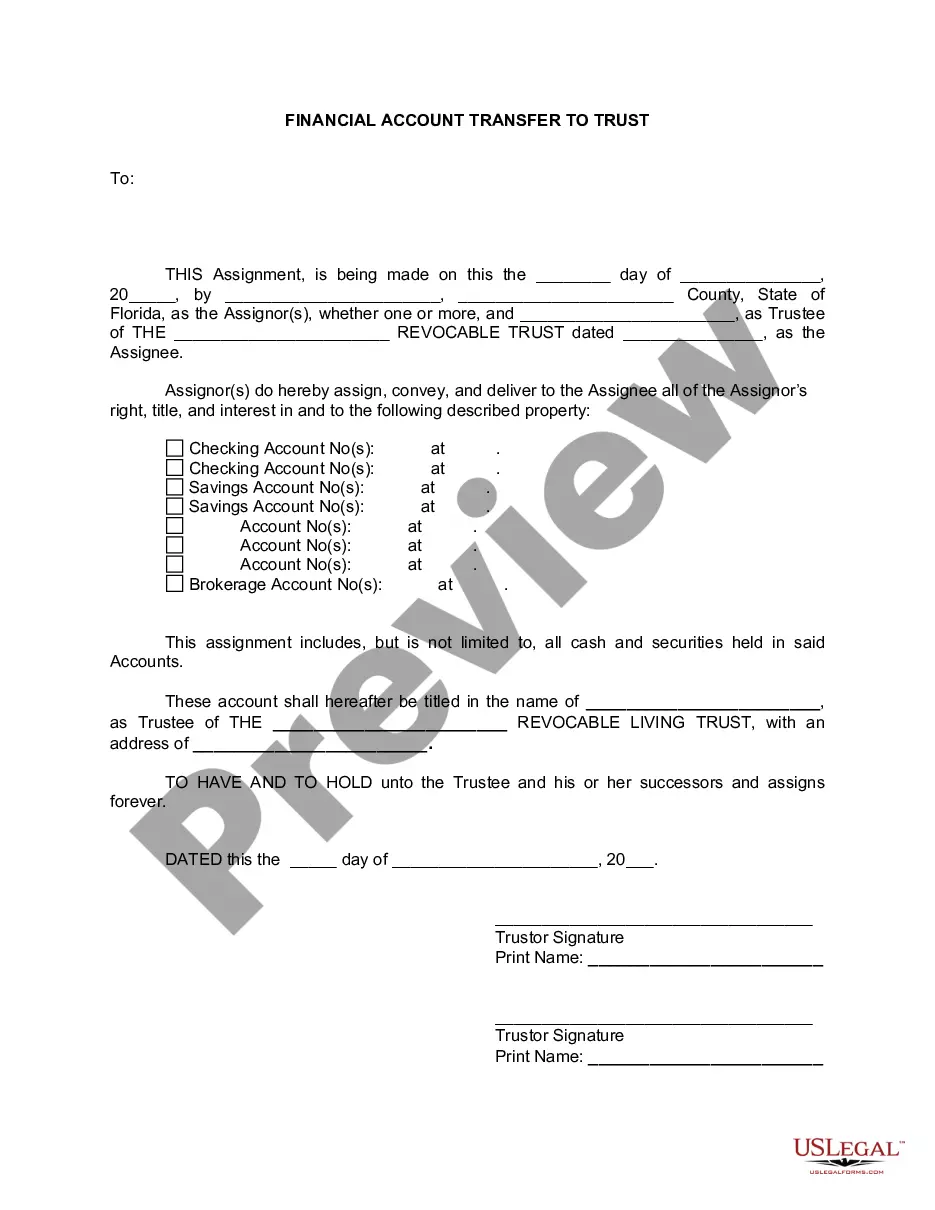

Coral Springs, Florida Financial Account Transfer to Living Trust: Explained When it comes to managing your financial affairs and ensuring the smooth transfer of assets, establishing a living trust is a wise decision. A living trust is a legal document that allows you to transfer the ownership of your financial accounts and assets into the trust's name, providing continuity and protection for your loved ones after your passing. In Coral Springs, Florida, residents have the option to undertake a financial account transfer to a living trust, thereby avoiding the probate process and ensuring their assets are distributed according to their wishes. This process involves re-titling various types of financial accounts and assets in the name of the living trust. Here are some common types of Coral Springs, Florida financial account transfers to a living trust: 1. Bank Accounts: This includes savings accounts, checking accounts, certificates of deposit (CDs), money market accounts, and any other banking instruments where you hold funds. By transferring these accounts to your living trust, you can retain control over your finances during your lifetime while providing clear instructions for their distribution upon your passing. 2. Investment Accounts: If you have a brokerage account, individual retirement account (IRA), stocks, bonds, or mutual funds, it is essential to transfer these assets to your living trust. This ensures they are properly managed and distributed to your designated beneficiaries as per your wishes. 3. Real Estate: The transfer of real estate holdings, including primary residences, vacation homes, rental properties, and undeveloped land, is crucial for seamless asset management. By assigning these properties to your living trust, you can avoid the time-consuming and expensive probate process, ensuring your chosen beneficiaries inherit these properties effortlessly. 4. Business Accounts: If you own a business, it is advisable to transfer the ownership of your business accounts, such as operating accounts, revenue accounts, and investment accounts, to your living trust. This safeguards the continuity of your enterprise and simplifies its transfer to the designated beneficiaries upon your incapacitation or death. 5. Retirement Accounts: Although retirement accounts, including 401(k)s, 403(b)s, and IRAs, usually have designated beneficiaries, naming your living trust as the beneficiary can offer additional advantages. It allows for the efficient distribution of retirement funds, provides potential tax benefits, and ensures the funds pass according to your estate planning instructions. In Coral Springs, Florida, undertaking a financial account transfer to a living trust involves thorough documentation, including trust agreements, assignment documents, and beneficiary designations. Working with an experienced estate planning attorney is highly recommended navigating the legal complexities and ensure a successful transfer. By setting up a living trust and undergoing a financial account transfer, residents of Coral Springs, Florida gain peace of mind knowing that their assets will be protected and their loved ones will be taken care of in the most efficient and streamlined manner possible. Take charge of your financial future today!

Coral Springs Florida Financial Account Transfer to Living Trust

Description

How to fill out Coral Springs Florida Financial Account Transfer To Living Trust?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone with no legal education to draft such paperwork cfrom the ground up, mainly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our platform offers a huge library with over 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you require the Coral Springs Florida Financial Account Transfer to Living Trust or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Coral Springs Florida Financial Account Transfer to Living Trust quickly using our trusted platform. If you are already an existing customer, you can go on and log in to your account to download the needed form.

Nevertheless, if you are new to our library, ensure that you follow these steps before downloading the Coral Springs Florida Financial Account Transfer to Living Trust:

- Be sure the form you have chosen is suitable for your location since the regulations of one state or county do not work for another state or county.

- Review the form and go through a brief description (if available) of scenarios the document can be used for.

- In case the one you chosen doesn’t meet your requirements, you can start again and search for the suitable form.

- Click Buy now and choose the subscription plan that suits you the best.

- Log in to your account credentials or register for one from scratch.

- Pick the payment method and proceed to download the Coral Springs Florida Financial Account Transfer to Living Trust as soon as the payment is through.

You’re all set! Now you can go on and print out the form or fill it out online. If you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.