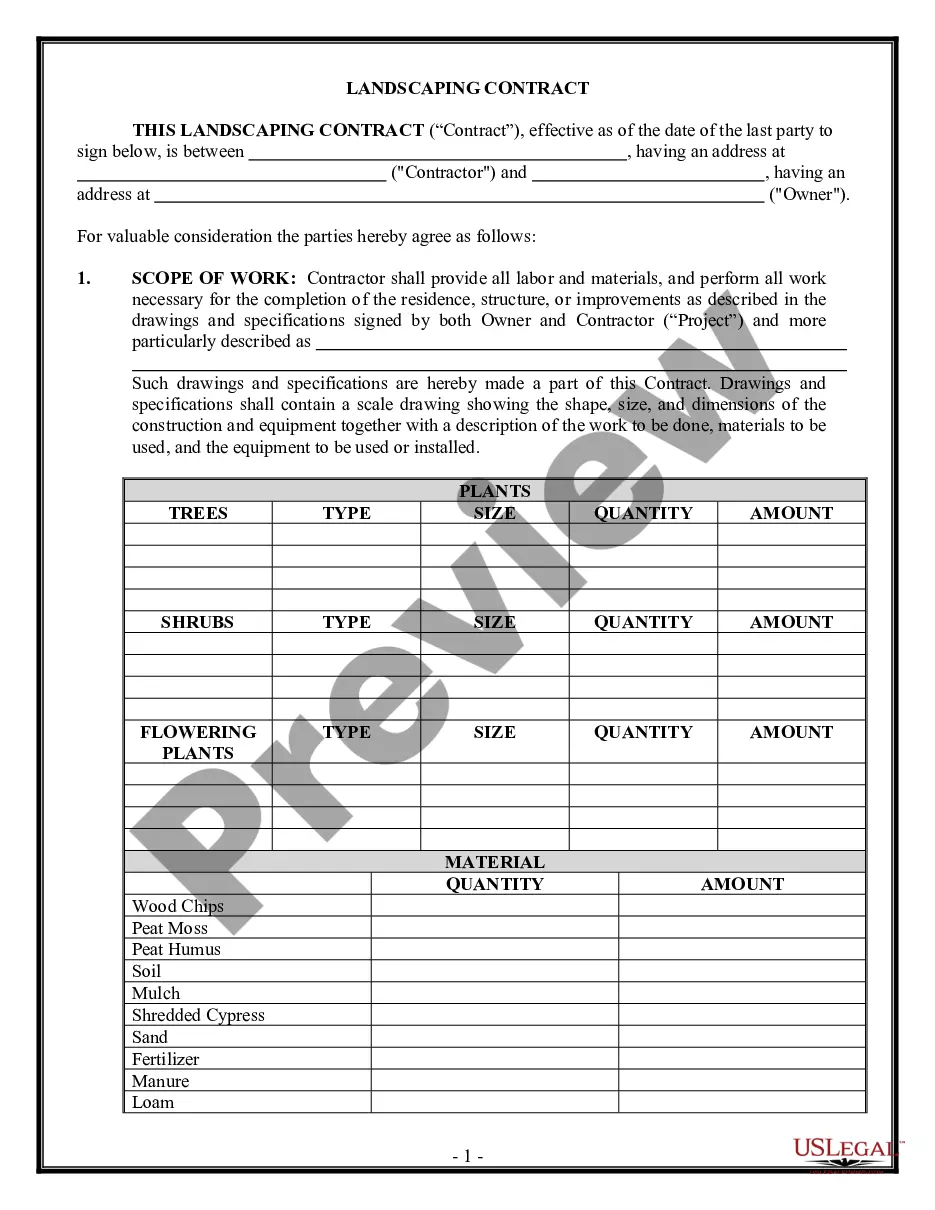

Keywords: Hollywood Florida, living trust, single individual, divorced individual, widow or widower, no children Description: A Hollywood Florida Living Trust for individuals who are single, divorced, widowed, or widower with no children is an estate planning tool designed to provide financial security and ensure the proper distribution of assets for those in such circumstances. Living trusts are legal documents that allow individuals to control and protect their assets during their lifetime and direct their distribution upon their death, without the need for probate. There are several types of living trusts available in Hollywood, Florida, catering to the unique needs of single, divorced, or widowed individuals with no children. Here are some common types: 1. Revocable Living Trust: A revocable living trust allows the individual (known as the granter) to maintain full control over their assets. It can be changed, modified, or revoked at any time during the granter's lifetime. In the event of disability or death, the trust assets are seamlessly transferred to the designated beneficiaries without the requirement of a court-supervised probate process. 2. Irrevocable Living Trust: An irrevocable living trust is a legal arrangement where the granter transfers ownership of assets to the trust, relinquishing control. Once established, it cannot be changed or revoked without the consent of the beneficiaries. This type of trust offers advantages like reduced estate taxes and protection against creditors. 3. Testamentary Trust: A testamentary trust is created through a will and becomes effective upon the death of the individual. It allows the granter to designate specific assets to be distributed to intended beneficiaries, such as family, friends, charities, or organizations. This type of trust is often used by individuals who are single, divorced, or widowed with no children to ensure their assets are distributed according to their wishes. 4. Special Needs Trust: A special needs trust is designed to provide for the financial needs of a disabled individual, while still allowing them to qualify for government benefits. If an individual is single, divorced, or widowed with no children but has a disabled family member or loved one, they may choose to establish a special needs trust within their Hollywood Florida living trust to ensure the disabled person's ongoing care and support. Regardless of the type of trust chosen, individuals who are single, divorced, widowed, or widower with no children can benefit from a Hollywood Florida Living Trust. It provides peace of mind by ensuring their assets are protected, properly managed, and distributed according to their wishes, while also potentially minimizing estate taxes and avoiding the time-consuming probate process. It is advisable to consult with an experienced estate planning attorney in Hollywood, Florida to determine the most suitable type of living trust based on individual circumstances and goals.

Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

How to fill out Hollywood Florida Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children?

Are you looking for a reliable and inexpensive legal forms provider to buy the Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children? US Legal Forms is your go-to solution.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of specific state and area.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the document is intended for.

- Start the search over in case the form isn’t good for your legal situation.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is completed, download the Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children in any available file format. You can return to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal paperwork online for good.