Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children

Description

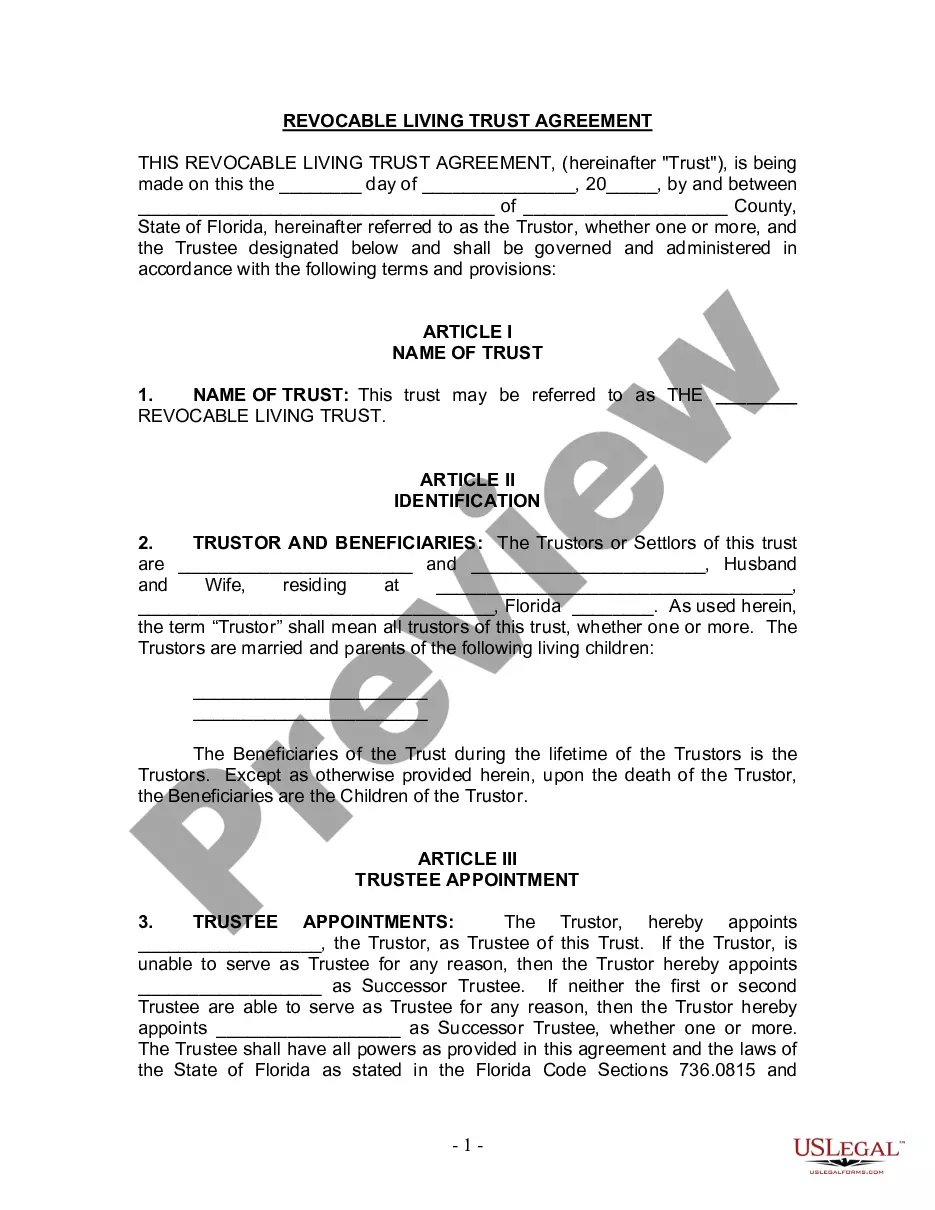

How to fill out Florida Living Trust For Husband And Wife With Minor And Or Adult Children?

If you are looking for a legitimate document, it’s impossible to select a more suitable service than the US Legal Forms website – likely the most comprehensive online libraries.

With this collection, you can acquire a vast number of document samples for corporate and personal uses by categories and locations, or keywords.

Utilizing our improved search feature, obtaining the most recent Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children is as simple as 1-2-3.

Download the document. Select the format and save it to your device.

Make adjustments. Fill in, alter, print, and sign the obtained Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children.

- If you are already familiar with our platform and have an account, all you need to access the Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children is to Log In and click the Download option.

- If you are using US Legal Forms for the first time, just follow the instructions listed below.

- Ensure you have selected the form you need. Review its description and use the Preview feature to verify its content. If it doesn’t meet your requirements, utilize the Search box at the top of the page to locate the appropriate document.

- Validate your choice. Choose the Buy now button. After that, select your preferred pricing plan and provide your information to create an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

While it is possible to set up a trust without an attorney in Florida, using a professional can simplify the process significantly. For those considering a Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children, a knowledgeable attorney can provide essential guidance tailored to your family's needs. Additionally, platforms like uslegalforms offer resources that can assist you in creating your trust legally and effectively, reducing the risk of mistakes that could complicate the administration later.

In Florida, a marriage does not automatically override a trust, including a Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children. However, if one spouse created the trust before marriage, the other spouse may not have automatic rights to the assets. It is crucial for couples to review their estate plans after marriage to ensure that both partners' priorities and assets are reflected. Regular updates can help prevent misunderstandings and ensure that your trust meets your family needs.

You do not actually file a living trust in Florida, as it does not require court approval. Instead, focus on retitling your assets into the name of the trust to ensure they are managed according to your wishes. This is particularly important for a Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children, where asset management can greatly benefit your heirs.

Yes, you can prepare your own living trust in Florida using online resources or legal forms. However, it is crucial to follow the legal requirements accurately to prevent future disputes regarding your Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children. Utilizing uslegalforms can simplify this process, offering templates that comply with Florida's legal standards.

You do not need to register a living trust in Florida, as it operates outside of the court system. Simply ensure that all trust assets are properly transferred to the trust, which may involve changing titles and deeds. For a thorough process with your Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children, consider using resources from uslegalforms.

While it is not required to hire an attorney to prepare a living trust in Florida, consulting with one is highly beneficial. An attorney can ensure that your Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children is set up correctly, reflecting your wishes and adhering to state laws. An expert can also provide guidance tailored to your family's unique situation.

In Florida, a living trust does not need to be recorded. Instead, the trust document is retained privately by the trustee or the individuals involved. This can be advantageous for maintaining privacy regarding your assets, particularly with a Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children.

To obtain a living trust in Florida, start by defining your needs and goals. You can create a Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children through a qualified attorney, or you may use online platforms like uslegalforms. This approach simplifies the process and ensures your trust is compliant with Florida laws. Taking this step is essential for safeguarding your family's future.

Yes, you can write your own living trust in Florida. However, drafting a Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children can be complex. Many choose to consult a legal expert or use an online service to ensure the trust is legally valid and meets specific needs. This step can provide peace of mind for you and your family.

The greatest mistake parents often make is not discussing plans with their children before establishing the trust. Open communication can prevent misunderstandings and ensure that everyone understands the purpose and terms of the Cape Coral Florida Living Trust for Husband and Wife with Minor and or Adult Children. It promotes family harmony and clarity that can last for generations.