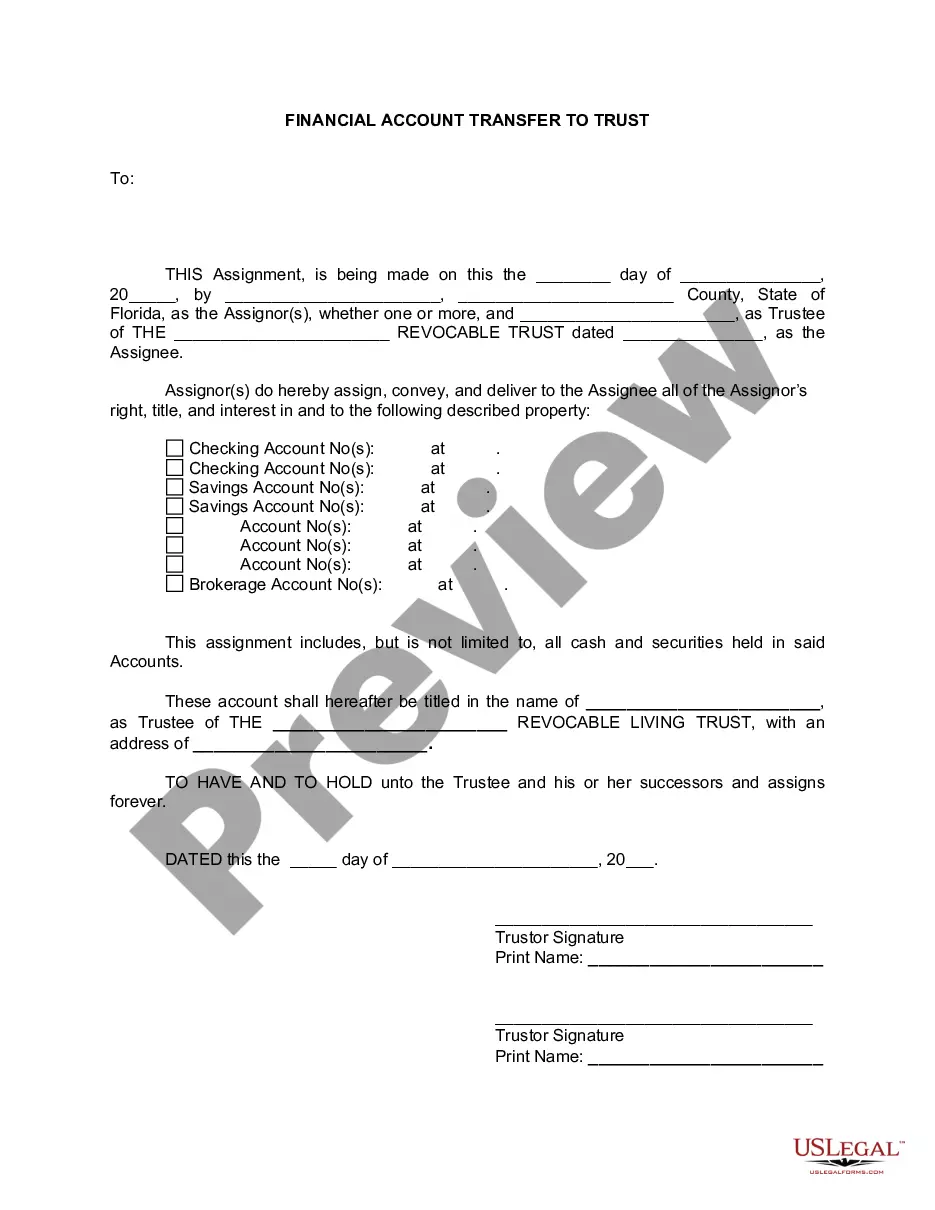

Port St. Lucie Florida Financial Account Transfer to Living Trust — A Detailed Description Financial account transfer to a living trust is an important step in estate planning in Port St. Lucie, Florida. This process involves transferring ownership of financial accounts from an individual's name to a living trust, ensuring that assets are protected and managed according to the estate owner's wishes during their lifetime and after their passing. The primary purpose of establishing a living trust is to avoid probate, providing a streamlined and private asset distribution process for beneficiaries. Port St. Lucie residents can create different types of financial account transfers to a living trust based on their specific needs and goals: 1. Bank Accounts: This includes checking, savings, money market, and certificate of deposit (CD) accounts. 2. Investment Accounts: Such transfers cover brokerage accounts, stocks, bonds, mutual funds, annuities, and retirement accounts like IRAs and 401(k)s. 3. Real Estate: While not a financial account, transferring real estate to a living trust is a common practice for many Port St. Lucie residents to ensure seamless management and transfer of property ownership. 4. Life Insurance Policies: Individuals can designate their living trust as the beneficiary of their life insurance policies, allowing the trust to receive the proceeds upon their death. 5. Business Interests: If an individual owns a business, they can transfer their ownership interest to the living trust to ensure its seamless continuation or orderly sale upon their passing. The process of transferring financial accounts to a living trust involves the following key steps: 1. Establishing a Living Trust: Consult with an estate planning attorney in Port St. Lucie to draft a living trust document that outlines your wishes for asset distribution and management. 2. Funding the Trust: Once the trust is established, it needs to be funded by transferring ownership of financial accounts. This involves contacting each financial institution, providing them with the necessary legal documents, and following their specific procedures for transferring ownership to the trust. 3. Updating Beneficiary Designations: Review and update beneficiary designations on life insurance policies, retirement accounts, and other relevant financial accounts to ensure they align with the trust's distribution plan. 4. Ongoing Trust Management: After the financial accounts are transferred into the trust, it becomes the responsibility of the designated trustee to manage and distribute assets in accordance with the trust document's instructions. By transferring financial accounts to a living trust, Port St. Lucie residents can achieve greater control, privacy, and efficiency in estate planning. It is crucial to seek guidance from a qualified estate planning attorney to navigate the legalities and complex procedures associated with this process. Start planning today to protect your assets and ensure that your wishes are honored for generations to come.

Port St. Lucie Florida Financial Account Transfer to Living Trust

Description

How to fill out Port St. Lucie Florida Financial Account Transfer To Living Trust?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person without any law education to draft this sort of papers from scratch, mainly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our platform offers a huge library with more than 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you need the Port St. Lucie Florida Financial Account Transfer to Living Trust or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Port St. Lucie Florida Financial Account Transfer to Living Trust in minutes using our reliable platform. In case you are presently a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, if you are unfamiliar with our library, ensure that you follow these steps prior to downloading the Port St. Lucie Florida Financial Account Transfer to Living Trust:

- Ensure the template you have found is suitable for your location because the rules of one state or county do not work for another state or county.

- Preview the form and read a brief outline (if provided) of cases the paper can be used for.

- If the one you selected doesn’t suit your needs, you can start again and search for the suitable form.

- Click Buy now and choose the subscription plan that suits you the best.

- with your login information or register for one from scratch.

- Select the payment gateway and proceed to download the Port St. Lucie Florida Financial Account Transfer to Living Trust as soon as the payment is completed.

You’re good to go! Now you can proceed to print out the form or fill it out online. In case you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.