Pompano Beach Florida Financial Account Transfer to Living Trust

Description

How to fill out Florida Financial Account Transfer To Living Trust?

If you are seeking a suitable document, it’s incredibly challenging to discover a superior source than the US Legal Forms website – arguably the most extensive online collections.

Here you can locate numerous templates for both business and personal reasons, categorized by type and geographical regions, or keywords.

Utilizing our premium search feature, finding the most recent Pompano Beach Florida Financial Account Transfer to Living Trust is as simple as 1-2-3.

Process the payment. Use your credit card or PayPal account to complete the registration procedure.

Obtain the template. Choose the file format and download it to your device.

- Moreover, the validity of each document is validated by a team of experienced attorneys who regularly assess the templates on our platform and update them according to the latest state and county requirements.

- If you are already familiar with our site and possess an account, all you need to do to obtain the Pompano Beach Florida Financial Account Transfer to Living Trust is to sign in to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions given below.

- Ensure you have accessed the document you need. Review its description and utilize the Preview feature (if available) to examine its content. If it does not fulfill your needs, use the Search option at the top of the page to find the right template.

- Confirm your selection. Click the Buy now button. Then, choose your desired subscription plan and provide the necessary details to create an account.

Form popularity

FAQ

To transfer bank accounts into a living trust, you first need to create the living trust document outlining the trust's terms. Next, notify your bank of your intention to perform a Pompano Beach Florida Financial Account Transfer to Living Trust. This usually involves completing a trust transfer form and providing a copy of the trust document to your bank. Resources like uslegalforms can guide you through this process with templates and legal information designed to simplify each step.

Certain accounts, like retirement accounts (401(k)s or IRAs) and health savings accounts, should typically remain outside of a trust. This is important because these types of accounts have specific tax implications that a trust may complicate. For anyone in Pompano Beach considering a Florida Financial Account Transfer to Living Trust, it’s wise to properly assess which accounts to include and which to exclude. Utilizing platforms like uslegalforms can provide clarity on this topic.

The 5 year rule for trusts generally refers to the requirement for certain assets to remain in a trust for at least five years before the trust can provide certain benefits, such as Medicaid eligibility. For individuals considering a Pompano Beach Florida Financial Account Transfer to Living Trust, understanding this rule is crucial. It ensures that any financial accounts you transfer into the trust do not negatively impact your eligibility for government assistance programs. Planning ahead and using resources like uslegalforms can make this process smoother and compliant.

Transferring your bank account into a living trust typically requires contacting your bank to request a change in account ownership. The bank will provide the necessary forms to designate the trust as the account owner. Ensure you have all trust documents ready, as they may need to be presented. For a seamless experience, consider our Pompano Beach Florida Financial Account Transfer to Living Trust services, which can guide you through the required steps.

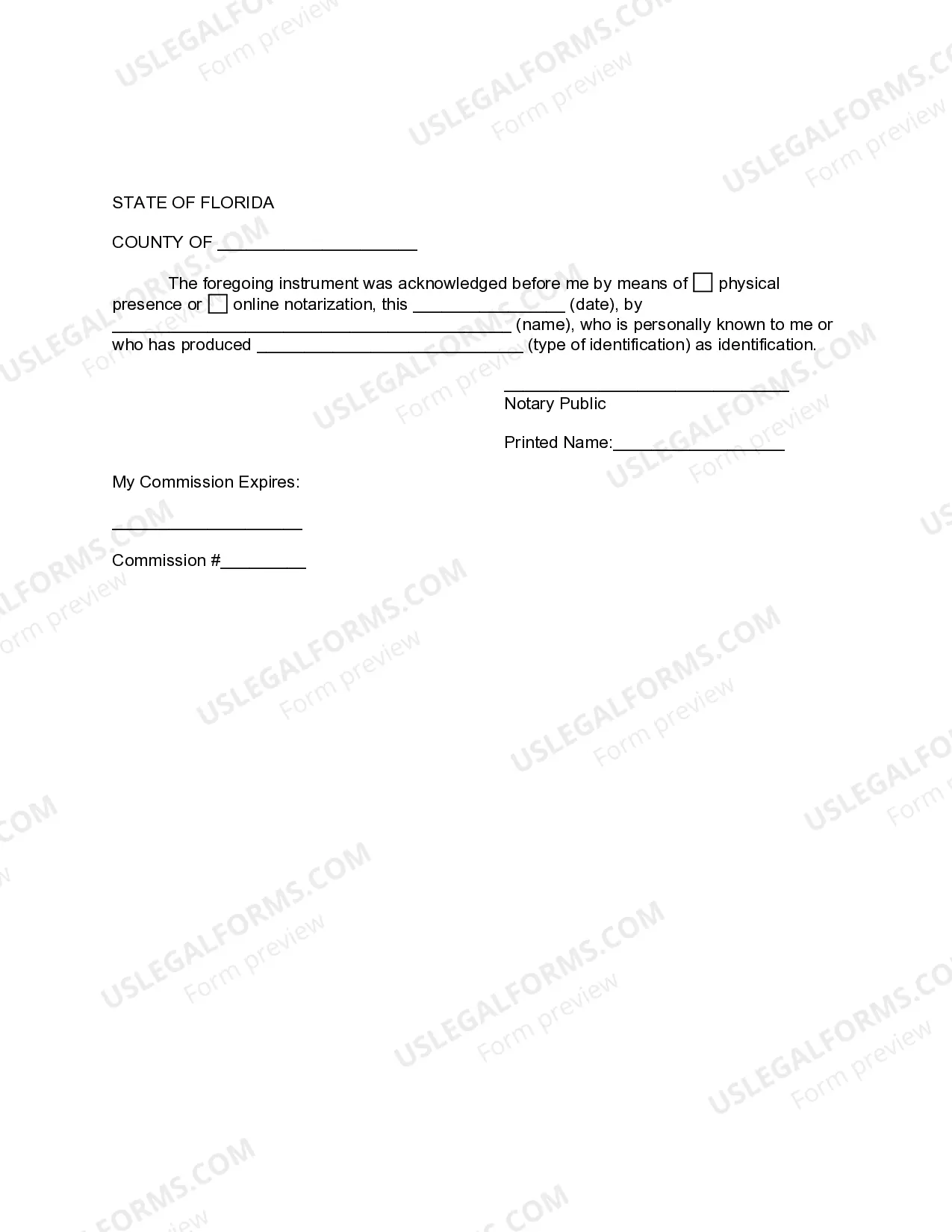

To transfer your property to a trust in Florida, you need to execute a new deed that indicates the trust as the property owner. It must be properly signed, notarized, and recorded with your local county recorder's office. Engaging with a legal professional can simplify the entire process and ensure compliance with local regulations. If you're looking for an effective way to manage this transition, consider our Pompano Beach Florida Financial Account Transfer to Living Trust solutions.

A significant mistake parents often make is failing to communicate their plans with their children. This lack of communication can lead to confusion or resentment when the time comes to manage the trust. Furthermore, not regularly updating the trust can result in outdated terms that might not reflect current family dynamics or financial needs. For guidance on how to navigate these issues, explore our Pompano Beach Florida Financial Account Transfer to Living Trust options, which can help you set up a trust that meets your family's needs.

While placing your house in a trust offers many benefits, there are some disadvantages to consider. First, you may incur costs associated with setting up and maintaining the trust, which could include attorney's fees. Additionally, if you need to finance the property or refinance your mortgage, managing the trust can complicate the process. Before proceeding, evaluate how a Pompano Beach Florida Financial Account Transfer to Living Trust aligns with your financial goals.

To transfer your property into a living trust in Florida, you will typically need to prepare a new deed that designates the trust as the owner. This process involves filing the deed with your local county clerk's office. It’s advisable to work with a legal professional to ensure that all necessary documents are properly executed. If you want assistance, consider our Pompano Beach Florida Financial Account Transfer to Living Trust service for a smooth transition.

In Florida, transferring property into a living trust generally does not trigger reassessment for tax purposes. This means that your property's assessed value and tax rate are likely to remain unchanged. However, it's always best to consult with a local attorney or tax professional for specific guidance. Exploring options like Pompano Beach Florida Financial Account Transfer to Living Trust can help you understand your unique situation.