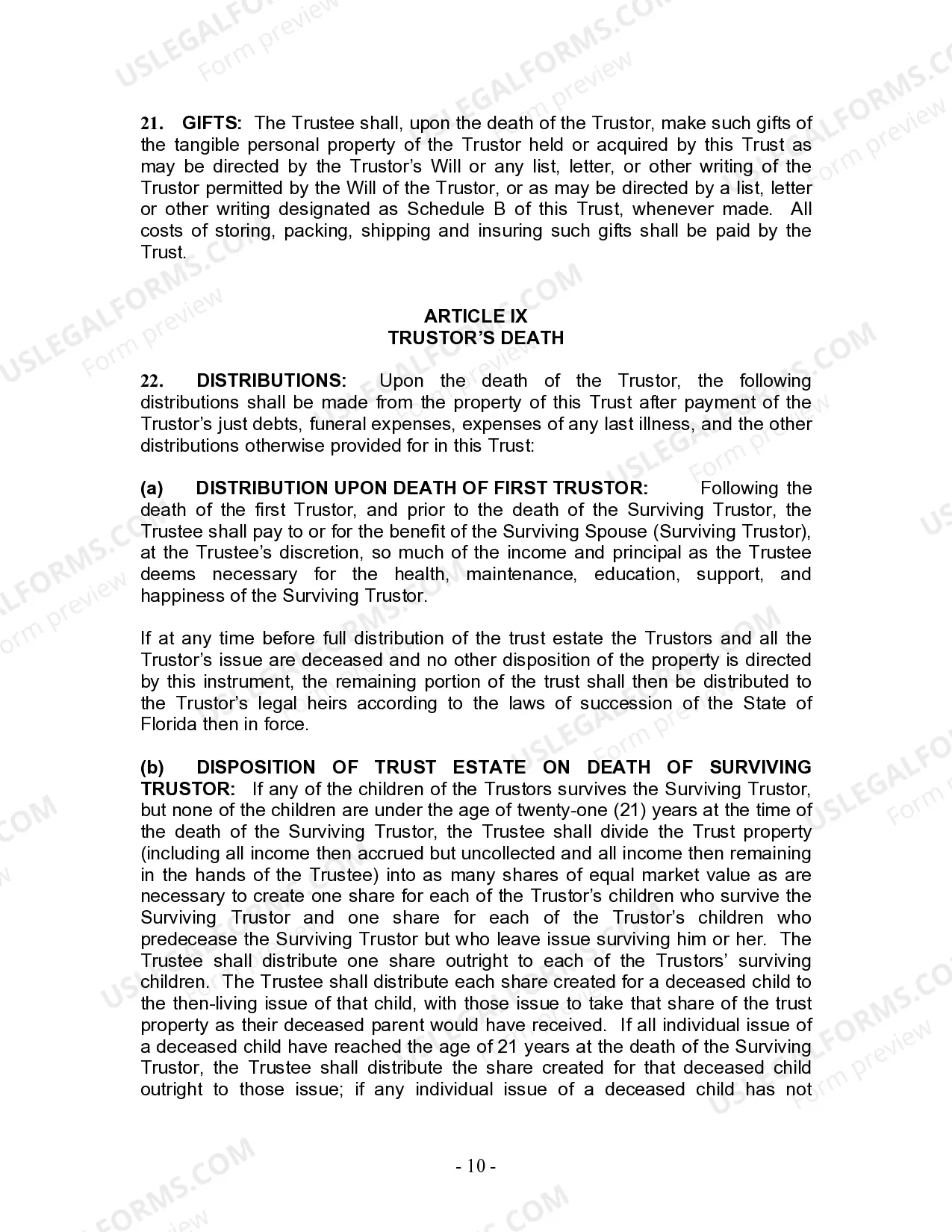

A Tampa Florida Living Trust for Husband and Wife with Minor and/or Adult Children is an estate planning tool designed specifically for spouses who want to ensure the seamless transfer of their assets to their children while minimizing probate costs and taxes. This legal document sets forth the guidelines for the management and distribution of their assets both during their lifetimes and after their passing. By creating a living trust, couples can retain control over their assets while providing for the financial security of their minor and/or adult children. Here are some different types of Tampa Florida Living Trusts that may suit the unique needs of a Husband and Wife with Minor and/or Adult Children: 1. Revocable Living Trust: This type of trust is flexible and allows the couple to make changes or revoke the trust during their lifetime. It offers control over assets, avoids probate, and ensures a smooth transfer of assets to beneficiaries. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be modified or revoked once established. It provides enhanced asset protection from creditors, minimizes estate taxes, and facilitates long-term wealth preservation. 3. Testamentary Trust: This trust is established within a will and becomes effective upon the death of the surviving spouse. It is commonly used when there are minor children involved and allows for the appointment of a trustee to manage the assets until the children reach a specific age or milestone. 4. Special Needs Trust: A special needs trust is designed to provide financial support to a disabled child without jeopardizing their eligibility for government benefits. It ensures that the child's needs are met while protecting their Supplemental Security Income (SSI) and Medicaid benefits. 5. Education Trust: This type of trust is specifically designed to ensure that funds are available to cover educational expenses for children and grandchildren. It provides a dedicated source of funding for school tuition, books, and other related expenses. 6. Charitable Remainder Trust: In cases where a couple wishes to leave a portion of their estate to a charitable cause, a charitable remainder trust allows them to do so while providing income to their surviving spouse or children during their lifetimes. Creating a Tampa Florida Living Trust for Husband and Wife with Minor and/or Adult Children ensures that your assets are protected, your wishes are respected, and your loved ones are provided for in a manner that aligns with your goals and intentions. It is advisable to consult an experienced estate planning attorney in Tampa to understand the specific legal requirements and tailor the trust to your unique circumstances.

Tampa Florida Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Tampa Florida Living Trust For Husband And Wife With Minor And Or Adult Children?

If you are looking for a valid form, it’s impossible to find a more convenient service than the US Legal Forms site – probably the most considerable online libraries. Here you can find a huge number of document samples for business and personal purposes by categories and states, or keywords. With the high-quality search function, getting the most up-to-date Tampa Florida Living Trust for Husband and Wife with Minor and or Adult Children is as easy as 1-2-3. Additionally, the relevance of each file is confirmed by a team of expert lawyers that on a regular basis review the templates on our platform and update them in accordance with the most recent state and county requirements.

If you already know about our system and have a registered account, all you should do to get the Tampa Florida Living Trust for Husband and Wife with Minor and or Adult Children is to log in to your account and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have found the sample you need. Look at its explanation and utilize the Preview option (if available) to see its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to discover the proper record.

- Confirm your decision. Select the Buy now button. Next, select your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Indicate the format and download it on your device.

- Make changes. Fill out, modify, print, and sign the acquired Tampa Florida Living Trust for Husband and Wife with Minor and or Adult Children.

Each and every form you add to your account has no expiration date and is yours forever. It is possible to gain access to them using the My Forms menu, so if you want to receive an extra duplicate for enhancing or creating a hard copy, you can come back and export it once again at any time.

Make use of the US Legal Forms professional library to get access to the Tampa Florida Living Trust for Husband and Wife with Minor and or Adult Children you were seeking and a huge number of other professional and state-specific templates on a single platform!