The Miami-Dade Florida Amendment to Living Trust is an important legal document that enables trust creators (also known as granters or settlers) to make changes to their existing living trust. This amendment is designed to provide flexibility and meet the evolving needs of granters, ensuring that their intentions are accurately reflected in their estate plans. By amending a living trust, individuals residing in Miami-Dade County, Florida, can make revisions or additions to various aspects of their trust, such as beneficiaries, trustees, assets, or even the distribution of assets. These changes may be necessary due to a variety of reasons, including changes in personal circumstances, preferences, or changes in tax laws. The Miami-Dade Florida Amendment to Living Trust is highly customizable, allowing granters to tailor their trust to their specific requirements. This document is crucial for ensuring that their assets are protected and allocated according to their wishes. Different types of Miami-Dade Florida Amendments to Living Trust may include: 1. Beneficiary Amendment: Granters may wish to add, remove, or modify the beneficiaries designated in their living trust. This amendment ensures that their loved ones or charitable organizations are correctly designated and receive the intended benefits. 2. Trustee Amendment: This amendment allows granters to make changes to the individuals or entities appointed as trustees responsible for managing the trust assets and carrying out the granter's wishes. Granters may appoint successor trustees in case the original trustee is unable or unwilling to fulfill their role. 3. Asset Amendment: Granters may want to add or remove specific assets from their living trust. This amendment allows for the adjustment of assets held within the trust, ensuring that the appropriate estate planning strategies are applied for each asset. 4. Distribution Amendment: Granters may modify how their assets are distributed among beneficiaries or change the terms and conditions for the distribution of assets. This amendment ensures that the assets are distributed in line with the granter's latest wishes. When considering a Miami-Dade Florida Amendment to Living Trust, it is advisable to consult an experienced estate planning attorney who specializes in trust law. They can provide legal guidance, ensure compliance with local laws, and assist in customizing the amendment to meet the granter's specific needs. Remember, making amendments to a living trust should be done carefully and with expert advice to ensure the trust amendment aligns with the granter's overall estate planning goals.

Miami-Dade Florida Amendment to Living Trust

Description

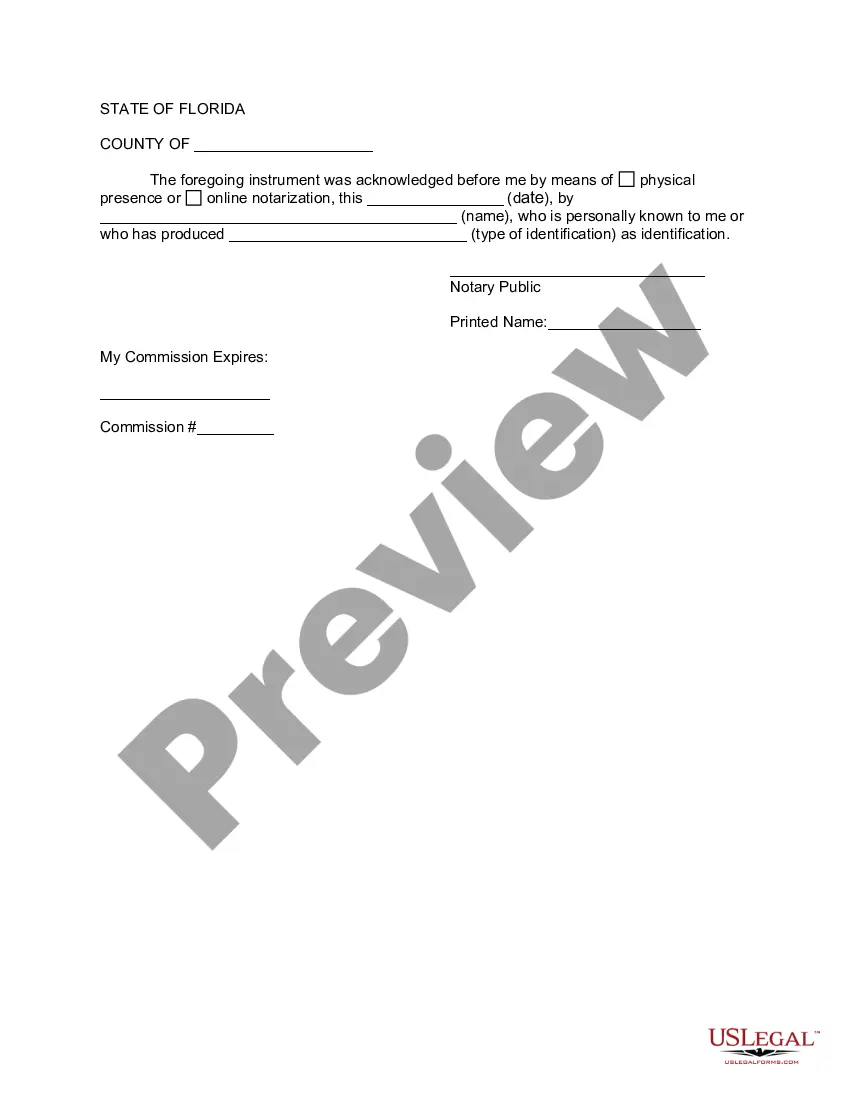

How to fill out Miami-Dade Florida Amendment To Living Trust?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone with no law education to draft this sort of paperwork cfrom the ground up, mainly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms can save the day. Our service provides a massive collection with more than 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you want the Miami-Dade Florida Amendment to Living Trust or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Miami-Dade Florida Amendment to Living Trust in minutes using our reliable service. If you are already a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, if you are a novice to our platform, ensure that you follow these steps prior to downloading the Miami-Dade Florida Amendment to Living Trust:

- Be sure the form you have chosen is good for your location because the regulations of one state or area do not work for another state or area.

- Preview the form and go through a quick outline (if provided) of scenarios the document can be used for.

- If the form you selected doesn’t meet your needs, you can start again and search for the needed document.

- Click Buy now and choose the subscription plan you prefer the best.

- utilizing your login information or create one from scratch.

- Select the payment gateway and proceed to download the Miami-Dade Florida Amendment to Living Trust once the payment is through.

You’re all set! Now you can proceed to print out the form or complete it online. If you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.