Fort Lauderdale Florida Financial Account Transfer to Living Trust: A Comprehensive Overview Introduction: The process of transferring financial accounts to a living trust in Fort Lauderdale, Florida is a vital step in estate planning. By transferring assets to a living trust, individuals can ensure seamless management and distribution of their finances while minimizing probate costs and maintaining privacy. This guide provides a detailed description of Fort Lauderdale Florida Financial Account Transfer to Living Trust, covering key aspects, options, and considerations. Types of Fort Lauderdale Florida Financial Account Transfer to Living Trust: 1. Bank Accounts: This category includes various types of financial accounts such as checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). Each account must be transferred individually to the living trust, with the trust named as the account owner. 2. Investment Accounts: Investments accounts encompass brokerage accounts, stocks, bonds, mutual funds, and other securities. Transferring these accounts involves updating ownership records to reflect the living trust as the account holder. 3. Retirement Accounts: Retirement accounts like IRAs (Individual Retirement Accounts), 401(k)s, and 403(b)s requirement special attention when transferring to a living trust. Beneficiary designations should be carefully coordinated with the trust to ensure proper distribution upon the account holder's passing. 4. Real Estate: While not an account per se, real estate holdings can be transferred to a living trust to streamline its management and bypass probate proceedings. Residential and commercial properties, including condos, houses, and land, can benefit from such transfers. Process of Fort Lauderdale Financial Account Transfer to Living Trust: 1. Establishing a Living Trust: To initiate the transfer, individuals must first create a living trust. This involves consulting an attorney well-versed in estate planning and drafting a comprehensive trust agreement outlining asset distribution instructions. 2. Identifying and Listing Accounts: Once the trust is established, all pertinent financial accounts must be identified and listed for transfer. A thorough review of account statements should be conducted, including bankers and brokers who can assist with this process. 3. Updating Account Ownership: Next, the account holders must notify each financial institution (e.g., banks, brokers, retirement plan administrators) about the living trust and request the necessary paperwork to transfer ownership. This may involve notarized letters of instruction, signature verification, or account-specific forms. 4. Coordinating with Professionals: It is advisable to work closely with an estate planning attorney, CPA or financial advisor to ensure a smooth transfer of all financial accounts. They can provide valuable guidance, review documentation, and ensure compliance with legal requirements. 5. Maintaining Records: It is essential to keep meticulous records of all financial account transfers, including copies of correspondence, account statements, and any related documentation. These records will be crucial in monitoring the effectiveness and progress of the transfer. Key Considerations: 1. Consultation with Professionals: Seeking professional advice when setting up a living trust and transferring financial accounts is highly recommended. Professionals can help navigate the complex legal and financial landscape while ensuring compliance with applicable laws. 2. Beneficiary Designations: When transferring retirement accounts, revisiting and updating beneficiary designations is crucial to align them with the living trust. This helps avoid conflicts and ensures assets are distributed according to the trust's instructions. 3. Tax Implications: It is important to understand the potential tax consequences associated with transferring financial accounts to a living trust. Consulting a tax professional can help minimize tax liabilities and maximize asset protection. 4. Regular Review and Maintenance: Updating the living trust regularly, especially when financial circumstances or asset ownership change, is essential to ensure its effectiveness. Periodically reviewing and adjusting account transfers can keep the trust in line with one's long-term goals. Conclusion: Fort Lauderdale Florida Financial Account Transfer to Living Trust involves transferring various types of accounts — including bank accounts, investment accounts, retirement accounts, and real estate — to a living trust. This process is a valuable aspect of estate planning, ensuring efficient asset management, reducing probate costs, and preserving privacy. It is advisable to consult professionals throughout the transfer process to ensure compliance with legal requirements and to maximize the benefits of a living trust.

Fort Lauderdale Florida Financial Account Transfer to Living Trust

Description

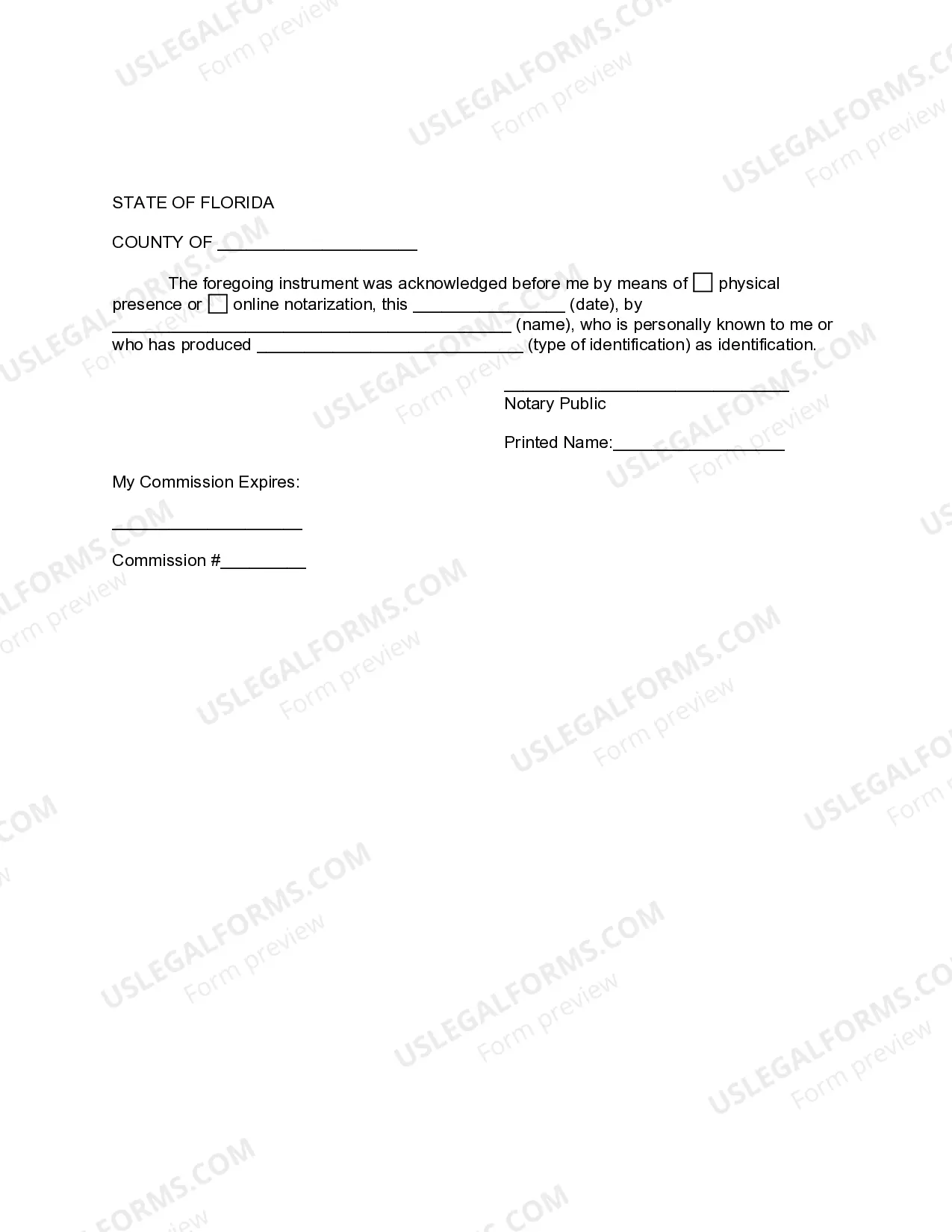

How to fill out Fort Lauderdale Florida Financial Account Transfer To Living Trust?

Benefit from the US Legal Forms and obtain instant access to any form template you want. Our helpful website with thousands of documents makes it simple to find and get almost any document sample you require. It is possible to export, fill, and sign the Fort Lauderdale Florida Financial Account Transfer to Living Trust in just a couple of minutes instead of browsing the web for several hours looking for a proper template.

Utilizing our collection is a wonderful strategy to increase the safety of your record filing. Our experienced lawyers regularly check all the documents to ensure that the forms are appropriate for a particular region and compliant with new laws and polices.

How can you get the Fort Lauderdale Florida Financial Account Transfer to Living Trust? If you have a subscription, just log in to the account. The Download option will appear on all the samples you view. Additionally, you can find all the earlier saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction listed below:

- Find the template you need. Make sure that it is the form you were looking for: examine its headline and description, and use the Preview option if it is available. Otherwise, use the Search field to find the needed one.

- Start the saving procedure. Select Buy Now and choose the pricing plan you like. Then, create an account and process your order with a credit card or PayPal.

- Download the file. Pick the format to obtain the Fort Lauderdale Florida Financial Account Transfer to Living Trust and revise and fill, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable template libraries on the internet. We are always happy to assist you in virtually any legal process, even if it is just downloading the Fort Lauderdale Florida Financial Account Transfer to Living Trust.

Feel free to make the most of our platform and make your document experience as convenient as possible!