Jacksonville Florida Financial Account Transfer to Living Trust is a legal process where individuals transfer their financial accounts to a living trust in Jacksonville, Florida. A living trust is a legal document created by an individual (known as the granter) during their lifetime, which holds assets and specifies how they should be managed and distributed after the granter's death. The financial account transfer to a living trust in Jacksonville, Florida offers numerous benefits, including asset protection, estate planning, and the avoidance of probate. By transferring their financial accounts to a living trust, the granter maintains control over their assets while also ensuring a smooth and efficient distribution upon their passing. There are different types of Jacksonville Florida Financial Account Transfers to Living Trust, including: 1. Bank Account Transfer: This type involves transferring various types of bank accounts such as checking accounts, savings accounts, money market accounts, and certificates of deposit to the living trust. The granter will need to contact their bank and complete the necessary paperwork to initiate the transfer. 2. Investment Account Transfer: Individuals can also transfer investment accounts, including stocks, bonds, mutual funds, and brokerage accounts, to their living trust. This transfer ensures that the assets and income from these accounts are managed according to the granter's wishes, even after their passing. 3. Retirement Account Transfer: Retirement accounts such as Individual Retirement Accounts (IRAs), 401(k)s, and pensions can be transferred to a living trust. However, caution must be exercised when dealing with retirement accounts to avoid unintended tax consequences. Consulting with a financial advisor or tax professional is advisable in these cases. 4. Real Estate Transfer: In addition to financial accounts, individuals may also transfer real estate assets, such as primary residences, vacation homes, rental properties, and commercial properties, to their living trust. This transfer ensures that the properties are managed and distributed per the granter's instructions, helping to avoid lengthy probate proceedings. To proceed with a Jacksonville Florida Financial Account Transfer to Living Trust, individuals should seek the assistance of an experienced estate planning attorney who specializes in living trusts. The attorney will guide the granter through the process, ensuring that all legal requirements and considerations are met. It is important to consider both the legal and financial implications of the transfer and how it aligns with the granter's overall estate planning goals.

Jacksonville Florida Financial Account Transfer to Living Trust

Category:

State:

Florida

City:

Jacksonville

Control #:

FL-E0178C

Format:

Word;

Rich Text

Instant download

Description

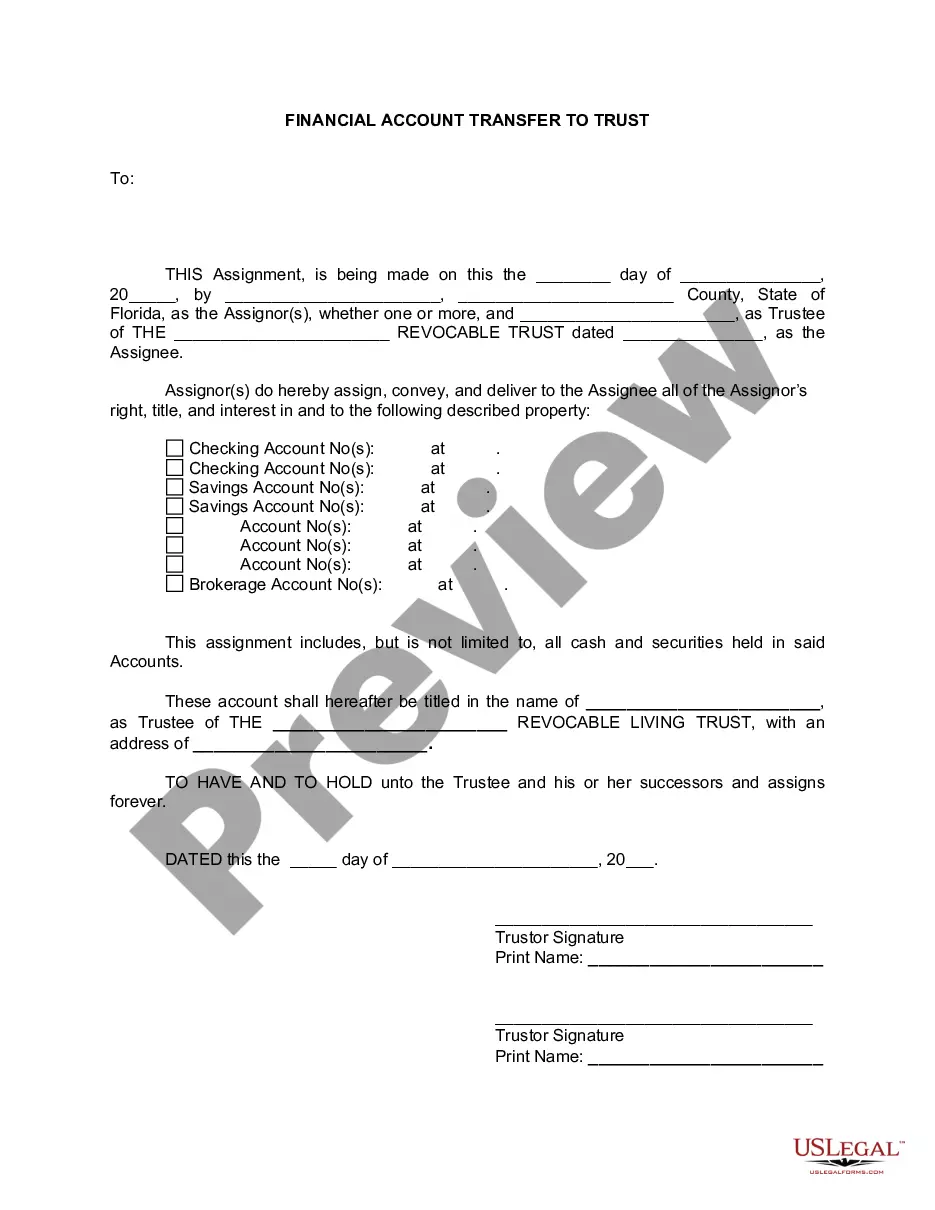

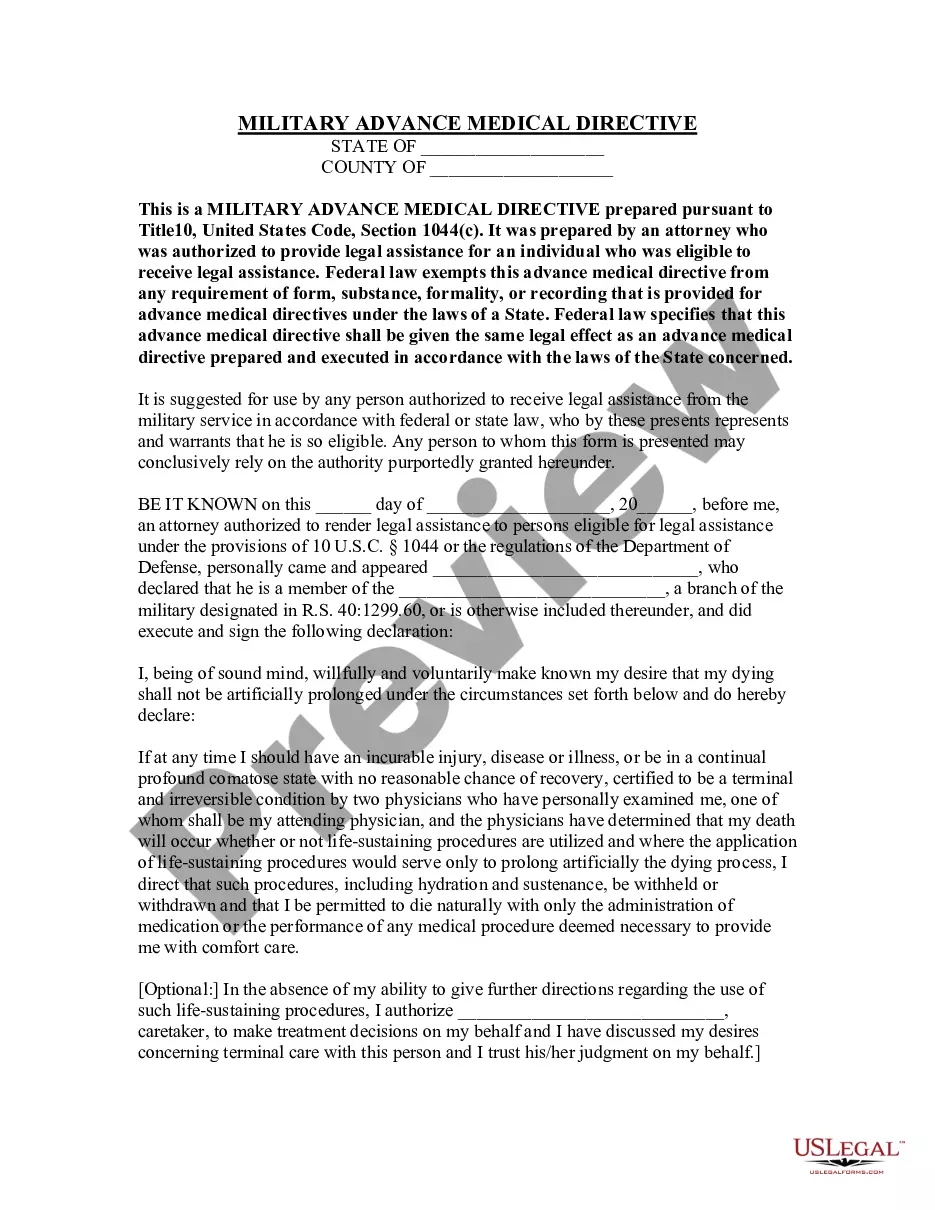

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

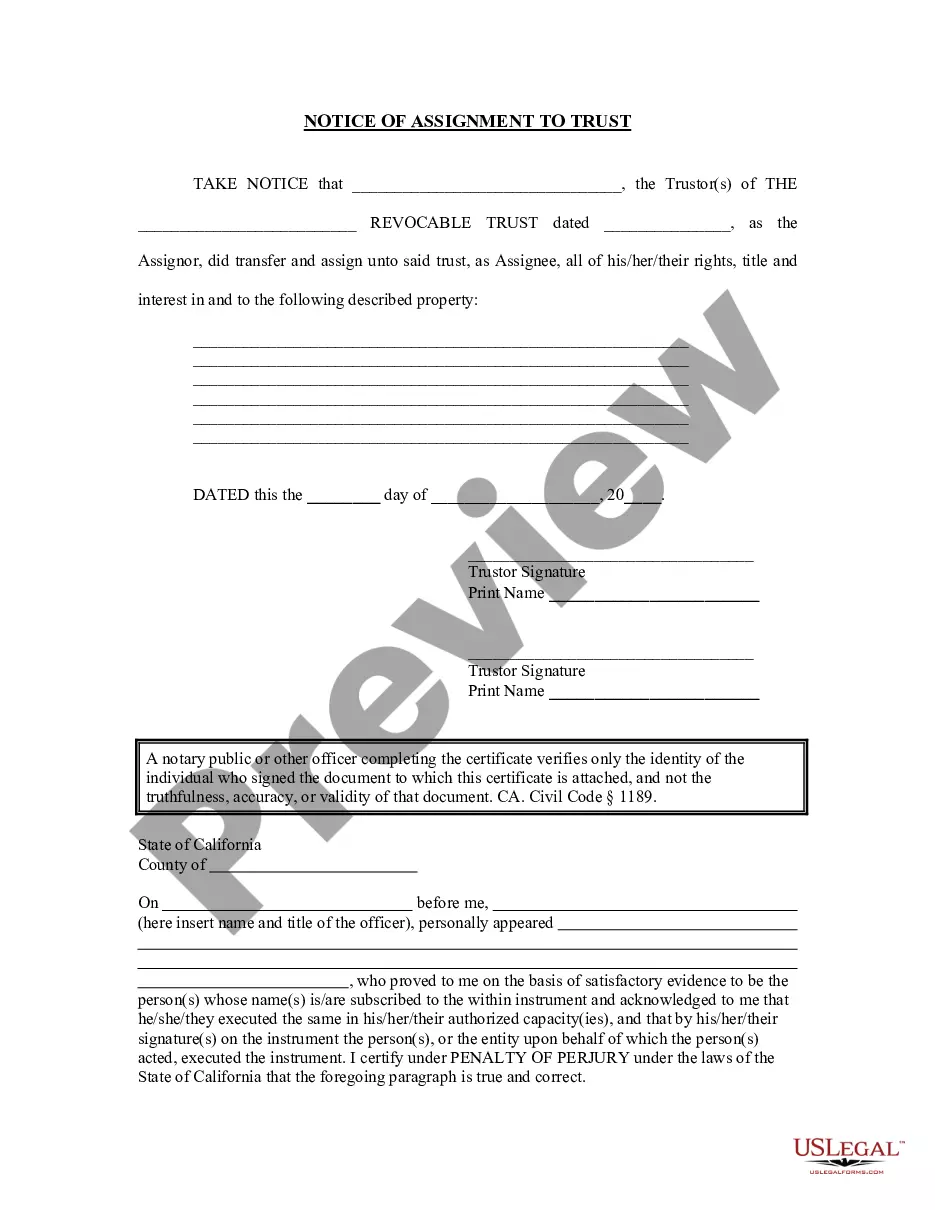

Jacksonville Florida Financial Account Transfer to Living Trust is a legal process where individuals transfer their financial accounts to a living trust in Jacksonville, Florida. A living trust is a legal document created by an individual (known as the granter) during their lifetime, which holds assets and specifies how they should be managed and distributed after the granter's death. The financial account transfer to a living trust in Jacksonville, Florida offers numerous benefits, including asset protection, estate planning, and the avoidance of probate. By transferring their financial accounts to a living trust, the granter maintains control over their assets while also ensuring a smooth and efficient distribution upon their passing. There are different types of Jacksonville Florida Financial Account Transfers to Living Trust, including: 1. Bank Account Transfer: This type involves transferring various types of bank accounts such as checking accounts, savings accounts, money market accounts, and certificates of deposit to the living trust. The granter will need to contact their bank and complete the necessary paperwork to initiate the transfer. 2. Investment Account Transfer: Individuals can also transfer investment accounts, including stocks, bonds, mutual funds, and brokerage accounts, to their living trust. This transfer ensures that the assets and income from these accounts are managed according to the granter's wishes, even after their passing. 3. Retirement Account Transfer: Retirement accounts such as Individual Retirement Accounts (IRAs), 401(k)s, and pensions can be transferred to a living trust. However, caution must be exercised when dealing with retirement accounts to avoid unintended tax consequences. Consulting with a financial advisor or tax professional is advisable in these cases. 4. Real Estate Transfer: In addition to financial accounts, individuals may also transfer real estate assets, such as primary residences, vacation homes, rental properties, and commercial properties, to their living trust. This transfer ensures that the properties are managed and distributed per the granter's instructions, helping to avoid lengthy probate proceedings. To proceed with a Jacksonville Florida Financial Account Transfer to Living Trust, individuals should seek the assistance of an experienced estate planning attorney who specializes in living trusts. The attorney will guide the granter through the process, ensuring that all legal requirements and considerations are met. It is important to consider both the legal and financial implications of the transfer and how it aligns with the granter's overall estate planning goals.

Free preview

How to fill out Jacksonville Florida Financial Account Transfer To Living Trust?

If you’ve already utilized our service before, log in to your account and download the Jacksonville Florida Financial Account Transfer to Living Trust on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Jacksonville Florida Financial Account Transfer to Living Trust. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!