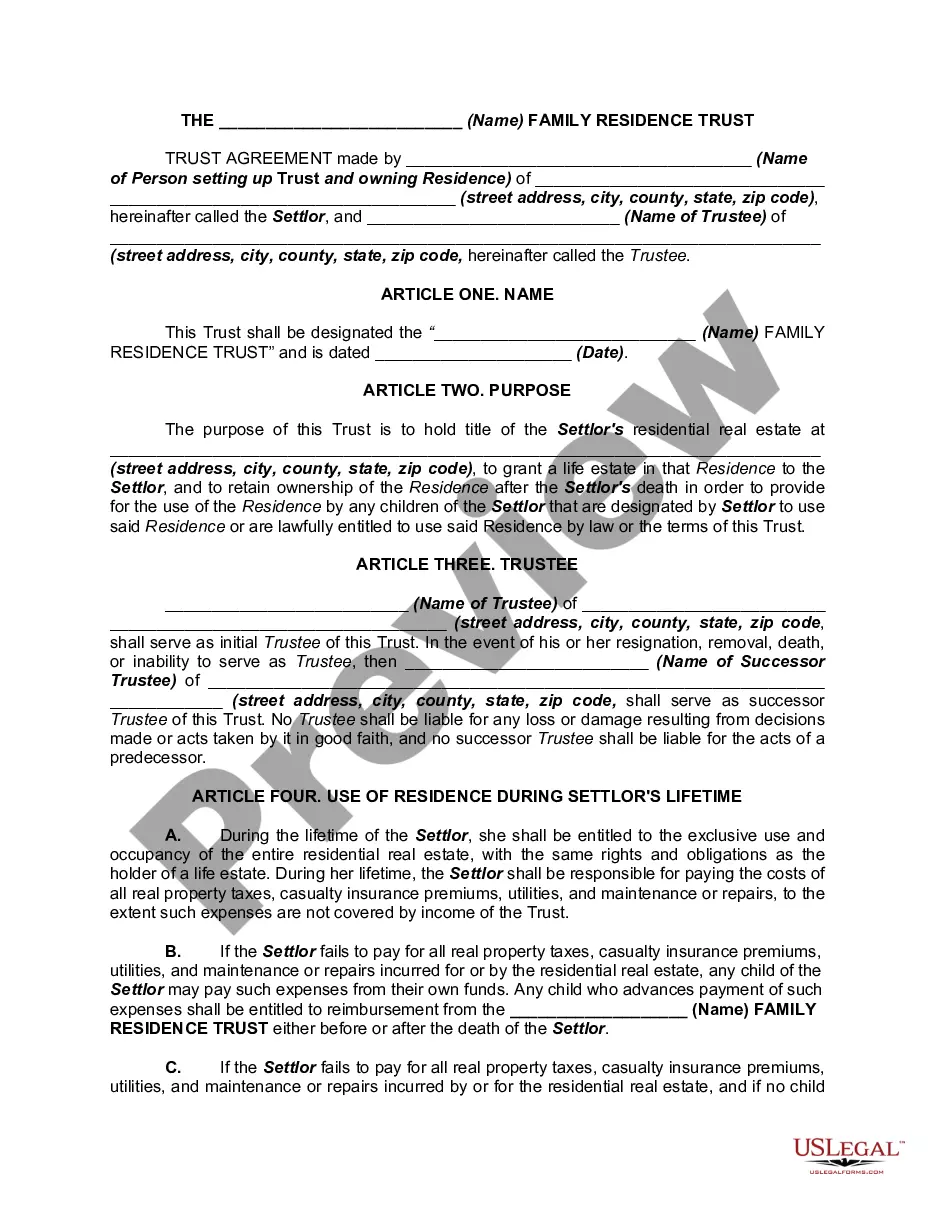

Miami Gardens Florida Financial Account Transfer to Living Trust refers to the process of transferring financial accounts to a living trust for residents of Miami Gardens, Florida. This estate planning strategy offers individuals the opportunity to protect their assets, plan for the future, and ensure their assets are efficiently managed in the event of incapacitation or death. Through this transfer, financial accounts such as savings accounts, retirement accounts, investment portfolios, and life insurance policies are re-registered to the living trust's name. There are several types of Miami Gardens Florida Financial Account Transfer to Living Trust that individuals may consider based on their specific needs: 1. Savings Account Transfer: This type of transfer involves moving funds from a personal savings account to a living trust. By doing so, the account holder ensures that their savings are managed and distributed according to the trust's established guidelines after their passing. 2. Retirement Account Transfer: Individuals may transfer various types of retirement accounts, including 401(k)s, Individual Retirement Accounts (IRAs), and pension plans, to their living trust. This ensures that retirement assets pass directly to the trust beneficiaries, avoiding probate and potential delays. 3. Investment Portfolio Transfer: Those with investment portfolios, such as stocks, bonds, mutual funds, or exchange-traded funds (ETFs), can transfer these assets to their living trust. This allows assets to be managed and distributed by the designated trustee, following the trust's guidelines. 4. Life Insurance Policy Transfer: By transferring an existing life insurance policy to a living trust, individuals can ensure that the policy's proceeds are distributed directly to the trust and subsequently managed according to their wishes. 5. Real Estate Property Transfer: While not directly financial accounts, real estate properties can also be transferred to a living trust. This includes residential, commercial, or rental properties owned by the individual. Transferring real estate to a living trust can avoid probate and simplify the transfer process for future beneficiaries. In summary, Miami Gardens Florida Financial Account Transfer to Living Trust involves the transfer of various financial accounts to a living trust to protect assets, efficiently manage them, and ensure their proper distribution. By exploring the different types of transfers available, individuals can tailor their estate planning to their unique needs and goals.

Miami Gardens Florida Financial Account Transfer to Living Trust

Description

How to fill out Miami Gardens Florida Financial Account Transfer To Living Trust?

If you’ve already used our service before, log in to your account and save the Miami Gardens Florida Financial Account Transfer to Living Trust on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Miami Gardens Florida Financial Account Transfer to Living Trust. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!

Form popularity

FAQ

It might be wise for your parents to consider placing their assets in a trust, as doing so can provide benefits such as avoiding probate and ensuring that their wishes are honored after their passing. However, they should assess their individual financial situations and consult with a specialist. For those looking into Miami Gardens Florida Financial Account Transfer to Living Trust, USLegalForms can offer necessary resources to make informed decisions.

To transfer a bank account to your living trust, you will generally need to contact your bank and provide them with a copy of your trust document. The bank will guide you through their procedures, which usually involves filling out specific forms. When dealing with a Miami Gardens Florida Financial Account Transfer to Living Trust, working with a reliable platform like USLegalForms can simplify this process considerably.

The primary downside to placing assets in a trust is the initial setup and ongoing management costs. Individuals must ensure they comply with regulations, thereby sometimes requiring legal assistance. If you're exploring options for a Miami Gardens Florida Financial Account Transfer to Living Trust, be sure to weigh these costs against the long-term benefits of estate management.

When the account holder of a trust checking account passes away, the assets typically remain within the trust and are distributed according to the trust agreement. This ensures a smoother transition of assets compared to probate proceedings. So, if you are navigating a Miami Gardens Florida Financial Account Transfer to Living Trust, this can significantly ease the financial burden on your loved ones.

Including a checking account in a trust can simplify your financial management after death. However, many individuals prefer to keep their checking accounts outside of the trust for ease of access and daily use. If you are thinking about a Miami Gardens Florida Financial Account Transfer to Living Trust, consider discussing your checking account options with a financial planner to make the best choice.

Certain types of accounts are generally not suited for inclusion in a trust, such as retirement accounts and health savings accounts. These accounts often have specific beneficiary designations that operate independently. When considering a Miami Gardens Florida Financial Account Transfer to Living Trust, it is crucial to evaluate which assets should be titled in the trust versus those that should not.

Trust funds can sometimes create a disconnect between beneficiaries and their assets. This might lead to a lack of financial responsibility among heirs, as they may not appreciate the value of the assets held in Miami Gardens Florida Financial Account Transfer to Living Trust. Furthermore, there may be ongoing administrative duties that can add to the complexity for both trustees and beneficiaries.

While trusts can be highly beneficial, some people view them negatively due to potential complexity and costs. Managing a trust can involve legal fees, which might seem daunting, especially for those unfamiliar with the process of Miami Gardens Florida Financial Account Transfer to Living Trust. Additionally, some individuals may perceive that trusts limit their control over assets during their lifetime.

Certain accounts may be best kept outside of your living trust, such as retirement accounts like 401(k)s and IRAs, which have their own designated beneficiary designations. Additionally, health savings accounts may not be suitable for inclusion, as they can complicate tax implications. When considering a Miami Gardens Florida Financial Account Transfer to Living Trust, make sure to evaluate the specific types of accounts you hold to optimize your estate plan effectively.

Including bank accounts in your living trust is often advisable, as it allows for easier access and management of your funds. When you include these accounts, you ensure they are part of your overall estate plan, allowing your successors to take control without facing probate delays. If you are looking into a Miami Gardens Florida Financial Account Transfer to Living Trust, it's a crucial step in enhancing the security and efficiency of your financial planning.