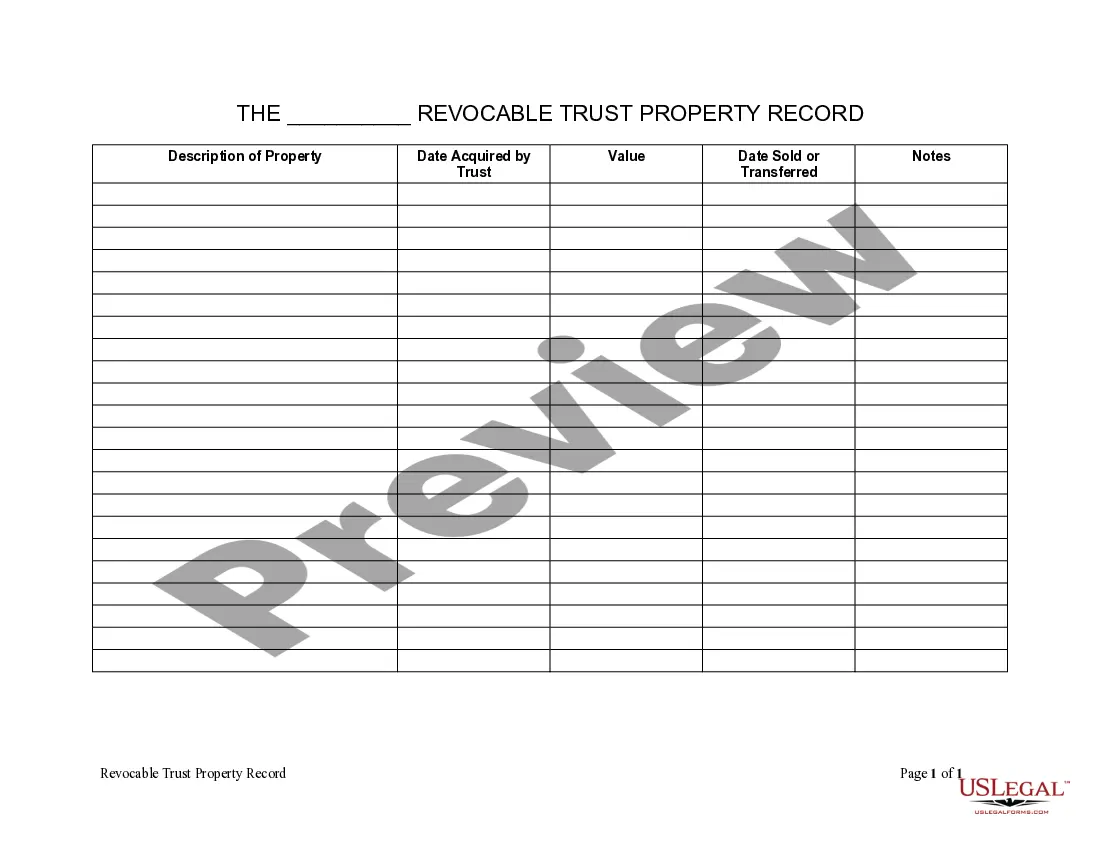

Port St. Lucie Florida Living Trust Property Record

Description

How to fill out Florida Living Trust Property Record?

We consistently endeavor to reduce or evade legal complications when handling intricate law-related or financial matters.

To achieve this, we seek legal remedies that are typically very expensive.

However, not every legal issue is of the same degree of complexity.

The majority can be managed independently.

Take advantage of US Legal Forms whenever you need to obtain and download the Port St. Lucie Florida Living Trust Property Record or any other document promptly and securely. Simply Log In to your account and click the Get button next to it. If you find you have lost the form, you can always re-download it from the My documents tab. The procedure is just as uncomplicated if you’re new to the site! You can create your account within minutes. Ensure you verify if the Port St. Lucie Florida Living Trust Property Record complies with the laws and regulations of your state and area. Moreover, it's crucial that you examine the form's outline (if available), and if you notice any inconsistencies with what you were initially seeking, look for a different template. Once you’ve confirmed that the Port St. Lucie Florida Living Trust Property Record suits your needs, you can choose the subscription plan and complete the payment. Then, you can download the document in any format offered. For over 24 years, we’ve assisted millions of individuals by providing customizable and current legal forms. Maximize the benefits of US Legal Forms today to conserve time and resources!

- US Legal Forms serves as an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our repository allows you to take control of your matters without needing to utilize the services of an attorney.

- We grant access to legal document templates that aren’t always publicly available.

- Our templates are tailored to specific states and regions, which significantly eases the search process.

Form popularity

FAQ

Living in Port St. Lucie is considered safe, with families and retirees often drawn to the area. Community initiatives and local law enforcement work together to maintain this level of safety. When planning your estate, consider creating a living trust to ensure protection and clear ownership of your property within your Port St. Lucie Florida living trust property record.

Port St. Lucie features a mix of income levels, contributing to a well-rounded community. While some neighborhoods may display affluence, the area offers affordable housing options as well. Establishing a living trust can safeguard your assets and investment properties in the area, enhancing the management of your Port St. Lucie Florida living trust property record.

Port St. Lucie is known for its diverse community, with various racial and ethnic groups contributing to the local culture. This diversity enhances the community feel and fosters inclusivity. If you are looking to invest or settle down, a clear understanding of community dynamics can inform your estate planning and should be part of your Port St. Lucie Florida living trust property record considerations.

Property taxes in Port St. Lucie are moderate compared to other regions in Florida. This can be beneficial for home buyers and investors looking at long-term returns on real estate. While property taxes are a consideration, establishing a living trust can help manage instances of tax liability when it comes to your Port St. Lucie Florida living trust property record.

The crime rate in Port St. Lucie, Florida, is generally lower than the national average. This makes it a safe place to reside for families and individuals alike. If you're considering establishing a living trust, understanding the safety of the area can influence your decisions regarding property ownership and security. Port St. Lucie Florida living trust property record ensures that your assets are well protected.

The new homestead exemption in Florida includes increased exemptions for seniors and disabled individuals, aiming to provide greater relief. Recently, changes have introduced additional benefits that may affect how property taxes are calculated. Staying updated on these changes helps preserve your benefits and can positively affect your Port St. Lucie Florida Living Trust Property Record.

To transfer property out of a trust after a person's death in Florida, you must follow the instructions outlined in the trust document. Generally, you will need to prepare a transfer deed, and in some cases, the assistance of an attorney may be necessary to ensure compliance with state laws. This process is crucial when managing a Port St. Lucie Florida Living Trust Property Record, as it ensures that property is distributed according to the deceased's wishes.

The homestead exemption for Port St. Lucie property appraisers allows qualified homeowners to reduce their property’s assessed value by up to $50,000. This exemption is essential as it can lead to substantial savings on property taxes. Every year, Port St. Lucie residents should ensure they file their exemptions on time to maintain their tax benefits, which can significantly impact the Port St. Lucie Florida Living Trust Property Record.

In Florida, seniors can qualify for exemptions that may reduce their property taxes, but there is no age at which they completely stop paying property taxes. However, once you reach 65 years of age, you may apply for the Senior Exemption, which can further reduce your taxable value. It is wise to keep detailed records, especially if you are managing a Port St. Lucie Florida Living Trust Property Record.

The assessed value of a homestead exemption in Florida represents the value assigned to your home for tax purposes, after applying the exemption. In most cases, the exemption reduces your home's value by up to $50,000, which directly lowers your property taxes. For homeowners in the Port St. Lucie area, understanding this assessed value can aid in better management of your Port St. Lucie Florida Living Trust Property Record.