Tallahassee, the capital city of Florida, offers residents various options for financial account transfer to a living trust. A living trust is a legal document created during one's lifetime to manage and distribute assets. This transfer process ensures that the individual's financial accounts are protected and can be smoothly transitioned to their chosen beneficiaries. Here are some key types of Tallahassee Florida Financial Account Transfer to Living Trust: 1. Bank Account Transfer: Individuals in Tallahassee can transfer their bank accounts, such as checking, savings, and money market accounts, to their living trust. This transfer ensures that the trust becomes the owner of these accounts and allows the individual to maintain control over their assets while alive. 2. Investment Account Transfer: Tallahassee residents can also transfer their investment accounts, including stocks, bonds, mutual funds, and brokerage accounts, to a living trust. This transfer allows for seamless management and potential growth of these investments within the trust, benefiting the named beneficiaries. 3. Retirement Account Transfer: The transfer of retirement accounts, such as IRAs (Individual Retirement Accounts) and 401(k) plans, to a living trust is another vital option in Tallahassee. This process ensures that the retirement funds are protected and can be efficiently distributed according to the trust's guidelines. 4. Real Estate Transfer: Along with financial accounts, Tallahassee residents can transfer real estate properties, including residential homes, rental properties, and commercial buildings, to a living trust. This type of transfer helps minimize the potential probate process and provides a clear plan for property management and distribution. 5. Business Account Transfer: For individuals who own businesses in Tallahassee, transferring their business accounts to a living trust is essential. This type of transfer ensures that the business's financial assets and operations can continue smoothly, benefiting both the owner and the designated beneficiaries. In summary, Tallahassee Florida Financial Account Transfer to Living Trust encompasses various options, including bank accounts, investment accounts, retirement accounts, real estate properties, and business accounts. These transfers are crucial steps towards efficient asset management, protection, and seamless distribution according to the individual's wishes. It's advisable to consult with a qualified attorney or financial advisor to understand the specific legal requirements and implications of each type of transfer.

Tallahassee Florida Financial Account Transfer to Living Trust

Description

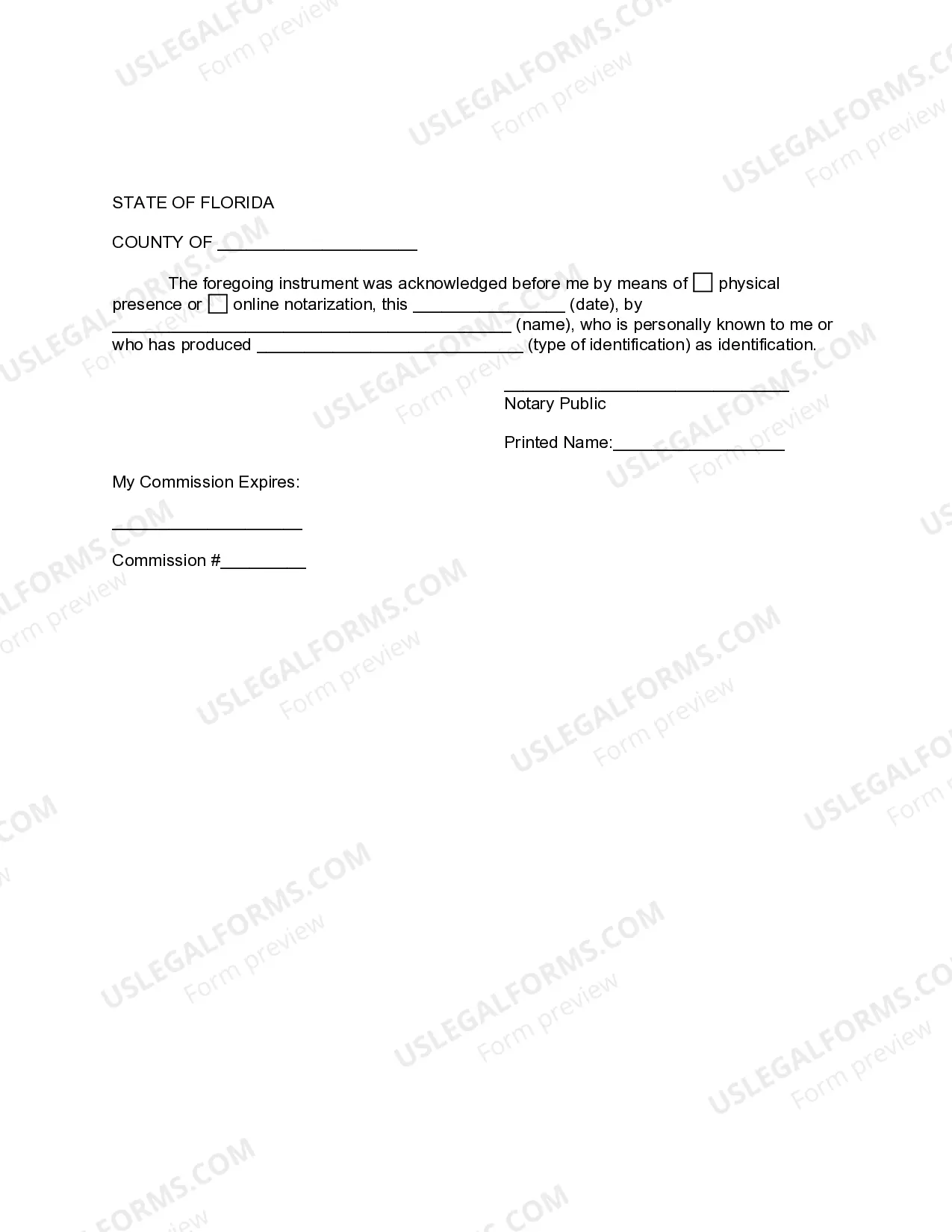

How to fill out Tallahassee Florida Financial Account Transfer To Living Trust?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for someone without any legal background to draft such papers cfrom the ground up, mainly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our service provides a massive library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you need the Tallahassee Florida Financial Account Transfer to Living Trust or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Tallahassee Florida Financial Account Transfer to Living Trust in minutes using our trusted service. If you are already an existing customer, you can go on and log in to your account to download the needed form.

Nevertheless, if you are a novice to our platform, ensure that you follow these steps prior to downloading the Tallahassee Florida Financial Account Transfer to Living Trust:

- Be sure the form you have found is specific to your location since the rules of one state or county do not work for another state or county.

- Preview the form and go through a brief outline (if available) of cases the paper can be used for.

- In case the one you chosen doesn’t meet your needs, you can start again and look for the suitable form.

- Click Buy now and pick the subscription plan you prefer the best.

- Access an account {using your login information or register for one from scratch.

- Pick the payment method and proceed to download the Tallahassee Florida Financial Account Transfer to Living Trust once the payment is through.

You’re all set! Now you can go on and print the form or complete it online. If you have any issues locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.