Lakeland Florida Financial Account Transfer to Living Trust: A Comprehensive Guide Overview: When it comes to estate planning, the process of transferring financial accounts to a living trust can be complex, but it offers numerous benefits and considerations. This detailed guide aims to provide a comprehensive understanding of Lakeland Florida financial account transfer to a living trust, including the key steps involved, potential types of transfers, and essential keywords related to this process. Key Steps Involved in Lakeland Florida Financial Account Transfer to Living Trust: 1. Understanding Living Trusts: A living trust refers to a legal document that allows individuals (known as granters or settlers) to transfer their assets, including financial accounts, into a trust during their lifetime. These assets are then managed by a designated trustee and distributed according to the granter's wishes after their passing. 2. Seek Professional Guidance: Given the intricacies of financial account transfers to a living trust, it is crucial to consult an experienced estate planning attorney in Lakeland, Florida. They can provide personalized guidance and ensure compliance with relevant laws and regulations. 3. Identify Financial Accounts: Compile a comprehensive list of all financial accounts that need to be transferred to the living trust. This may include bank accounts, investment portfolios, retirement accounts, insurance policies, and more. 4. Review Ownership and Beneficiary Designations: Evaluate the current ownership and beneficiary designations of the financial accounts. It is important to update these designations to reflect their transfer to the living trust, ensuring a seamless transition of assets. 5. Amend Account Titles: Contact each financial institution where accounts are held and request the necessary paperwork to transfer ownership to the living trust. This involves amending the account titles from individual names to the trust's name. 6. Obtain Tax Identification Number: Obtain an Employer Identification Number (EIN) for the living trust from the Internal Revenue Service (IRS). This EIN will be used for tax reporting purposes for the trust's financial accounts. 7. Coordinate with Financial Institutions: Work closely with the financial institutions to complete the necessary paperwork and processes for transferring each account to the living trust. Some institutions may require specific documentation or forms tailored to their policies. Types of Lakeland Florida Financial Account Transfer to Living Trust: 1. Bank Account Transfer: This involves transferring personal bank accounts to a living trust, ensuring the trust becomes the account owner, and the named trustee can handle the account on the granter's behalf. 2. Investment Portfolio Transfer: For individuals with investment portfolios, transferring these accounts to a living trust is crucial to allow seamless management and distribution of assets according to the trust's terms. 3. Retirement Account Transfer: Transferring retirement accounts, such as IRAs or 401(k)s, to a living trust enables efficient asset distribution while considering tax implications and ensuring legislative compliance. 4. Life Insurance Policy Transfer: By transferring life insurance policies to a living trust, policy proceeds can be managed and distributed as per the granter's wishes, bypassing probate and ensuring a smooth transfer to beneficiaries. 5. Real Estate Title Transfer: Although not a financial account, transferring real estate titles to a living trust can provide control over property management and streamline the distribution process after the granter's passing. Keywords: — Estate planning Lakeland Florida — Living trustransferfe— - Financial account transfer — Estate planninattorneyne— - Financial institution coordination — Lakeland Florida assetransferfe— - Probate avoidance — Tax implications in trust transfer— - Living trust management — Living trusbeneficiariesie— - Retirement account distribution Conclusion: Transferring financial accounts to a living trust in Lakeland, Florida, is a critical part of comprehensive estate planning. By understanding the step-by-step process, seeking professional guidance, and familiarizing oneself with the various types of transfers involved, individuals can ensure their assets are protected and distributed according to their wishes while minimizing potential legal complications.

Lakeland Florida Financial Account Transfer to Living Trust

Description

How to fill out Lakeland Florida Financial Account Transfer To Living Trust?

If you are looking for a relevant form, it’s impossible to choose a more convenient service than the US Legal Forms website – probably the most considerable online libraries. Here you can get thousands of templates for company and personal purposes by categories and regions, or key phrases. With the advanced search function, getting the latest Lakeland Florida Financial Account Transfer to Living Trust is as easy as 1-2-3. Furthermore, the relevance of each and every document is verified by a team of expert lawyers that regularly check the templates on our platform and update them in accordance with the newest state and county regulations.

If you already know about our platform and have an account, all you need to receive the Lakeland Florida Financial Account Transfer to Living Trust is to log in to your user profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have discovered the form you want. Read its information and make use of the Preview function to check its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to find the proper document.

- Affirm your choice. Choose the Buy now button. After that, select the preferred pricing plan and provide credentials to register an account.

- Process the transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Receive the template. Select the format and download it to your system.

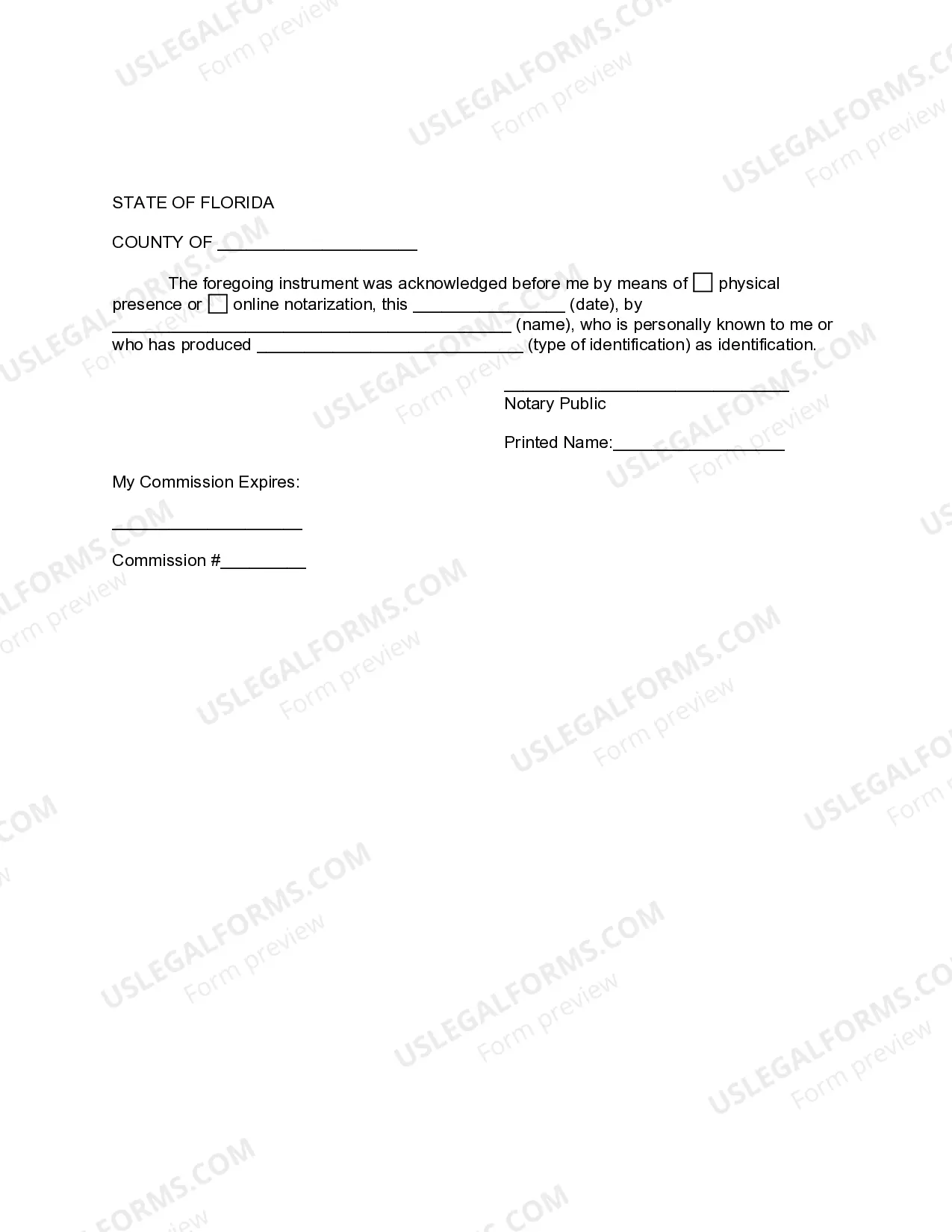

- Make modifications. Fill out, edit, print, and sign the obtained Lakeland Florida Financial Account Transfer to Living Trust.

Every template you save in your user profile does not have an expiry date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you want to receive an additional copy for editing or printing, feel free to come back and export it once more at any moment.

Make use of the US Legal Forms professional collection to get access to the Lakeland Florida Financial Account Transfer to Living Trust you were looking for and thousands of other professional and state-specific samples on a single website!