A Tallahassee Florida Living Trust for Husband and Wife with One Child, also known as a revocable living trust, is a legal document that allows a couple to manage and protect their assets during their lifetime and provide for the distribution of their estate after their passing. This type of trust offers various benefits, including probate avoidance, increased privacy, asset protection, and ease of asset management. Firstly, let's explore the process of setting up a Tallahassee Florida Living Trust for Husband and Wife with One Child. To establish this trust, the couple must begin by creating a comprehensive trust agreement. This agreement outlines the terms and conditions that will govern the trust, such as the appointed trustee(s), successor trustee(s), and beneficiaries. Additionally, the couple will need to legally transfer their assets, such as bank accounts, real estate, investments, and personal property, into the trust's name. By creating a Tallahassee Florida Living Trust, couples can ensure their assets are managed and protected during their lifetime, even if one spouse becomes incapacitated. The trust allows for seamless decision-making and asset management, as the appointed trustee(s) can step in and take control should one spouse be unable to do so. This provision ensures that the couple's financial affairs are handled according to their wishes and without the need for court intervention. Another significant advantage of a Tallahassee Florida Living Trust for Husband and Wife with One Child is the ability to avoid probate and its associated costs and delays. Probate is the legal process where a court oversees the distribution of a deceased person's assets. By placing assets within the trust, the couple's estate can pass directly to their child, bypassing probate entirely. This process enables a quicker and more efficient transfer of assets, preserving the value of the estate and avoiding potential disputes among family members. Privacy is an essential factor for many families when it comes to their estate planning. Unlike a will, which becomes a public record once probated, a living trust remains private. This means that the couple's financial information, beneficiary details, and asset distribution plans remain confidential. This aspect can be particularly important for those who prefer to keep their financial affairs private and protect their loved ones from attracting unwanted attention. Furthermore, a Tallahassee Florida Living Trust offers additional asset protection benefits. By holding assets within the trust, they are shielded from potential creditors, lawsuits, or other legal actions. This protection can be beneficial for families looking to safeguard their assets, especially in situations where one or both spouses may have unique financial risks, such as business ownership or professional liability. In summary, a Tallahassee Florida Living Trust for Husband and Wife with One Child is a versatile estate planning tool that provides numerous advantages, including probate avoidance, increased privacy, asset protection, and ease of asset management. Moreover, this type of trust ensures that the couple's assets are efficiently managed during their lifetime and transferred to their child without unnecessary delays or court involvement. While there may not be specifically named different types of Tallahassee Florida Living Trusts for Husband and Wife with One Child, there are variations within the trust agreement itself that can be customized to fit the unique needs of each couple. These variances may include specific provisions for asset distribution, asset management during incapacity, and additional instructions regarding the care and support of the child. Overall, a Tallahassee Florida Living Trust for Husband and Wife with One Child serves as a comprehensive and flexible estate planning tool that enables couples to protect and manage their assets effectively while ensuring a smooth transition to their child.

Tallahassee Florida Living Trust for Husband and Wife with One Child

Description

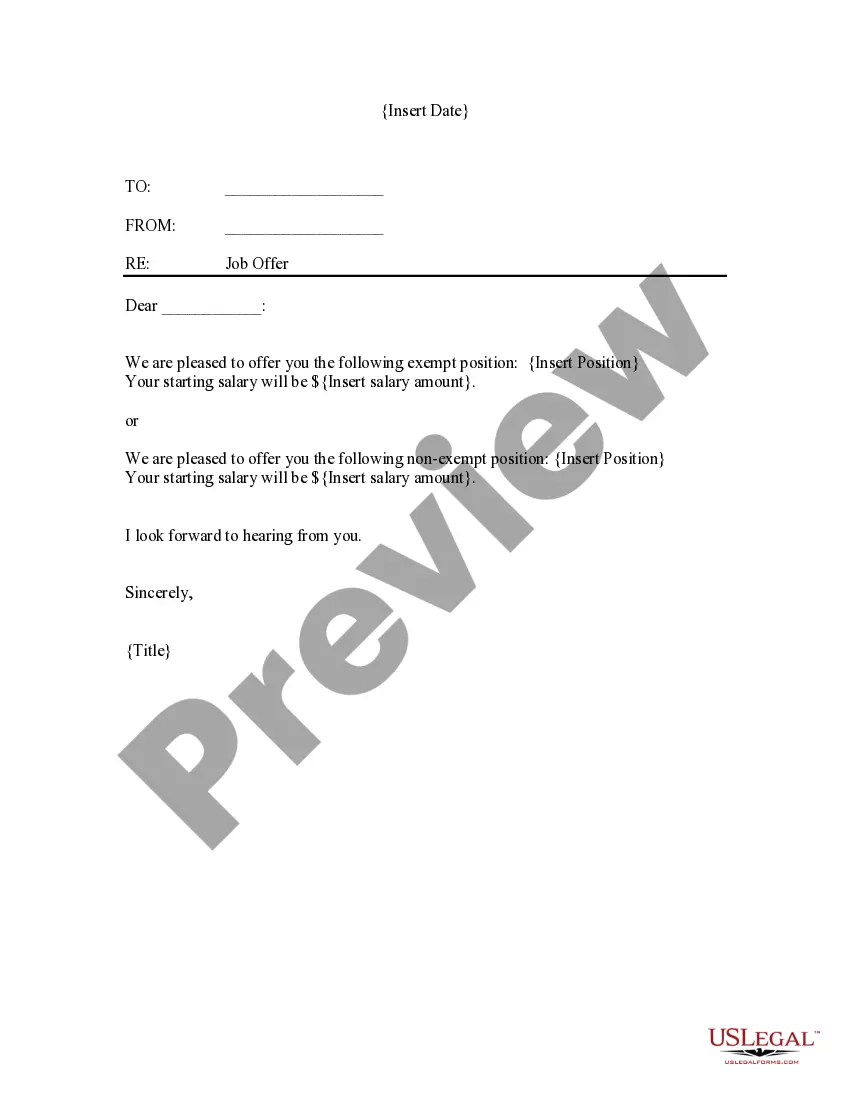

How to fill out Tallahassee Florida Living Trust For Husband And Wife With One Child?

Benefit from the US Legal Forms and get instant access to any form template you require. Our useful website with a huge number of document templates makes it easy to find and get virtually any document sample you want. You can save, fill, and sign the Tallahassee Florida Living Trust for Husband and Wife with One Child in just a matter of minutes instead of surfing the Net for several hours seeking a proper template.

Utilizing our library is a great strategy to improve the safety of your document filing. Our experienced lawyers on a regular basis check all the documents to make certain that the templates are relevant for a particular state and compliant with new laws and regulations.

How can you obtain the Tallahassee Florida Living Trust for Husband and Wife with One Child? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. Furthermore, you can find all the previously saved documents in the My Forms menu.

If you haven’t registered an account yet, follow the tips listed below:

- Find the template you need. Ensure that it is the template you were seeking: examine its title and description, and make use of the Preview function if it is available. Otherwise, use the Search field to find the needed one.

- Start the saving procedure. Select Buy Now and select the pricing plan you like. Then, create an account and process your order with a credit card or PayPal.

- Export the file. Select the format to get the Tallahassee Florida Living Trust for Husband and Wife with One Child and modify and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy document libraries on the internet. Our company is always happy to help you in any legal procedure, even if it is just downloading the Tallahassee Florida Living Trust for Husband and Wife with One Child.

Feel free to take advantage of our service and make your document experience as straightforward as possible!