Coral Springs Florida Living Trust Property Record is an essential document that plays a crucial role in estate planning and property ownership in the city of Coral Springs, Florida. This detailed description will outline what exactly this record entails and provide relevant keywords. A living trust, also known as an inter vivos trust, is a legal entity that holds ownership of assets, including real estate, on behalf of beneficiaries during the settler's lifetime and upon their death. The creation of a living trust allows individuals to have more control over the distribution of their assets and provides several benefits, such as avoiding probate and maintaining privacy. In the context of Coral Springs, Florida, individuals who establish a living trust to manage their real estate properties need to maintain a detailed Coral Springs Florida Living Trust Property Record. This record contains pertinent information related to the trust-owned properties within the city limits. The Coral Springs Florida Living Trust Property Record typically includes the following details: 1. Property Description: This includes the address, legal description, and any other pertinent information that uniquely identifies the property. 2. Trustee Information: The name, contact details, and role of the trustee(s) responsible for managing the trust and its property. 3. Trust Document Details: Information regarding the living trust document, such as the date of creation and any subsequent amendments that affect the ownership and control of the property. 4. Beneficiary Information: The names and contact details of the individuals or entities designated as beneficiaries who are entitled to benefit from the trust-owned property. 5. Tax Information: Any tax-related details, such as property tax identification numbers, tax assessments, and exemptions applicable to the trust property. 6. Encumbrances and Liens: Details of any mortgages, liens, or other financial encumbrances that may affect the trust-owned property. It's important to note that there are no distinct types of Coral Springs Florida Living Trust Property Records. However, variations may exist depending on the intricacies of the trust arrangement, such as shared living trusts where multiple properties are involved, commercial properties held within a trust, or trusts with specific conditions or restrictions on property usage. Overall, the Coral Springs Florida Living Trust Property Record serves as a comprehensive record-keeping tool for individuals who have established a living trust to manage their property in the city. It ensures smooth administration, effective property management, and the proper transfer of assets in accordance with the settler's wishes.

Coral Springs Florida Living Trust Property Record

Category:

State:

Florida

City:

Coral Springs

Control #:

FL-E0178B

Format:

Word

Instant download

Description

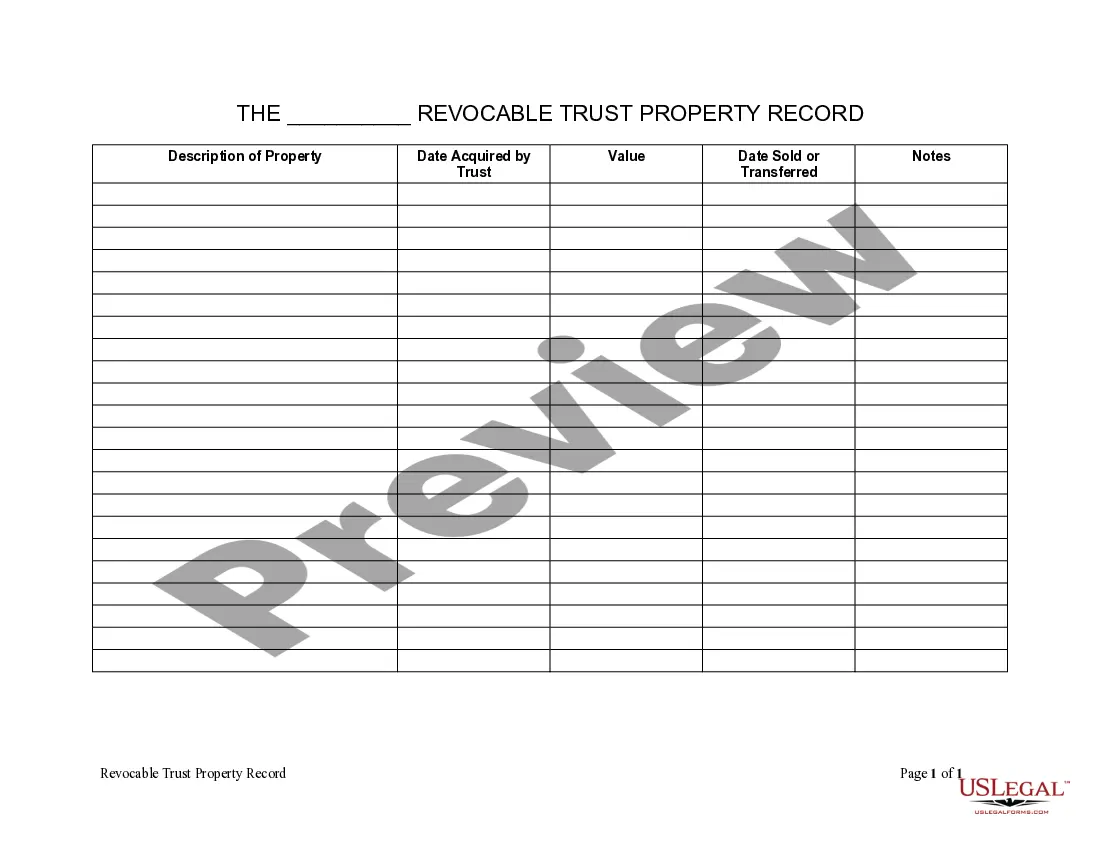

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Coral Springs Florida Living Trust Property Record is an essential document that plays a crucial role in estate planning and property ownership in the city of Coral Springs, Florida. This detailed description will outline what exactly this record entails and provide relevant keywords. A living trust, also known as an inter vivos trust, is a legal entity that holds ownership of assets, including real estate, on behalf of beneficiaries during the settler's lifetime and upon their death. The creation of a living trust allows individuals to have more control over the distribution of their assets and provides several benefits, such as avoiding probate and maintaining privacy. In the context of Coral Springs, Florida, individuals who establish a living trust to manage their real estate properties need to maintain a detailed Coral Springs Florida Living Trust Property Record. This record contains pertinent information related to the trust-owned properties within the city limits. The Coral Springs Florida Living Trust Property Record typically includes the following details: 1. Property Description: This includes the address, legal description, and any other pertinent information that uniquely identifies the property. 2. Trustee Information: The name, contact details, and role of the trustee(s) responsible for managing the trust and its property. 3. Trust Document Details: Information regarding the living trust document, such as the date of creation and any subsequent amendments that affect the ownership and control of the property. 4. Beneficiary Information: The names and contact details of the individuals or entities designated as beneficiaries who are entitled to benefit from the trust-owned property. 5. Tax Information: Any tax-related details, such as property tax identification numbers, tax assessments, and exemptions applicable to the trust property. 6. Encumbrances and Liens: Details of any mortgages, liens, or other financial encumbrances that may affect the trust-owned property. It's important to note that there are no distinct types of Coral Springs Florida Living Trust Property Records. However, variations may exist depending on the intricacies of the trust arrangement, such as shared living trusts where multiple properties are involved, commercial properties held within a trust, or trusts with specific conditions or restrictions on property usage. Overall, the Coral Springs Florida Living Trust Property Record serves as a comprehensive record-keeping tool for individuals who have established a living trust to manage their property in the city. It ensures smooth administration, effective property management, and the proper transfer of assets in accordance with the settler's wishes.

How to fill out Coral Springs Florida Living Trust Property Record?

If you’ve already utilized our service before, log in to your account and save the Coral Springs Florida Living Trust Property Record on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make certain you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Coral Springs Florida Living Trust Property Record. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!