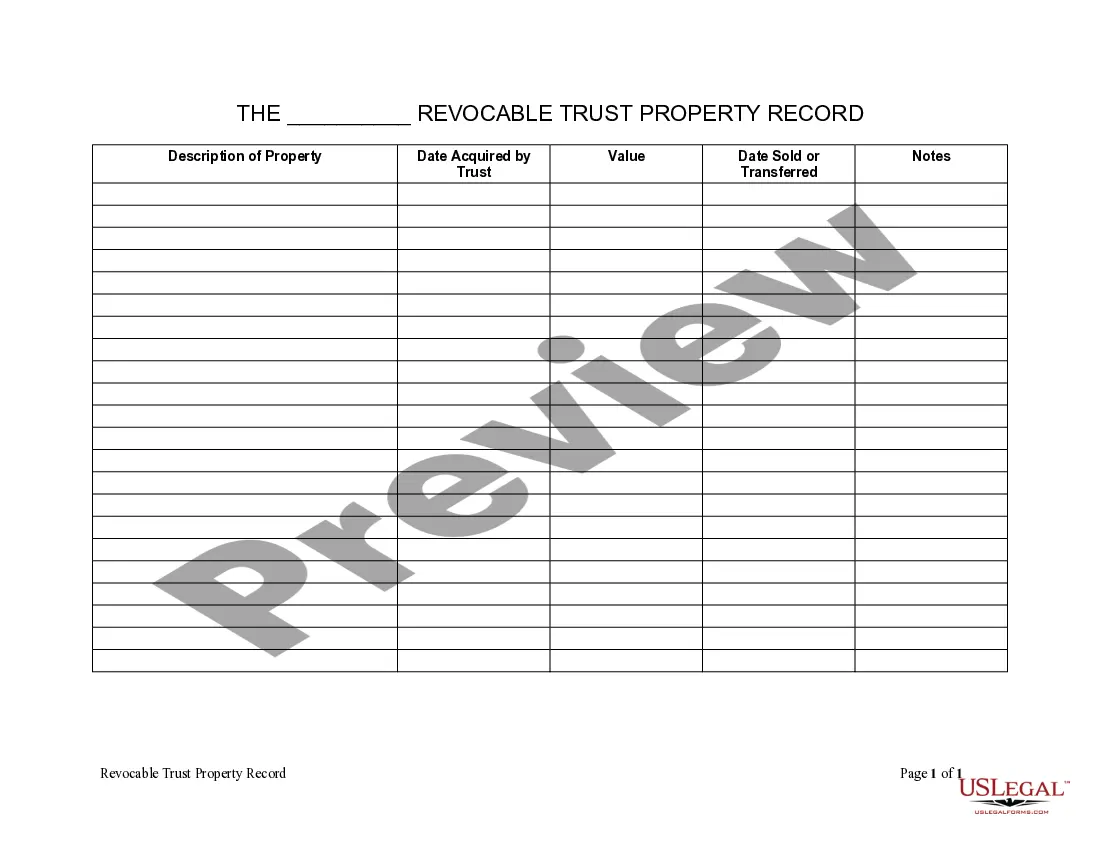

Orlando Florida Living Trust Property Record is a comprehensive documentation system that records ownership and legal information for properties held in living trusts within the city of Orlando, Florida. This record ensures the proper management and transfer of assets to beneficiaries while avoiding the time-consuming and costly probate process. One type of Orlando Florida Living Trust Property Record is the Revocable Living Trust Property Record. This record is established during the property owner's lifetime and can be modified or revoked at any time. It allows individuals to maintain control over their assets while providing designated beneficiaries with a seamless transfer of property upon their passing. Another type is the Irrevocable Living Trust Property Record. Once established, this record cannot be changed or terminated without the consent of all involved parties. Irrevocable trusts offer potential tax benefits and asset protection but require careful consideration and consultation with legal professionals. The Orlando Florida Living Trust Property Record provides crucial details, such as the property owner's name, the trust name, and the legal description of the property. It also includes information on any liens, mortgages, or encumbrances that may exist on the property, ensuring transparency and clarity in ownership. By maintaining a Living Trust Property Record, property owners in Orlando, Florida, can safeguard their assets, plan for the future, and mitigate potential disputes among beneficiaries. This record serves as a valuable resource for estate planning attorneys, real estate professionals, and other individuals involved in the management and transfer of trust-owned properties. Keywords: Orlando Florida, Living Trust, Property Record, Revocable Living Trust, Irrevocable Living Trust, property ownership, legal description, beneficiaries, probate process, asset transfer, estate planning, tax benefits, asset protection.

Orlando Florida Living Trust Property Record

Description

How to fill out Florida Living Trust Property Record?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our user-friendly website featuring a vast array of documents simplifies the process of locating and acquiring nearly any document template you require.

You can download, complete, and sign the Orlando Florida Living Trust Property Record in mere moments rather than spending hours online trying to find a suitable template.

Using our catalog is an excellent method to enhance the security of your form submissions.

If you do not yet have an account, follow the steps provided below.

Access the page containing the template you require. Verify that it is indeed the template you were searching for: confirm its title and description, and utilize the Preview feature if it is accessible. If not, use the Search field to locate the correct one.

- Our skilled attorneys routinely review all records to confirm that the forms are suitable for a specific jurisdiction and adhere to new laws and regulations.

- How do you access the Orlando Florida Living Trust Property Record.

- If you have an account, simply Log In.

- The Download button will be activated on all documents you view.

- Additionally, you can retrieve all previously saved documents from the My documents section.

Form popularity

FAQ

Filling out a certificate of trust involves several key steps. First, you need to identify the name of the trust and the trustee, ensuring the information matches what's in your Orlando Florida Living Trust Property Record. Next, you should outline the powers granted to the trustee, including their rights to manage and distribute the trust property. Finally, after completing the form, make sure to sign it in front of a notary, which validates the document and solidifies your trust’s authority in Florida.

In Florida, a reassessment can be triggered by changes in property ownership, substantial renovations, or changes to the property itself. If you transfer property into a trust, it may also lead to reassessment depending on how the trust is structured. For those focused on an Orlando Florida Living Trust Property Record, understanding these triggers can help you plan effectively. Consulting a legal expert can assist you in making informed decisions.

Typically, a land trust is not recorded in Florida, as it is considered a private matter. However, any property transactions related to the land trust will be recorded in the public property records. For managing an Orlando Florida Living Trust Property Record, knowing the implications of this can be important. Seeking advice from legal services can ensure you meet all necessary requirements.

Generally, transferring property into a trust may or may not trigger reassessment in Florida. The circumstances surrounding the transfer often determine this outcome. For those managing an Orlando Florida Living Trust Property Record, it's prudent to consult with a professional to understand potential tax implications. This approach will help you make informed decisions that protect your assets.

To avoid property tax reassessment in Florida, consider strategies like using a trust or maintaining the same ownership structure. Also, if property is transferred to a trust, it may qualify for tax benefits under specific conditions. Understanding your options regarding an Orlando Florida Living Trust Property Record is essential. Legal guidance can help you navigate these regulations effectively.

Yes, a trust can protect assets in Florida. By placing assets in a trust, you can shield them from probate and, in some cases, creditors. For an Orlando Florida Living Trust Property Record, this means that your estate can be managed according to your wishes without unnecessary delays. Engaging a legal service can ensure that your trust is set up correctly.

In Florida, a land trust does not need to be recorded to be valid. However, recording a land trust can provide an added layer of protection and transparency. For those managing an Orlando Florida Living Trust Property Record, recording the trust can help avoid potential disputes over property ownership. Legal platforms, such as US Legal Forms, can assist in this process.

To find a trust document in Florida, it is important to know where the trust was established. You can start by checking with the county clerk's office where the property is located. For Orlando Florida Living Trust Property Record, you may also need to access court records if the trust was probated. Consulting with a legal expert can improve your chances of obtaining the needed documents.

In Florida, trust documents are generally not public records. This means that the details of an Orlando Florida Living Trust Property Record may remain confidential unless the owner chooses to make them public. However, certain aspects of property ownership, such as property deeds, are recorded and accessible. If you seek specific information, consider contacting a legal professional or a trust service.

To file a living trust in Florida, begin by drafting your trust document, ensuring it complies with state laws. After completing the document, you must fund the trust by transferring assets into it. It's important to keep proper records, as this will establish your Orlando Florida Living Trust Property Record. Finally, consider using platforms like US Legal Forms for guidance and resources to simplify the process.