Pembroke Pines Florida Financial Account Transfer to Living Trust: A Comprehensive Overview In Pembroke Pines, Florida, residents have the option to transfer their financial accounts to a living trust as part of their estate planning strategy. A living trust is a legally binding arrangement where an individual, known as the granter, transfers ownership of their assets, including financial accounts, to a trust during their lifetime. This process ensures seamless management and distribution of these accounts upon the granter's incapacity or death, simplifying the estate settlement process and minimizing probate. There are several types of Pembroke Pines Florida financial account transfers to a living trust, each serving specific purposes based on individual circumstances. Let's discuss them in detail: 1. Revocable Living Trust: A revocable living trust in Pembroke Pines allows individuals to transfer financial accounts, such as savings or investment portfolios, into the trust and retain complete control over them during their lifetime. The flexibility to modify or revoke the trust gives granters the freedom to adapt to changing circumstances. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust in Pembroke Pines cannot be changed or revoked by the granter once it is established. The financial accounts transferred into this trust become the property of the trust, providing various advantages such as asset protection, minimizing estate taxes, or Medicaid planning. 3. Special Needs Trust: For individuals who have family members with disabilities or special needs, a special needs trust can be established in Pembroke Pines. By transferring financial accounts to this trust, the granter ensures that the beneficiary has access to support while preserving their eligibility for government benefits, such as Medicaid or Supplemental Security Income (SSI). 4. Testamentary Trust: A testamentary trust is established through a will and only becomes effective upon the death of the granter. Financial accounts can be transferred to this trust as per the granter's wishes outlined in their will. This type of trust allows for the orderly distribution of wealth and may offer potential tax benefits. 5. Charitable Remainder Trust: If philanthropy is a priority in Pembroke Pines, individuals can opt for a charitable remainder trust. By transferring financial accounts to this trust, the granter can provide for loved ones during their lifetime while ensuring that any remaining assets are donated to a charitable organization after their death. This allows granters to leave a lasting legacy while potentially enjoying immediate tax benefits. The process of transferring financial accounts to a living trust in Pembroke Pines involves various steps, including consulting with an experienced estate planning attorney, identifying the appropriate trust type, drafting the necessary legal documents, updating account titles, and meticulously transferring ownership. It is crucial to work with professionals well-versed in Florida estate laws to ensure a seamless and legally compliant transfer process. In conclusion, a Pembroke Pines Florida financial account transfer to a living trust offers individuals numerous benefits, such as enhanced privacy, probate avoidance, potential tax advantages, and flexible management options. Understanding the different trust types helps individuals select the most suitable mechanism for their unique circumstances, allowing them to secure their financial accounts and ensure the smooth transition of their wealth to their beneficiaries.

Pembroke Pines Florida Financial Account Transfer to Living Trust

Category:

State:

Florida

City:

Pembroke Pines

Control #:

FL-E0178C

Format:

Word;

Rich Text

Instant download

Description

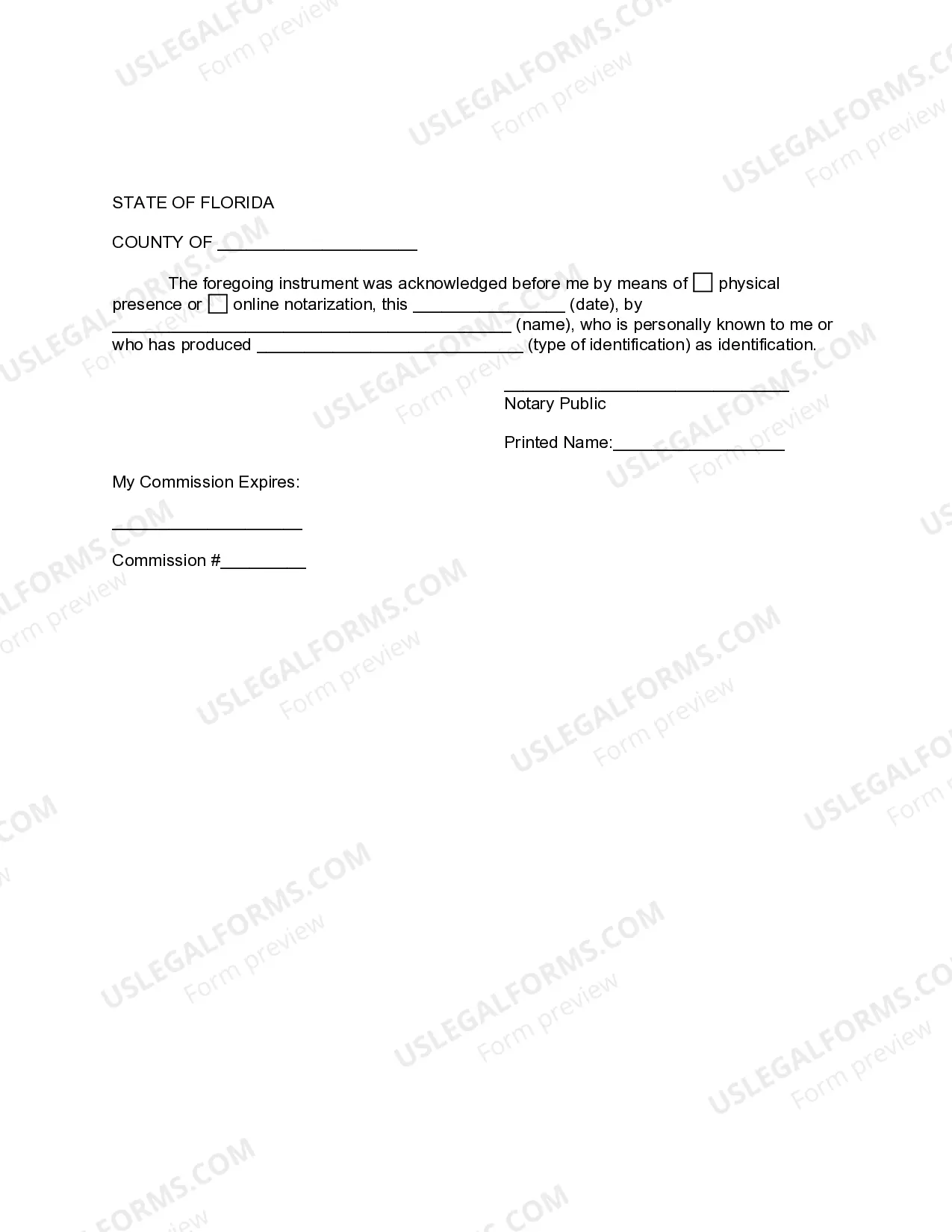

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Pembroke Pines Florida Financial Account Transfer to Living Trust: A Comprehensive Overview In Pembroke Pines, Florida, residents have the option to transfer their financial accounts to a living trust as part of their estate planning strategy. A living trust is a legally binding arrangement where an individual, known as the granter, transfers ownership of their assets, including financial accounts, to a trust during their lifetime. This process ensures seamless management and distribution of these accounts upon the granter's incapacity or death, simplifying the estate settlement process and minimizing probate. There are several types of Pembroke Pines Florida financial account transfers to a living trust, each serving specific purposes based on individual circumstances. Let's discuss them in detail: 1. Revocable Living Trust: A revocable living trust in Pembroke Pines allows individuals to transfer financial accounts, such as savings or investment portfolios, into the trust and retain complete control over them during their lifetime. The flexibility to modify or revoke the trust gives granters the freedom to adapt to changing circumstances. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust in Pembroke Pines cannot be changed or revoked by the granter once it is established. The financial accounts transferred into this trust become the property of the trust, providing various advantages such as asset protection, minimizing estate taxes, or Medicaid planning. 3. Special Needs Trust: For individuals who have family members with disabilities or special needs, a special needs trust can be established in Pembroke Pines. By transferring financial accounts to this trust, the granter ensures that the beneficiary has access to support while preserving their eligibility for government benefits, such as Medicaid or Supplemental Security Income (SSI). 4. Testamentary Trust: A testamentary trust is established through a will and only becomes effective upon the death of the granter. Financial accounts can be transferred to this trust as per the granter's wishes outlined in their will. This type of trust allows for the orderly distribution of wealth and may offer potential tax benefits. 5. Charitable Remainder Trust: If philanthropy is a priority in Pembroke Pines, individuals can opt for a charitable remainder trust. By transferring financial accounts to this trust, the granter can provide for loved ones during their lifetime while ensuring that any remaining assets are donated to a charitable organization after their death. This allows granters to leave a lasting legacy while potentially enjoying immediate tax benefits. The process of transferring financial accounts to a living trust in Pembroke Pines involves various steps, including consulting with an experienced estate planning attorney, identifying the appropriate trust type, drafting the necessary legal documents, updating account titles, and meticulously transferring ownership. It is crucial to work with professionals well-versed in Florida estate laws to ensure a seamless and legally compliant transfer process. In conclusion, a Pembroke Pines Florida financial account transfer to a living trust offers individuals numerous benefits, such as enhanced privacy, probate avoidance, potential tax advantages, and flexible management options. Understanding the different trust types helps individuals select the most suitable mechanism for their unique circumstances, allowing them to secure their financial accounts and ensure the smooth transition of their wealth to their beneficiaries.

Free preview

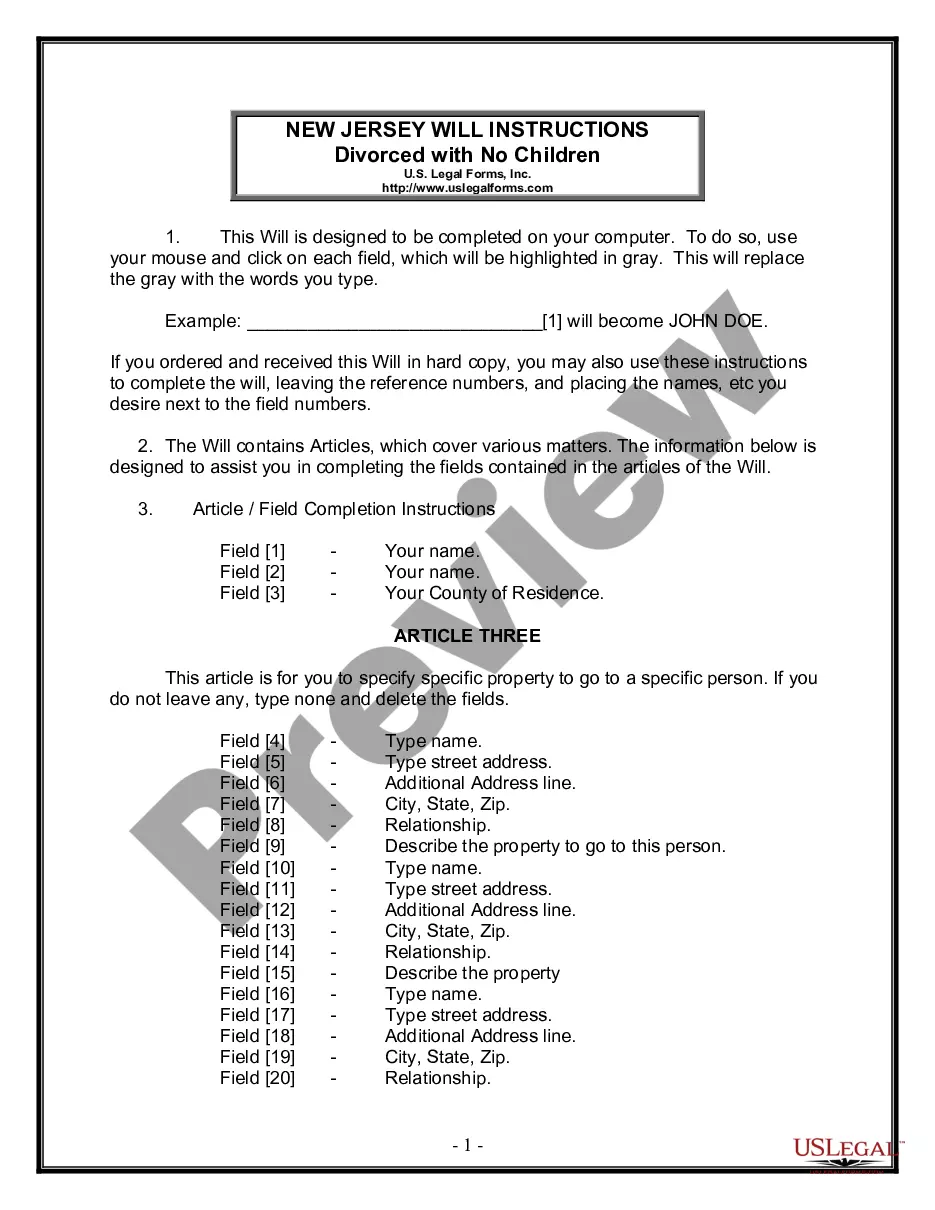

How to fill out Pembroke Pines Florida Financial Account Transfer To Living Trust?

If you’ve already used our service before, log in to your account and save the Pembroke Pines Florida Financial Account Transfer to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Pembroke Pines Florida Financial Account Transfer to Living Trust. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!